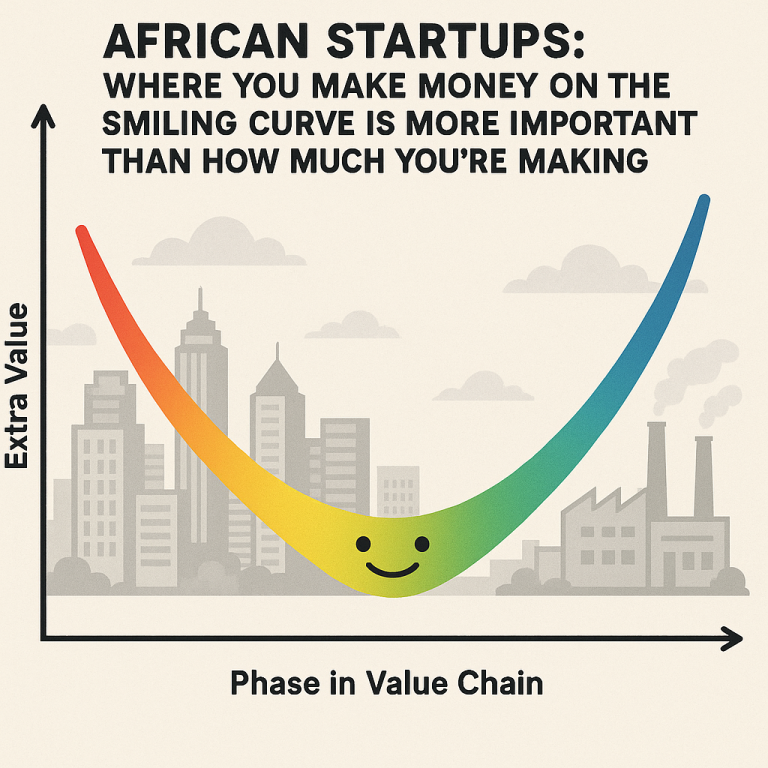

In the relentless pursuit of growth and market dominance, many startups, particularly across our emerging economies, often find themselves trapped in a value paradox. They build, they produce, they hustle, yet the margins remain thin, and true wealth creation feels elusive. The fundamental challenge, I submit, lies not in their effort, but in their strategic positioning along the value chain. This brings us back to the construct of “Smiling Curve”—a framework that remains remarkably pertinent for any startup aspiring to build a sustainable, defensible enterprise.

If you operate at the center of the curve which typical means delivery & centralization, you do not capture a lot of value. But if you operate at the edges of the curve, which has origination & creation or discovery & aggregation, you will capture extra value. Largely, where you make money is more important than how much money you’re making, as you’re looking for compounding capabilities and positioning over time.

Dangote Cement operates at the edges and the center. Elon Musk’s Tesla does the same for cars. These companies are category-king companies, and they typically have great margins provided they optimize the investments at the center.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

A bank could be operating at the center, hosting and supporting bank accounts in a country for citizens. But a card company like Interswitch Verve can focus on origination for payment and capture extra value at an edge even as fintech firm like Flutterwave does aggregation via APIs to merchants at the other side of the edge. Just like that, those at the edges will see better valuation because they do not have to spend as much as the bank which supports the ecosystem but captures little value, when benchmarked by assets deployed.

The Smiling Curve illustrates that in most industries, the highest value-added is found at the ‘edges’ of the value chain: namely, Research & Development (R&D), Design, and Intellectual Property (IP) at the upstream end, and Branding, Marketing, Distribution, and After-sales Services at the downstream end. The ‘bottom’ of the smile, where value is lowest, is typically occupied by manufacturing, assembly, and mere production.

For too long, our focus has been disproportionately skewed towards the manufacturing and assembly phase – the very belly of the smiling curve where competition is fiercest, margins are razor-thin, and differentiation is a constant, exhausting battle. When startups operate solely here, they become commoditized, easily replaceable cogs in a larger machine. This is not the pathway to building generational companies.

Why Startups Must Gravitate Towards the Edges:

- The Left Edge: Innovation and Uniqueness This is where ideas are born, where patents are filed, and where proprietary knowledge resides. Startups that invest heavily in R&D, unique design, and the creation of intellectual property build moats around their businesses. Think of software-as-a-service (SaaS) companies developing unique algorithms, biotech firms creating novel therapies, or material science startups inventing next-generation composites. They are not just selling a product; they are licensing an idea, solving a problem uniquely, and holding the keys to future iterations. This is a game of deep insight and sustained investment in knowledge creation.

- The Right Edge: Brand, Distribution & Customer Lock-in Once a product or service is created, its perceived value and accessibility determine its market capture. This edge is about building powerful brands that resonate with consumers, establishing efficient and expansive distribution networks, and fostering deep, lasting customer relationships through exceptional service. Consider the power of a global brand like Apple, whose manufacturing is outsourced, but whose design, marketing, and customer ecosystem command premium pricing and unparalleled loyalty. Here, customer data, network effects, and trust become your most valuable assets.

The African Startup Imperative:

For African startups, embracing the smiling curve is not merely an option; it is an imperative for leapfrogging traditional development paradigms. We cannot afford to compete solely on cheap labor in a globalized manufacturing landscape that increasingly favors automation. Instead, we must strategically:

- Innovate for Local Contexts, Scale Globally: Develop IP and solutions that address unique African challenges but are robust enough to scale internationally. This means investing in local R&D, design thinking, and data-driven insights.

- Build Authentic Brands: Connect with consumers emotionally. Storytelling, community building, and delivering consistent value will differentiate you beyond price.

- Master Digital Distribution and Service: Leverage mobile penetration and digital platforms to reach customers directly, collect feedback, and provide seamless after-sales support, bypassing traditional infrastructural limitations.

The future of value creation for startups lies in mastering the nexus points of innovation, design, brand narrative, and customer experience. It means moving beyond simply “making things” to “owning ideas” and “owning customers.” Analyze your current position on the smiling curve. Where can you shift your resources and focus to climb towards those high-value edges? This strategic pivot is not just about survival; it’s about building the enduring enterprises that will drive our continent’s economic renaissance.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

Some startups who want to leverage on the edges to make money may end up discovering that there’s no base to plug into, so you might be forced to build everything. Dangote Cement had to own both the power plants and delivery trucks, for it to capture massive value. The Dangote Refinery is following the same playbook. E-commerce is struggling because its success lies in owning the entire supply chain, from connecting farmlands and manufacturers to delivery logistics, even the payment systems.

The more there are reliable bases to plug into, the more you will see profitable startups with better margins springing up. An R&D and design focused entity can do much better if it doesn’t have to think of sourcing its own electricity, and security of its facilities and personnel.

The more the obstacles, the lesser the margins, except you can own the entire value chain; which only few can.