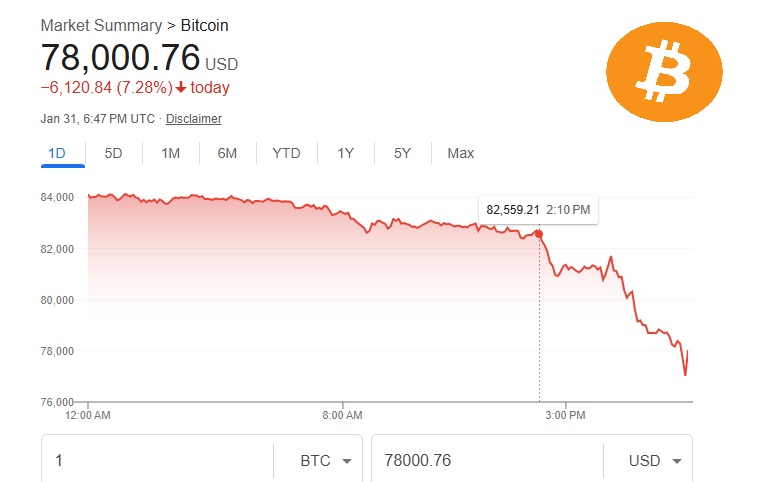

Again, Bitcoin reminds us of a simple truth many prefer to ignore: it is not as detached from government as its mythology suggests. The entire construct of absolute decentralization collapses the moment macro policy shifts. Good People, Bitcoin dipped on the news that Kevin Warsh is being considered for Chair of the U.S. Federal Reserve. Why? Because Warsh is associated with tighter monetary policy, higher real interest rates, and reduced liquidity. Markets read that as hostile terrain for risk assets and Bitcoin reacted immediately.

In plain terms, Warsh represents monetary discipline. Higher real rates reduce the appeal of non-yielding assets, and Bitcoin does not yield. So, when investors sense that the era of easy money may be curtailed, they rebalance. And Bitcoin, which claims independence from the state, moves in sympathy with the very institutions it says it wants to escape.

Yes, I missed Bitcoin early, when it was forgettable and ignored. But let us be honest with ourselves: anyone who claims Bitcoin is outside government influence is skipping basic logic. As long as fiat money is required to buy Bitcoin, and that fiat has alternative uses, Bitcoin remains inside the gravitational pull of central banks. You cannot be insulated from what determines the price of the currency you need to acquire the asset.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Today, investors are modeling a scenario where a strong dollar and higher real rates reduce the need for “non-yielding refuge” assets. And who determines that inflation and rate regime? Governments and their central banks. That is the reality.

Of course, markets are dynamic. Should the eventual Fed Chair pivot, loosen policy, or flood the system with liquidity, Bitcoin will likely return to celebration mode. It always does. But until then, let us retire the illusion. Bitcoin may be decentralized in architecture, but in price behavior, it still listens carefully to the state https://www.tekedia.com/bitcoin-slips-below-80000-as-bearish-momentum-deepens-analysts-eye-lower-support/

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube