Market optimism is building once again as long-term holders prepare for the next wave of liquidity in the crypto sector. Among the more established players, Ripple (XRP) and Stellar (XLM) are being closely analyzed to see whether they can revisit previous highs of ~$3.40 and ~$0.70, respectively.

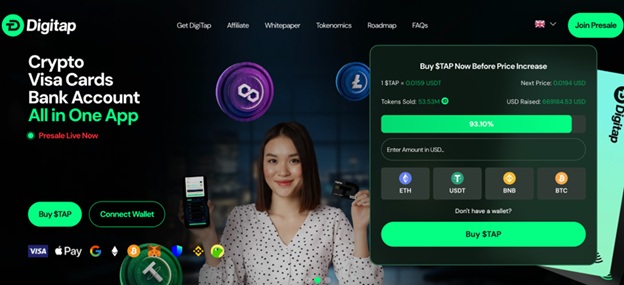

Yet the conversation isn’t just about legacy remittance networks—it’s about a project rapidly earning attention for inclusive finance. Digitap ($TAP), the world’s first omni bank, combines financial privacy with practical usability and offers zero-KYC onboarding that’s drawing interest from whale investors.

Digitap ($TAP): Where Privacy Meets Global Access

Digitap has entered the market with a clear goal: to make financial participation universal. While most banking systems rely on heavy identification checks that exclude much of the developing world, Digitap’s architecture takes a different path. The growing overlap between compliance, anonymity, and accessibility has made Digitap a serious talking point among analysts.

Its zero-KYC framework, permitted in compliant jurisdictions, allows users to open digital accounts, transact, and earn yield without exposing personal data unnecessarily. This appeals not only to privacy-conscious individuals but also to institutional players seeking scalable, regulatory-aligned alternatives to traditional banking.

At its core, Digitap functions as a full-service omni bank that merges both fiat and crypto accounts. Users can manage multi-currency IBANs, make instant global payments, and transfer value freely—all within a live working ecosystem. The project’s financial logic rests on accessibility rather than speculation.

Analysts note that the interest from large wallets and early venture participants reflects growing confidence in Digitap’s model. As global financial systems become more restrictive, projects offering both inclusion and privacy stand out as the best cryptos to invest in right now.

XRP ($XRP): Banking Bridges and Regulation Clarity

XRP has had a turbulent journey since 2018. Once seen as a disruptor to global remittances, it faced years of regulatory scrutiny. However, Ripple’s partial legal clarity in the United State has shifted sentiment. The project is now back in focus, especially as cross-border payments gain new importance.

At around $2.82, XRP has recovered from its lows, and traders are again watching liquidity metrics closely. Institutional adoption remains the biggest driver. Ripple’s partnerships with global banks and financial providers continue to grow. The difference this time is that XRP’s fundamentals are catching up to its long-term narrative.

Still, competition is intensifying. Even as XRP works to reclaim its previous highs, some traders are already reallocating portions of their holdings into early stage projects with more aggressive return potential, including Digitap, which is now frequently cited among the best crypto coins to invest in for those seeking growth.

Stellar ($XLM): A Shared Vision, Different Execution

Stellar was built to make global money transfers cheaper and faster. Over the years, it has partnered with remittance providers, fintech platforms, and even central banks exploring digital currencies. Its shared origins with Ripple give it a similar mission but a different governance structure. Where Ripple leans corporate, Stellar focuses on open access financial inclusion.

At around $0.37, Stellar remains at half the price of its previous peak nearing $0.70. However, on-chain data indicates a steady increase in active accounts and daily transactions. While not as explosive in performance as some newer chains, XLM’s consistent growth reflects its practical utility. The network has also leaned into stablecoin integrations, making it a quiet enabler of everyday cross-border value transfer.

That said, the market environment has changed since Stellar first launched. Privacy, user control, and integrated fiat on-ramps are now key differentiators. While Stellar still holds long-term value as a payment infrastructure coin, analysts suggest the bigger story may be unfolding within newer ecosystems designed around full financial sovereignty and immediate usability. Projects have to deliver, not just talk.

Why Digitap’s Model is Attracting Whale Interest

Digitap’s ecosystem is perfectly designed for a new era of financial inclusion. It’s already live, serving both individuals and businesses with a unified digital account structure. The platform’s compliant, zero-KYC setup bridges regulatory requirements with user autonomy, something traditional banks and many crypto exchanges still struggle to achieve.

Investors can become early adopters today with $TAP selling at just $0.0159—which could be the lowest ever entry. $TAP will jump 22% to $0.0194 in the next round, meaning anyone buying now can lock in gains almost instantly.

In contrast, XRP and XLM, while respected and established, may deliver smaller percentage returns due to their size and maturity. Taking into account 124% staking yields and deflationary economics, it’s easy to see why whales are showing interest in Digitap’s zero-KYC financial inclusion project over legacy remittance frameworks.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app