Clothing Imports to Europe Surge 14% in 2025 Amid Rising Competition from China

Quote from Alex Bobby on September 17, 2025, 4:33 AM

Clothes Imports Surge 14% in 2025 Amid Fierce Competition from China

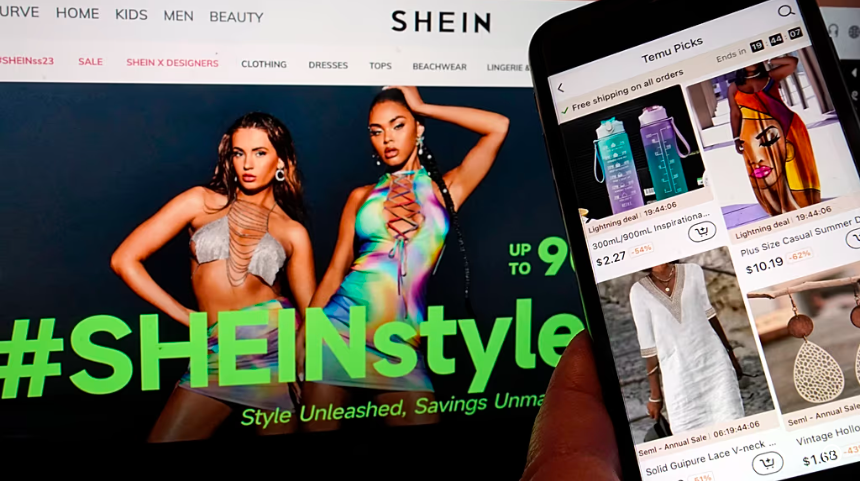

Europe’s textile industry is raising the alarm after clothing imports surged 14% in the first half of 2025, driven largely by ultra-fast fashion brands from China seeking new markets amid shifting global trade dynamics. As American tariffs on Chinese goods rise, Chinese exporters are increasingly turning to the European Union (EU)—and European manufacturers fear they could be overwhelmed.

Imports on the Rise as U.S. Tariffs Push Chinese Exports Toward Europe

According to figures shared with Euronews by a source in the clothing industry, imports into Europe increased by 14% between January and June 2025 compared to the same period in 2024. The surge follows a sharp change in U.S. trade policy: the American administration has hiked tariffs on Chinese imports to 57.6% and removed an exemption on packages valued under $800, which had previously allowed smaller Chinese shipments to flow into the U.S. market duty-free.

As a result, Chinese fast fashion retailers are shifting their focus to Europe, seeking to compensate for lost ground in the United States. This rapid pivot has put European textile producers under intense pressure, especially small and medium-sized enterprises (SMEs) already struggling to compete with ultra-low-cost imported goods.

Textile Federations Warn of Unfair Competition

This week, 22 European textile federations—including the Brussels-based association Euratex—issued a joint statement warning that the influx of low-cost, ultra-fast fashion threatens the stability of the European textile sector.

They described the current situation as “unfair competition” that is distorting the market. According to their statement, fast fashion now accounts for 20% of online clothing sales in Europe, much of it imported directly from China through e-commerce platforms.

“Ultra-fast fashion is exacerbating environmental, economic, and social imbalances,” the federations declared. “It puts unbearable pressure on European companies, particularly SMEs, which strive to meet high environmental, ethical, and social standards.”

The statement highlighted the sheer scale of imports: in 2024, 4.5 billion parcels were imported into the EU, with 91% of e-commerce shipments valued under €150 coming from China, according to a European Commission communication published earlier this year. The concern is that these figures are set to rise further in 2025 as Chinese retailers divert even more shipments to Europe.

Calls for New Fees and Stricter Customs Enforcement

In their joint appeal, the textile federations urged the European Commission to take decisive action. Their proposals included:

- Introducing a €2 handling fee on all small parcels entering the EU to fund customs inspections.

- Eliminating the current customs duty exemption for parcels valued up to €150, which allows many fast fashion retailers to bypass standard import taxes and duties.

- Accelerating investigations into potentially unfair trade practices by foreign e-commerce companies.

- Imposing the strongest possible sanctions under the EU’s Digital Services Act (DSA) to crack down on illegal content and unsafe products being sold online.

The industry argues that the current rules give ultra-fast fashion platforms an unfair advantage. While European brands must meet stringent environmental and labour regulations, their low-cost competitors can ship products into the EU almost tax-free, often without any oversight or accountability for product safety or sustainability.

Spotlight on Temu and Other E-Commerce Platforms

The European Commission has already begun tightening its scrutiny of major Chinese e-commerce platforms. In July, it found that Temu, one of the fastest-growing ultra-fast fashion retailers, was in breach of the Digital Services Act for failing to properly assess the risks of illegal products on its platform.

The textile federations now want the EU to go further. They are calling for e-commerce platforms to appoint legally authorised representatives in Europe, so they can be held accountable under EU law. This would prevent companies based outside Europe from escaping liability for safety violations or environmental breaches.

Balancing Competition and Sustainability

European textile manufacturers argue that the current system undermines their efforts to produce sustainably. Many SMEs invest heavily in meeting EU environmental and labour standards, which increases their production costs.

When ultra-fast fashion companies sell items at rock-bottom prices, often produced under less stringent conditions, it creates a race to the bottom that discourages sustainability. The flood of cheap clothing also contributes to environmental waste, as many fast fashion items are discarded after only a few uses.

The federations warn that without intervention, European textile producers could face widespread closures and job losses, particularly in countries like Italy, Spain, Portugal, and France, which have large textile manufacturing sectors.

What Comes Next for EU Policymakers

The EU is already considering several policy changes. A Commission proposal to introduce a €2 handling fee on all parcels entering the EU is currently under negotiation. Another proposal would remove the customs duty exemption for goods valued under €150, closing the loophole that allows small parcels to enter the EU tax-free.

Policymakers are also weighing stronger enforcement of the Digital Services Act to ensure that online marketplaces are responsible for the products they sell. If adopted, these measures could help level the playing field for European manufacturers while raising the cost of ultra-fast fashion imports.

Looking Forward

As discussions continue in Brussels, the future of Europe’s textile industry will depend on how decisively the EU responds to this surge in imports. Introducing handling fees, removing customs exemptions, and enforcing stricter digital marketplace rules could help level the playing field for European producers while ensuring fair competition.

If these measures are implemented effectively, they could slow the flood of ultra-fast fashion imports and give European SMEs the breathing room they need to innovate and invest in sustainable practices. Looking ahead, the EU has an opportunity not only to protect its textile sector but also to set global standards for ethical, environmentally responsible fashion production.

Final Thoughts

The sharp rise in clothing imports highlights how quickly global trade shifts can reshape local industries — and how vulnerable Europe’s textile sector is to external market pressures. As ultra-fast fashion giants from China seek new opportunities in the EU, they are flooding the market with cheap products that often bypass environmental and labour standards.

Without swift and coordinated action from EU policymakers, many European manufacturers — especially small and medium-sized businesses — could struggle to survive. The coming months will be critical in determining whether Europe can strike a balance between maintaining open trade and safeguarding the sustainability, quality, and ethical standards that its textile industry has long been known for.

Conclusion

The 14% surge in clothing imports in the first half of 2025 has intensified concerns that Europe is becoming the new dumping ground for ultra-fast fashion as Chinese exporters pivot away from the U.S. market. For European textile producers, especially smaller firms, this influx poses an existential threat.

Industry leaders are now pushing for swift action—through parcel fees, stricter customs rules, and tougher enforcement of digital regulations—to protect jobs, sustainability efforts, and the long-term health of Europe’s textile sector. As EU lawmakers debate these proposals, the outcome will shape not only the competitiveness of European fashion but also the ethical and environmental standards of the clothes sold in the bloc.

Meta Description:

Clothing imports into Europe jumped 14% in 2025 as Chinese fast fashion floods the market, prompting EU textile federations to call for tougher trade rules and protections.

Clothes Imports Surge 14% in 2025 Amid Fierce Competition from China

Europe’s textile industry is raising the alarm after clothing imports surged 14% in the first half of 2025, driven largely by ultra-fast fashion brands from China seeking new markets amid shifting global trade dynamics. As American tariffs on Chinese goods rise, Chinese exporters are increasingly turning to the European Union (EU)—and European manufacturers fear they could be overwhelmed.

Imports on the Rise as U.S. Tariffs Push Chinese Exports Toward Europe

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

According to figures shared with Euronews by a source in the clothing industry, imports into Europe increased by 14% between January and June 2025 compared to the same period in 2024. The surge follows a sharp change in U.S. trade policy: the American administration has hiked tariffs on Chinese imports to 57.6% and removed an exemption on packages valued under $800, which had previously allowed smaller Chinese shipments to flow into the U.S. market duty-free.

As a result, Chinese fast fashion retailers are shifting their focus to Europe, seeking to compensate for lost ground in the United States. This rapid pivot has put European textile producers under intense pressure, especially small and medium-sized enterprises (SMEs) already struggling to compete with ultra-low-cost imported goods.

Textile Federations Warn of Unfair Competition

This week, 22 European textile federations—including the Brussels-based association Euratex—issued a joint statement warning that the influx of low-cost, ultra-fast fashion threatens the stability of the European textile sector.

They described the current situation as “unfair competition” that is distorting the market. According to their statement, fast fashion now accounts for 20% of online clothing sales in Europe, much of it imported directly from China through e-commerce platforms.

“Ultra-fast fashion is exacerbating environmental, economic, and social imbalances,” the federations declared. “It puts unbearable pressure on European companies, particularly SMEs, which strive to meet high environmental, ethical, and social standards.”

The statement highlighted the sheer scale of imports: in 2024, 4.5 billion parcels were imported into the EU, with 91% of e-commerce shipments valued under €150 coming from China, according to a European Commission communication published earlier this year. The concern is that these figures are set to rise further in 2025 as Chinese retailers divert even more shipments to Europe.

Calls for New Fees and Stricter Customs Enforcement

In their joint appeal, the textile federations urged the European Commission to take decisive action. Their proposals included:

- Introducing a €2 handling fee on all small parcels entering the EU to fund customs inspections.

- Eliminating the current customs duty exemption for parcels valued up to €150, which allows many fast fashion retailers to bypass standard import taxes and duties.

- Accelerating investigations into potentially unfair trade practices by foreign e-commerce companies.

- Imposing the strongest possible sanctions under the EU’s Digital Services Act (DSA) to crack down on illegal content and unsafe products being sold online.

The industry argues that the current rules give ultra-fast fashion platforms an unfair advantage. While European brands must meet stringent environmental and labour regulations, their low-cost competitors can ship products into the EU almost tax-free, often without any oversight or accountability for product safety or sustainability.

Spotlight on Temu and Other E-Commerce Platforms

The European Commission has already begun tightening its scrutiny of major Chinese e-commerce platforms. In July, it found that Temu, one of the fastest-growing ultra-fast fashion retailers, was in breach of the Digital Services Act for failing to properly assess the risks of illegal products on its platform.

The textile federations now want the EU to go further. They are calling for e-commerce platforms to appoint legally authorised representatives in Europe, so they can be held accountable under EU law. This would prevent companies based outside Europe from escaping liability for safety violations or environmental breaches.

Balancing Competition and Sustainability

European textile manufacturers argue that the current system undermines their efforts to produce sustainably. Many SMEs invest heavily in meeting EU environmental and labour standards, which increases their production costs.

When ultra-fast fashion companies sell items at rock-bottom prices, often produced under less stringent conditions, it creates a race to the bottom that discourages sustainability. The flood of cheap clothing also contributes to environmental waste, as many fast fashion items are discarded after only a few uses.

The federations warn that without intervention, European textile producers could face widespread closures and job losses, particularly in countries like Italy, Spain, Portugal, and France, which have large textile manufacturing sectors.

What Comes Next for EU Policymakers

The EU is already considering several policy changes. A Commission proposal to introduce a €2 handling fee on all parcels entering the EU is currently under negotiation. Another proposal would remove the customs duty exemption for goods valued under €150, closing the loophole that allows small parcels to enter the EU tax-free.

Policymakers are also weighing stronger enforcement of the Digital Services Act to ensure that online marketplaces are responsible for the products they sell. If adopted, these measures could help level the playing field for European manufacturers while raising the cost of ultra-fast fashion imports.

Looking Forward

As discussions continue in Brussels, the future of Europe’s textile industry will depend on how decisively the EU responds to this surge in imports. Introducing handling fees, removing customs exemptions, and enforcing stricter digital marketplace rules could help level the playing field for European producers while ensuring fair competition.

If these measures are implemented effectively, they could slow the flood of ultra-fast fashion imports and give European SMEs the breathing room they need to innovate and invest in sustainable practices. Looking ahead, the EU has an opportunity not only to protect its textile sector but also to set global standards for ethical, environmentally responsible fashion production.

Final Thoughts

The sharp rise in clothing imports highlights how quickly global trade shifts can reshape local industries — and how vulnerable Europe’s textile sector is to external market pressures. As ultra-fast fashion giants from China seek new opportunities in the EU, they are flooding the market with cheap products that often bypass environmental and labour standards.

Without swift and coordinated action from EU policymakers, many European manufacturers — especially small and medium-sized businesses — could struggle to survive. The coming months will be critical in determining whether Europe can strike a balance between maintaining open trade and safeguarding the sustainability, quality, and ethical standards that its textile industry has long been known for.

Conclusion

The 14% surge in clothing imports in the first half of 2025 has intensified concerns that Europe is becoming the new dumping ground for ultra-fast fashion as Chinese exporters pivot away from the U.S. market. For European textile producers, especially smaller firms, this influx poses an existential threat.

Industry leaders are now pushing for swift action—through parcel fees, stricter customs rules, and tougher enforcement of digital regulations—to protect jobs, sustainability efforts, and the long-term health of Europe’s textile sector. As EU lawmakers debate these proposals, the outcome will shape not only the competitiveness of European fashion but also the ethical and environmental standards of the clothes sold in the bloc.

Meta Description:

Clothing imports into Europe jumped 14% in 2025 as Chinese fast fashion floods the market, prompting EU textile federations to call for tougher trade rules and protections.

Share this:

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to email a link to a friend (Opens in new window) Email

- Click to print (Opens in new window) Print