The team behind BlackRock’s iShares Bitcoin Trust (IBIT) ETF—specifically former BlackRock executives Kevin and Wyatt, who led the engineering for IBIT the fastest ETF to hit $100B in assets—have founded HelloTrade, a platform designed to provide global, frictionless access to leveraged trading in equities, ETFs, commodities, and crypto.

Built on MegaETH, an Ethereum Layer 2 network optimized for real-time, low-latency applications, HelloTrade aims to remove barriers like geography, high capital requirements, and legacy systems that limit retail and professional investors’ exposure to global markets.

The platform leverages MegaETH’s high-throughput design to enable seamless, directional bets on assets worldwide.In tandem with this, MegaETH is kicking off pre-deposits for its native stablecoin, USDM built in collaboration with Ethena’s USDtb infrastructure to generate yield and offset sequencer costs, via a USDC bridge capped at $250 million.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Eligible participants those who completed KYC during MegaETH’s recent MEGA token sale, which saw $1.39B in bids, and aren’t in restricted countries can deposit USDC from Ethereum mainnet starting November 25, 2025.

Deposits are first-come, first-served with no individual limits, locked until mainnet launch, and convert 1:1 to USDM in verified wallets—no restrictions or lockups post-launch. Depositors also qualify for MegaETH’s rewards campaign, earning points based on activity.

This move positions MegaETH as a hub for stable, predictable costs in high-frequency trading, aligning perfectly with HelloTrade’s vision.

By raising $4.6M in a lightning-fast seed round led by Dragonfly Capital, the platform signals robust investor faith in bridging high-frequency equity trading with DeFi’s openness.

HelloTrade’s mobile-first app eliminates crypto’s typical hurdles—no wallets, no gas fees, no jargon—while delivering brokerage-like speeds via MegaETH’s 100,000+ TPS capacity.

This could unlock leveraged exposure to U.S. stocks like Tesla for Vietnamese or Indonesian investors for billions in emerging markets, bypassing geographic and capital barriers that lock out retail traders today.

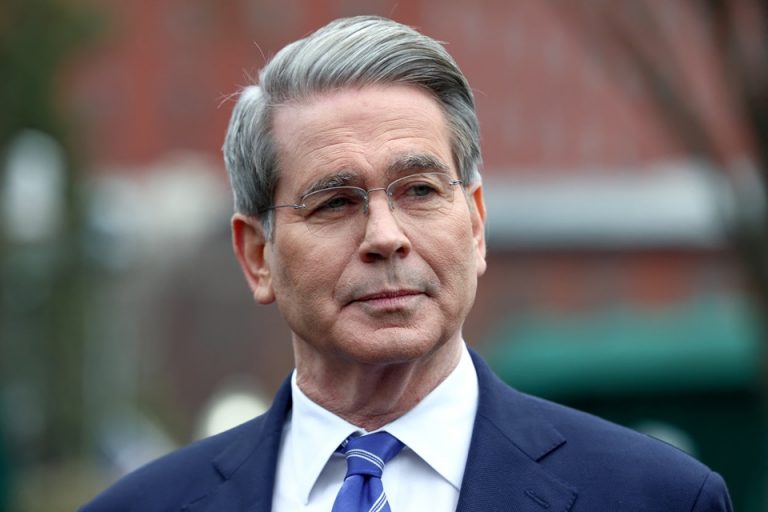

US Treasury Secretary’s Visit to a Bitcoin Bar

US Treasury Secretary Scott Bessent made a surprise appearance at the grand opening of Pubkey, a Bitcoin-themed bar in Washington, DC, though the buzz has spread nationwide, on November 20, 2025.

The unannounced visit ignited the Bitcoin community, with many hailing it as a “signal” of mainstream institutional embrace—especially given Bessent’s crypto-friendly track record since his 2024 nomination.

He’s advocated for policies like the GENIUS Act, using seized Bitcoin to seed a Strategic Bitcoin Reserve without sales, and praised BTC’s “always-on” resilience during the white paper’s 17th anniversary amid a government shutdown.

Prominent voices like Strive’s CIO Ben Werkman called it a pivotal moment: “Having the Secretary of the Treasury at the Pubkey DC launch seems like a moment I could easily look back on and say ‘wow, it was all so obvious’.”

Others, including Bitcoin analysts and podcasters, echoed the optimism, viewing it as symbolic validation amid a more restrained SEC under Chair Paul Atkins with enforcement down 30% in FY2025. This comes as spot Bitcoin ETFs like IBIT face $3.79B in November outflows (IBIT alone at $2.47B), highlighting volatility even as policy winds shift favorably.

These developments underscore Bitcoin and crypto’s accelerating integration into finance—from ETF innovators building on L2s to top officials mingling at BTC spots. If you’re eyeing deposits or trades, double-check eligibility and timelines.