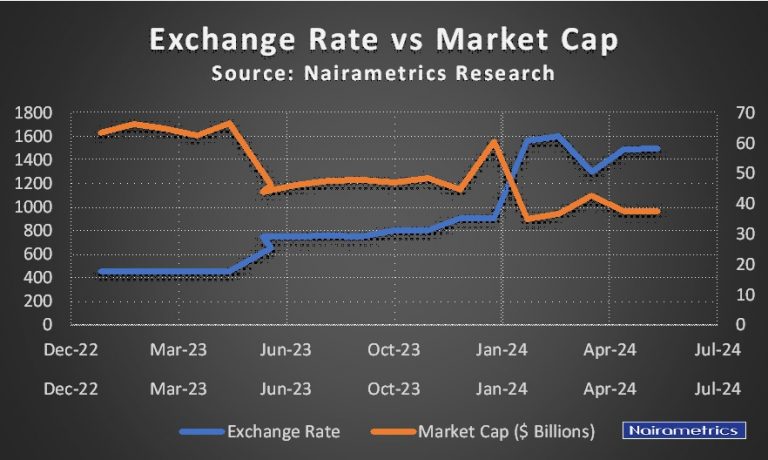

This is Nigeria: “On June 9, 2023, the Nigerian Exchange (NGX) closed with a market capitalization of N30.45 trillion, which was about $65.5 billion at the old exchange rate. And in 2024, the NGX closed the first half of the year with a market capitalization of N56.6 trillion, about $37.7 billion. Hence, the disparity between both periods amounted to $27.8 billion, thus pushing the NGX out of the list of top five largest stock markets in Africa“ – Nairametrics

In other words, while prices of fuel, electricity, etc were going up, investors in the Nigerian stock exchange lost more than 50% of their (absolute) wealth, benchmarked in US dollars. In comparison, the largest market in Africa (South Africa’s Johannesburg Stock Exchange) is at about $1.2 TRILLION, and now Nigeria operates at about sub-$40b. Naspers in South Africa can buy the Nigerian stock exchange with less than 30% of its global wealth now.

Good People, this is an unprecedented wealth deterioration because even during the Biafra War, both the Nigerian pounds and Biafran pounds appreciated in value. But in a peaceful time, we saw what we experienced last year. That means that ALL of us in Nigeria dropped the ball, and this must be quickly reversed to advance shared prosperity.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

One step forward, two steps backward. What is the to say? Nobody needs to explain failure, it’s self-evident.