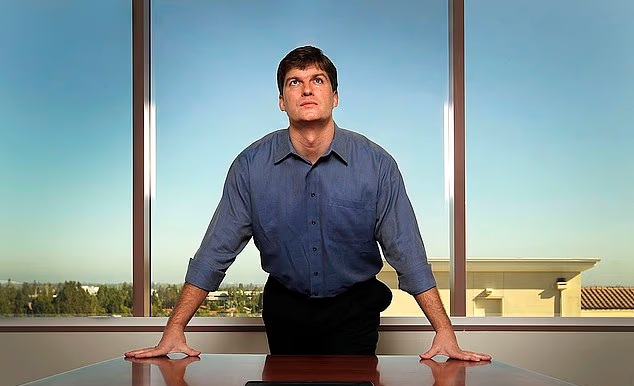

Michael Burry, the legendary investor from The Big Short who famously bet against the housing market before the 2008 crash, has indeed launched a paid Substack newsletter.

It went live on November 23, 2025—just a day ahead of the November 25 reveal he teased on X. The newsletter is titled Cassandra Unchained, a nod to the Greek myth of the prophetess who foretells disasters but is never believed, Warren Buffett once called Burry a “Cassandra” for his early warnings.

This move comes right after Burry deregistered his hedge fund, Scion Asset Management, from the SEC, shifting his focus to personal trading and direct commentary without regulatory constraints.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

$379 per year roughly $31.58/month, a discount over monthly billing. Monthly: $39 per month. Currently, it has over 21,000 paid subscribers, generating an estimated $737,000 in net monthly revenue for Burry after Substack’s 10% cut. Substack handles payments and distribution, with creators keeping 90%.

Burry explained in his launch post that professional money management “muzzled” his voice due to SEC rules, leading to misinterpretations of his 13F filings. Now, he says, the Substack has his “full attention”—he’s “not retired,” just unchained.

Burry’s posts draw on his value-investing roots and history of spotting bubbles. His first two entries:” My 1999 and part of 2000″: A memoir-style piece from his days as a Stanford neurology resident, where he blogged about shorting Amazon amid the dot-com hype.

He contrasts it with today’s AI frenzy, quoting Fed Chair Alan Greenspan’s 2005 dismissal of the housing bubble and Jerome Powell’s 2025 comments on AI profitability “it’s a different thing”.

The Cardinal Sign of a Bubble

A deep dive into AI infrastructure overbuilds, likening Nvidia to Cisco during the 2000 dot-com peak which later crashed 78%. Burry warns of “catastrophically overbuilt supply” from hyperscalers like Microsoft, Google, Meta, Amazon, and Oracle outpacing real demand—echoing the subprime excess he shorted in 2008.

He promises ongoing analysis of stocks, markets, economic trends, and “potential economic bubbles,” with historical parallels to help subscribers spot risks. Some X users see it as a contrarian buy signal like “Burry launching a Substack is bullish—markets love ignoring Cassandras”, while others joke it’s his pivot to “funding his trading” amid a tough economy.

Korean media highlighted the $379 price as premium access to his bubble-busting insights. A few Reddit threads gripe about the cost “Buffett gives advice for free”, but defenders argue $39/month for unfiltered Burry intel beats decoding his cryptic tweets or incomplete 13Fs.

Burry’s Nvidia skepticism has fueled buzz, especially after he exited Palantir puts in October and clashed publicly with its CEO Alex Karp. Burry’s track record—nailing the 2008 crash and early pandemic calls—makes it intriguing for contrarians, but remember, his views are bearish by nature.

Past performance isn’t a guarantee, and this is his first foray into paid newsletters. Michael Burry’s pivot to a $379/year Substack— just days after deregistering Scion Asset Management—marks a seismic shift for the “Big Short” icon.

No longer constrained by SEC regulations or client mandates, Burry is unleashing unfiltered bearish insights on markets, stocks, and bubbles, with early posts zeroing in on AI’s “supply-side gluttony” akin to the dot-com era. With over 21,000 subscribers already up from 7,700 in the first hours, it’s not just a newsletter—it’s a potential market disruptor.

Burry’s timing screams caution. Launching amid record-highs in tech S&P 500 up ~25% YTD, his debut critiques Nvidia (NVDA) and hyperscalers like Microsoft and Amazon for overbuilding AI infrastructure, mirroring Cisco’s 78% post-dot-com crash.

He flags “aggressive accounting” inflating profits and warns of “catastrophic oversupply” outpacing demand—echoing his 2008 subprime calls.

Burry’s cryptic X posts once sparked mini-panics. NVDA’s flat performance today (-0.2%), with traders joking it’s a “contrarian buy” markets ignore Cassandras until they don’t. If his thesis gains traction—especially with thin holiday liquidity—expect amplified swings in QQQ or NVDA, potentially 5-10% corrections if sentiment sours.

At $39/month, 21k subs yield ~$819k gross monthly revenue, netting ~$737k after Substack’s 10% cut—over $8.8M annually. This dwarfs many hedge fund returns in down years and funds his personal trading without AUM pressures. It’s a savvy monetization of his brand, but risks dilution if predictions falter.

Contrarians may pile into value plays, Burry’s old favorites like Alibaba or water utilities, while bulls double down on AI’s “infinite demand curve” as one analyst countered, noting intelligence scales unlike finite networks.

Substack’s finance category like Citrini at $999/year shows appetite for premium alpha, but at $379, it’s a litmus for how many value Burry’s edge over free Buffett wisdom.