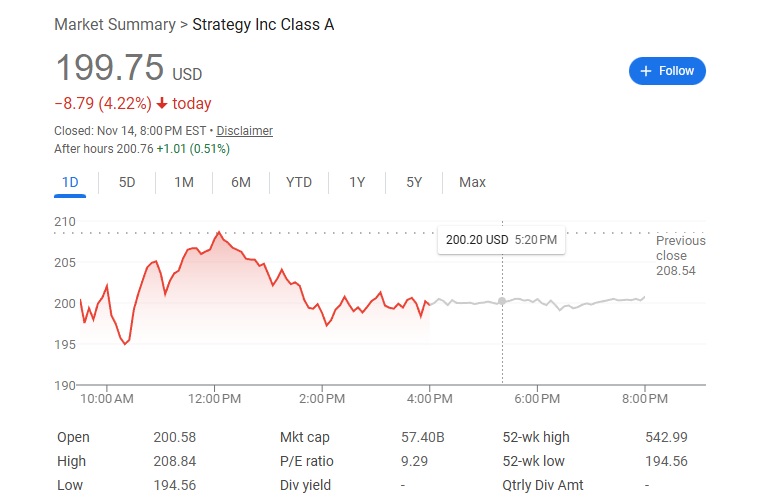

As of pre-market trading on November 14, 2025, MicroStrategy now rebranded as Strategy shares have fallen below $200 for the first time since early October 2024, when the stock traded around $180–$190 amid post-election volatility following Donald Trump’s victory.

The stock closed at $208.54 on November 13, down 7.15% for the day, and is extending losses today with pre-market bids around $195–$198. This marks a roughly 63% drawdown from its all-time high of $543 earlier in 2025, and a staggering 54% decline since mid-July.

MicroStrategy’s stock is essentially a leveraged bet on Bitcoin (BTC), holding over 397,000 BTC valued at approximately $70 billion (as of Q3 2025). The recent slide mirrors BTC’s pullback below $100,000—down 20% from its October peak—but MSTR has underperformed dramatically, decoupling from its crypto proxy role.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Historically correlated at 0.92 with BTC, MSTR has amplified downside due to its aggressive debt-fueled BTC acquisitions. BTC is only -20% YTD, while MSTR is -73% from its 2025 peak. The stock’s multiple-to-net-asset-value (mNAV) has collapsed to 1.06x from 2.7x last year, now trading near or briefly below the value of its BTC holdings per share adjusted for debt.

This erodes the “premium” investors once paid for CEO Michael Saylor’s strategy. The stock has experienced significant volatility in 2025, peaking at $543 in early November before a sharp correction. It is now trading about 62% below its all-time high, with the multiple-to-net-asset-value (mNAV) ratio—comparing stock price to Bitcoin holdings per share—compressing to around 1.22x, down from highs above 2.7x earlier in the year.

This narrowing premium has raised concerns about the sustainability of its “Bitcoin treasury” strategy, though CEO Michael Saylor has emphasized continued accumulation rather than sales. -29.22% underperforming the S&P 500’s ~20% gain.

These figures reflect a broader downtrend in crypto-related equities, with MSTR down over 10% in the past month alone as Bitcoin fell more than 10% from its recent peak.

MSTR’s stock has declined in tandem with Bitcoin’s drop to a six-month low, amplifying losses due to the company’s leveraged exposure via debt-financed BTC purchases. Despite this, Strategy recently added to its holdings, bringing total BTC to 641,692.

Analyst Sentiment: Of 15 analysts, 12 rate it “Strong Buy,” 1 “Moderate Buy,” 1 “Hold,” and 1 “Strong Sell.” The average price target is $523, implying over 155% upside potential from current levels.

RSI at 23.7 deeply bearish, price below the 200-day SMA ($342). Death cross confirmed: 50-day EMA crossed below 200-day EMA. Short interest up to 10% from 7% YTD low, with bears like Jim Chanos who recently closed his short warning of potential BTC liquidation if mNAV dips below 1x.

Inverse cup-and-handle pattern suggests further downside. Q3 earnings showed $2.8B net income from unrealized BTC gains, but core BI software revenue ~$480M TTM grows modestly at 5–7% YoY and remains unprofitable without crypto boosts.

High debt/equity (14%) creates negative carry but boosts ROE to 25.59%. Recent upsized stock offerings for BTC buys have sparked dilution fears, especially as passive funds post-2022 inclusion hold steady.

Further downside to $187–$190 next support, or even $180 if BTC tests $90K. Analysts see risk of BTC sales if mNAV <1x, potentially flooding the market. High-beta nature could drag it 80% from ATH as in 2022.

Oversold bounce if BTC reclaims $110K. Contrarians eye a 2023-like +1700% run if premium rebuilds to 2x+. Saylor’s playbook remains intact with $70B treasury, and passive inflows could stabilize.

Traders call it “brutal AF” and a “deep correction,” with some eyeing $180 targets, while others insist “$MSTR will never go below $200 again!” ironically, just before it did. If you’re holding or trading, watch BTC’s $100K level closely—it’s the linchpin.