The crypto market is entering a brutal phase for altcoins, and XRP is at the center of the breakdown. Its long-awaited push toward $10 looks more distant than ever, especially after today’s decisive crack below the $2.00 support. Meanwhile, a new presale coin, Little Pepe (LILPEPE), priced under $0.003, is capturing market attention as a high-momentum opportunity with 2025 upside that XRP can no longer promise. As confidence drains from older alts, early-stage meme coins with real ecosystems are quickly becoming the dominant narrative. Below, we break down why XRP’s situation is turning from concerning to critical, and why many investors are now redirecting capital into Little Pepe’s fast-moving presale.

XRP’s $10 Narrative Falls Apart as Price Crashes Below $2.00

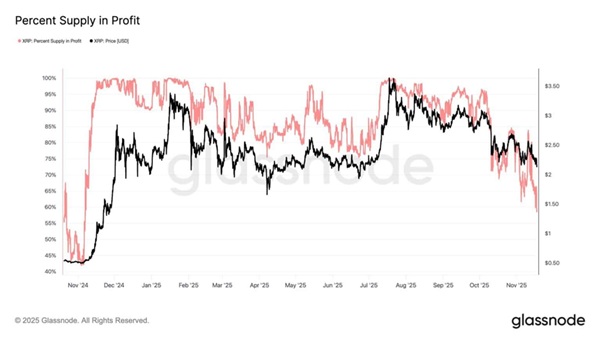

XRP’s drop today wasn’t just another red candle; it was a structural breakdown. The chart sliced under the $2.00 support, a level bulls absolutely needed to defend. On-chain data confirms that 42% of XRP holders purchased around $3, meaning a significant block of holders is now sitting on 40%+ losses. That’s the exact kind of pressure that triggers capitulation during weak market conditions.

XRP Holders’ Percent Supply in Profit | Source: Glassnode

Sentiment is already terrible, altcoins are bleeding across the board, and Bitcoin’s dominance is climbing to 58.45%, indicating that investors are fleeing alts altogether. Even Bitwise’s new spot XRP ETF listing on NYSE Arca, something that should have been a bullish catalyst, failed to provide any lift. Instead, whales dumped 190 million XRP in 24 hours, a clear rejection of the bullish ETF narrative. Everything now points to the same conclusion: the $10 dream isn’t just delayed; it’s slipping out of reach.

Technical Breakdown Suggests More Pain Ahead

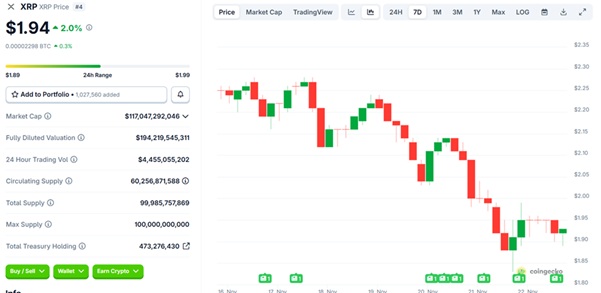

Today’s candle sent XRP to a fresh low, briefly bouncing back from a small demand pocket at $1.94. The wick shows buyers are attempting to defend the level, but the pressure remains heavy and emotional. XRP’s RSI collapsing near 18 tells you the market is massively oversold, often the precursor to a temporary relief move.

XRP Price Chart | Source: CoinGecko

Bulls can still push the XRP price above $2 if the current level holds. However, if XRP fails to maintain this zone, the next liquidity magnet is around $1.90, and that level could easily become a trapdoor for a deeper slide. Currently, the entire structure is teetering between a brief bounce and a full continuation breakdown, and momentum is leaning toward weakness unless buyers step in with force.

Little Pepe Surges as Investors Rotate Into High-Growth Low-Cap Plays

With XRP struggling, traders are pivoting toward early-stage tokens that offer explosive upside with minimal capital required. That’s where Little Pepe (LILPEPE) has separated itself from the rest of the pack. Priced under $0.003, this meme-powered ecosystem is building on a sniper-bot-resistant EVM Layer 2, delivering zero buy/sell tax, near-zero trading fees, and a meme-exclusive launchpad that will roll out post-launch. The presale has already raised over $27.6 million, with more than 16.7 billion tokens sold, confirming intense demand from retail investors. Stages are selling out rapidly, and LILPEPE now sits on CoinMarketCap with a confirmed $0.003 launch price and a $300 million market cap at listing. Add the CertiK audit, strict vesting (0% at TGE with a 3-month cliff), and high staking APY, and it becomes clear why investors view LILPEPE as the safer high-reward play compared to bleeding large caps. The crypto market isn’t showing a nice picture of legacy tokens. Currently, attention is focused on fresh legs with enough fuel to run.

Why Analysts Say LILPEPE Could Be the Top Crypto to Buy in 2025

Ripple’s $10 dream is fading, but the opportunity for a new breakout project is emerging. Little Pepe’s fundamentals position it as one of the few meme coins capable of delivering a massive 2025 run. Analysts point to three core reasons:

- Low entry price below $0.003 makes early multiples realistic

- Layer 2 infrastructure gives it utility that older meme coins never had

- Presale momentum mirrors early-stage SHIB and PEPE before their exponential rallies

With retail liquidity rotating and altcoins struggling, LILPEPE is becoming the clear favorite for traders searching for the next notable upside wave. XRP’s breakdown may be painful, but it’s also revealing where the real opportunity is now.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

$777k Giveaway: https://littlepepe.com/777k-giveaway/