Thank you, Dr. Reuben Abati, for mentioning this Ovim village boy and for referencing my Harvard Business Review work on the Umunneoma Economics of the Igbo Apprenticeship System, in your show.

Let me also use this moment to explain this economic framework more clearly, so that as people study Adam Smith’s classical economics, Confucian economic philosophy in China, and other schools of thought, they can also add Umunneoma Economics, literally, the economics of good brethren, to their intellectual toolkit.

It is a framework rooted in community, reciprocity, and shared prosperity, where enterprise is not just about individual accumulation but about lifting others as you climb. In Umunneoma Economics, wealth creation is intertwined with obligation: you succeed, and you return to enable another; you rise, and you pull a brother or sister up. That is the logic behind the Igbo apprenticeship system and the cooperative spirit that rebuilt communities after devastation.

So yes, alongside the invisible hand of Adam Smith and the moral order of Confucius, there is also the visible hand of community, Umunneoma, where trust, mentorship, and shared destiny become factors of production.

Umunneoma Economics, explained by Ndubuisi Ekekwe in a seminal Harvard Business Review project, is a business philosophy rooted in the traditional African (specifically Igbo) concept of shared prosperity and community support, captured by the maxim “onye aghana nwanne ya” (do not leave your brethren behind). It is a model of stakeholder capitalism that contrasts with traditional Western shareholder capitalism focused on individual accumulation and market dominance.

Key tenets of Umunneoma Economics include:

- Shared Prosperity: The core idea is that success should be measured by the quantifiable support provided to stakeholders and the community, rather than by absolute market dominance or building individual conglomerates.

- Poverty Prevention: The system aims to prevent poverty by mass-scaling opportunities for everyone, ensuring that wealth accumulation lifts the entire community.

- Co-opetition (Cooperative Competition): Participants in the system “co-opetitively participate to attain organic economic equilibrium”. This involves major participants funding their competitors, surrendering market share, and enabling the formation of livable economic clusters.

- The Igbo Apprenticeship System (IAS): Umunneoma economics is largely an articulation of the successful Igbo Apprenticeship System (known locally as Igba-Boi), which is considered responsible for the rapid economic recovery and wealth accumulation in Southeast Nigeria after the 1970 Biafran War.

- Focus on Stakeholders: Unlike shareholder capitalism which prioritizes investor returns, Umunneoma economics focuses on the welfare and rise of all stakeholders (employees, community members, and even competitors).

This economic philosophy has gained recognition as a viable framework for a more equitable world, aligning with emerging discussions on stakeholder capitalism.

Thank you, Dr. Reuben Abati, for mentioning this village boy and for referencing my Harvard Business Review work on the Umunneoma Economics of the Igbo Apprenticeship System.

Let me also use this moment to explain this economic framework so that as people study Adam Smith’s… pic.twitter.com/I5BmbS1wWN

— Ndubuisi Ekekwe (@ndekekwe) December 29, 2025

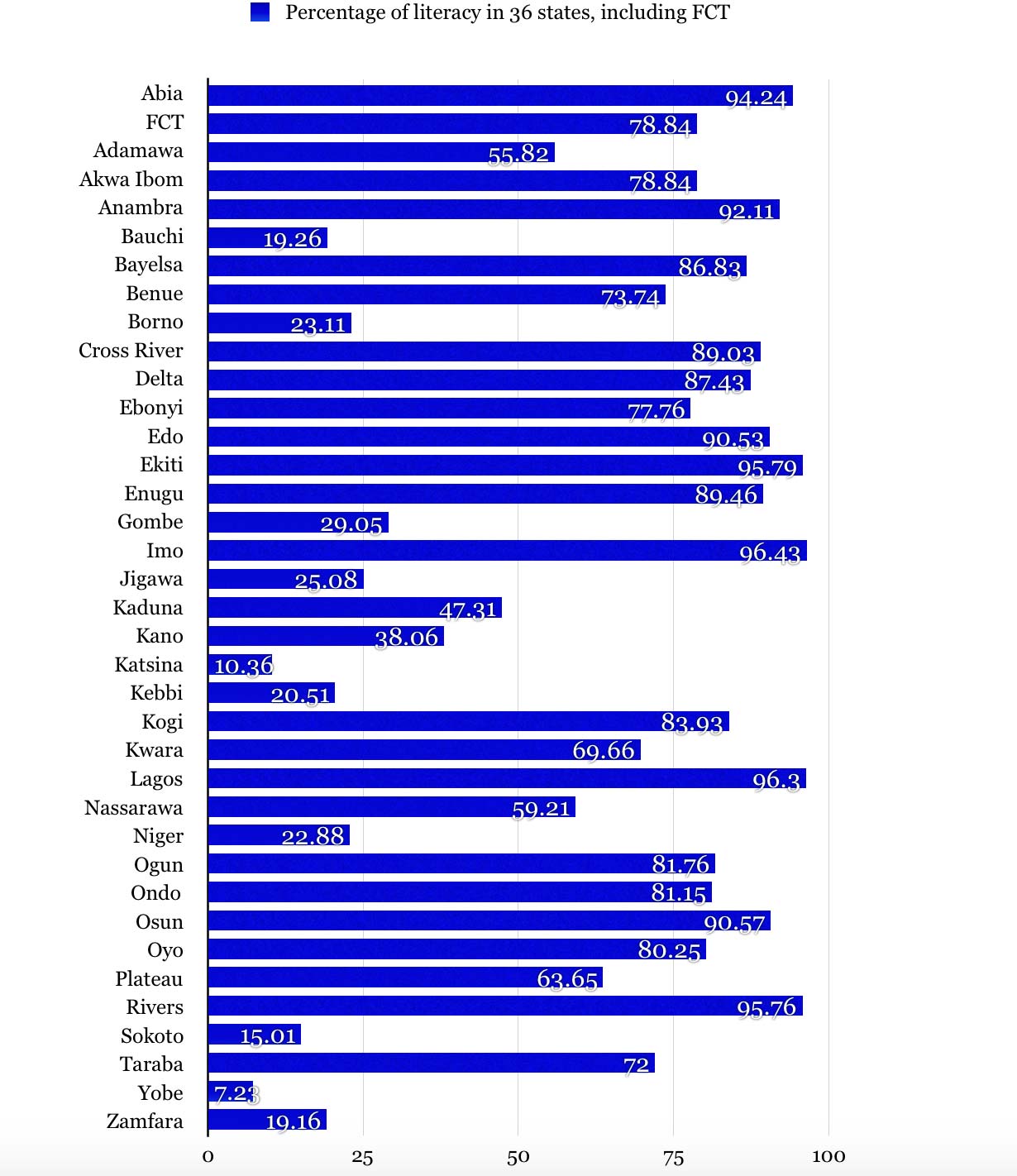

On literacy rates:

Dr. Abati, let me address the point on literacy rates. The facts are these: using official government data, South-East Nigeria has consistently done well in literacy rates. Abia, Imo, and Anambra have for years recorded literacy levels of above 90%. Enugu is in the high 80s, while Ebonyi is slightly below 80%. These are among the strongest literacy outcomes in Nigeria by geopolitical zone, and they would not have been possible if boys are not enrolled in schools!

Therefore, the thesis that Umunneoma Economics has negatively affected male-child enrollment is not supported by data. The evidence points in the opposite direction. (See data here: https://www.tekedia.com/yobe-states-7-23-literacy-rate-and-digital-transformation/)

That said, I concede one historical nuance. In the 1970s and 1980s, male-child enrollment in parts of the South-East was indeed lower than female enrollment. But that was not because education was devalued. It was because The Greatest Generation, Igbo men and women who engineered the rebuilding after the Biafra War, made a strategic choice.

They challenged young males to move into enterprise, using the apprenticeship system as a vehicle to escape the miry clay in the Igbo Nation, and to prevent a vicious cycle of poverty. It was a deliberate economic reconstruction strategy. I have spoken with some of these men, and many confirmed that the reconstruction was “war” and the boys were tasked to fight it through the markets.

By the late 1980s, that phase had largely run its course. And from the early 1990s, as Igbos began integrating fully into Nigeria’s capital formation system (visible via investments and properties across Lagos, Abuja, and beyond), male literacy rebounded strongly. Since then, literacy rates in the South-East, including for males, have remained among the highest in the country.

In short, history must be read with data and context. And on literacy, the numbers speak clearly.