Tesla’s Q3 2025 earnings report confirmed that the electric car giant held tight to its $1.3 billion Bitcoin position, refusing to sell a single satoshi. With Bitcoin holding above $107,000, Tesla’s stance signals a bullish sentiment that could drive the next major altcoin surge. Investors now have their eyes set on the next wave of tokens that could follow Bitcoin’s momentum. Here are the five cryptos to buy right now, and leading the list is Little Pepe (LILPEPE), a meme coin sensation with serious market potential.

Little Pepe (LILPEPE): The Meme Coin About to Explode

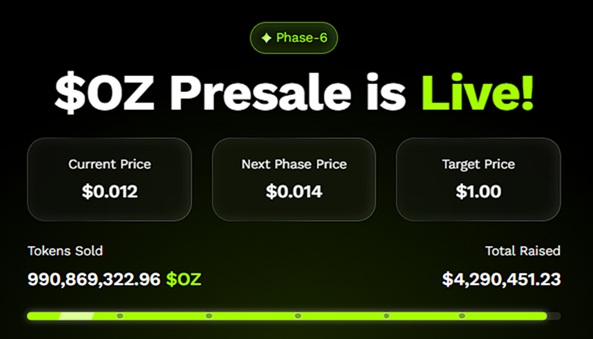

Little Pepe (LILPEPE) is stealing the show as the top crypto to buy following Tesla’s decision to hold its $1.3 billion Bitcoin stake through Q3 2025. With a presale that has already raised over $27.35 million, this meme token is creating massive buzz across the DeFi space. Priced at $0.0022 in stage 13 after a complete sellout of earlier stages, investors are rushing to grab their share before the next price jump. This high level of engagement demonstrates that the community’s backing for Little Pepe is both broad and strong. Experts are already comparing LILPEPE’s potential to that of early-stage giants like PEPE and SHIB, predicting that its price could surge once the token launches on exchanges.

LILPEPE’s security credentials are equally impressive. It has been successfully audited by CertiK, achieving a security score of 95.49%, proving that investor protection is a top priority.

Its roadmap playfully describes the project as being in its “pregnancy stage,” preparing for a major market launch alongside “Mumma Pepe.” Once this meme coin hits major exchanges, analysts expect a massive price surge that could push Little Pepe into the top tier of cryptocurrencies. With Tesla showing faith in Bitcoin, meme coins with strong fundamentals and vibrant communities are next in line to benefit. Among them, Little Pepe (LILPEPE) stands out as a must-watch token for anyone seeking explosive gains.

Cardano (ADA): Smart Contract Growth Back in Focus

Following Tesla’s Bitcoin holdings, Cardano (ADA) is back on the radar of investors seeking a robust smart contract platform to add to their portfolios. ADA has reclaimed a 4.54% gain for the week. If the $0.84 resistance is breached, ADA could descend towards $0.97. A short-term dip could open up buying opportunities for traders anticipating a market recovery. As DeFi users and activity increase, Cardano’s potential for bullish performance looks promising.

Sui (SUI): Fast-Growth Token Ready for More Gains

Sui (SUI) has proven itself to be one of the fastest movers in the market since Tesla confirmed its Bitcoin holdings. After dropping to $0.56 in late October, SUI skyrocketed by over 380% to $2.71, breaking out from a symmetrical triangle with rising volume. As the crypto market gains more strength, SUI’s performance could extend further, making it a top pick for traders seeking short-term upside.

TRON (TRX): Stability Meets Steady Growth

Elon Musk’s steady Bitcoin strategy is giving extra fuel to reliable projects like TRON (TRX). Trading at $0.297, TRX remains one of the most consistent performers in the market. With low 4.5% volatility over the past month, TRON offers investors a stable accumulation zone.

Ripple (XRP): Whale Accumulation Signals Strength

Ripple (XRP) has crossed a major resistance level at $2.63, and with the current price at $2.68, it registers a 3% price growth. Weekly trading volume is up by 26%. With regulatory clarity improving and other countries’ interest piqued, XRP might finally garner some market excitement again now that Tesla has decided not to sell.

Conclusion

Tesla’s confidence in Bitcoin has reshaped the crypto sentiment, and savvy investors are moving quickly. Among the five cryptos to buy, Little Pepe (LILPEPE) is leading the charge with unmatched community engagement, verified security, and explosive presale growth. With excitement building, this meme token could soon be the next headline-making success story in the crypto space.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

$777k Giveaway: https://littlepepe.com/777k-giveaway/