Solana and XRP are both showing strength heading into the next leg of the bull market, and their price forecasts continue to reinforce confidence among long-term holders. SOL is riding strong momentum from growing network activity, while XRP’s recent technical structure hints at a potential breakout if macro market conditions align. Yet despite these solid setups, many traders are shifting their attention elsewhere—not to big caps, but to early-stage plays. Ozak AI has become one of the hottest targets for those seeking exponential returns, not just steady gains.

Ozak AI Attracts Traders Looking Beyond Solana and XRP

Solana’s ecosystem expansion and XRP’s network utility are well-documented, but their upside potential is far more conservative compared to early presale projects. SOL pushing to $300 or XRP breaking $2 would be impressive, but those moves pale in comparison to the kind of multiples possible when getting in early on a promising low-cap token.

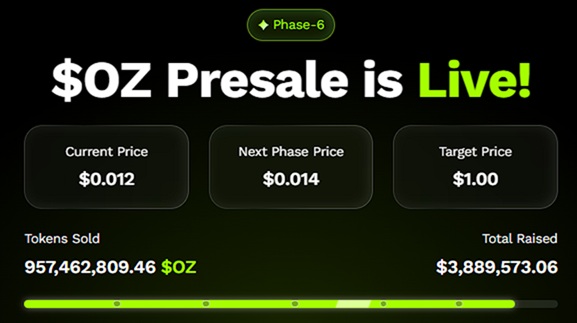

Ozak AI, currently in its 6th OZ presale stage at $0.0012, offers traders that very early entry point. With more than 950 million tokens sold and over $3.8 million raised, the project has already drawn significant attention from both retail investors and early whale capital. For traders seeking 20x, 50x, or even 100x upside potential, Ozak AI represents an opportunity that Solana and XRP simply can’t match at their current valuations.

Ozak AI’s Flip Appeal Comes From Early Positioning

The biggest fortunes in crypto are often made by those who position early, long before tokens become mainstream. Ozak AI’s presale stage gives traders a front-row seat to exactly that kind of positioning. At $0.0012, even a modest allocation can secure a large token stack. If Ozak AI lists between $0.01 and $0.05 during a heated bull market, the resulting returns could easily dwarf those from larger, more established projects.

While Solana and XRP provide stability and steady appreciation, Ozak AI caters to traders chasing aggressive upside. It’s the same mentality that fueled early investments in meme coins like Dogecoin and Shiba Inu, but with a narrative rooted in one of the fastest-growing sectors in tech: artificial intelligence.

Ozak AI Rides the Strongest Narrative of the Cycle

This bull run is already being defined by the rise of AI narratives. Just as DeFi dominated 2020 and meme coins defined 2021, AI integration with blockchain is emerging as the star theme of this cycle. Ozak AI sits directly at that intersection, leveraging AI-powered predictive agents and data intelligence to create real utility on-chain.

For traders, narrative matters just as much as fundamentals. When the broader market begins chasing a dominant narrative, tokens aligned with that story often experience explosive demand. Ozak AI is already building traction before listing—a sign that momentum could accelerate sharply post-launch.

Ozak AI Could Outperform Even Strong Forecasts

Solana and XRP are positioned to deliver respectable returns for investors who prefer larger caps, but traders seeking outsized gains are increasingly looking toward Ozak AI. The combination of low entry price, strong narrative positioning, and growing presale traction creates a setup that mirrors some of the biggest winners of past cycles.

If the AI narrative continues to heat up and Ozak AI executes on its roadmap, it could deliver far more dramatic flips than SOL or XRP in this bull run. While big caps build the foundation, it’s often the early-stage plays like Ozak AI that define the stories traders talk about for years.

About Ozak AI

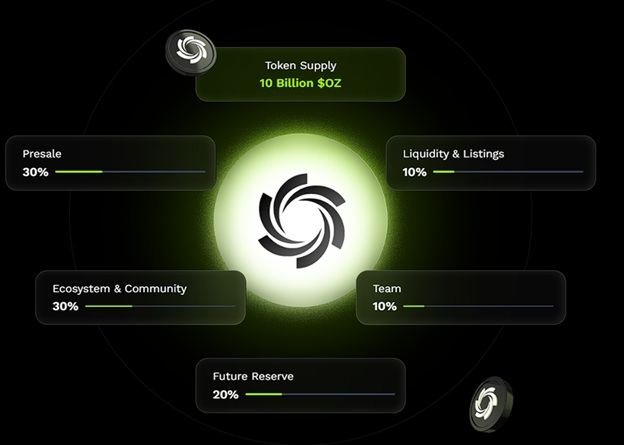

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi