In October 2025, a ride booked through InDrive from Surulere to Mafoluku Oshodi in Lagos became the center of a heated online controversy that reflected the deep link between insecurity and trust in Nigeria’s mobility ecosystem. The passenger, a young woman named Itohan, alleged that her driver, James Oluwatosin, deliberately faked a car breakdown around Onipanu to enable robbers to attack them. She claimed that the driver sat idly in his vehicle while thugs extorted money from her and her friend. Her public narration on social media quickly went viral, fueling outrage and calls for the driver’s suspension.

According to the driver’s account, however, the event unfolded very differently. He explained that his car developed an electrical fault, causing it to shut down suddenly. Using the vehicle’s remaining motion, he steered to a lighted area to inspect the problem and advised the passengers to stay locked inside for safety. The women refused, stepped out of the car, and were soon approached by local street thugs, popularly known in Lagos as area boys, who demanded payment to allow the car to remain parked.

The driver engaged them, but they insisted on ?20,000. Itohan then intervened, negotiating the amount down to ?8,000, which she transferred to the thugs herself. With assistance from the same group, the driver fixed the car and completed the trip, receiving ?4,000 from Itohan instead of the agreed ?4,800. He later discovered that his InDrive account had been suspended due to her report accusing him of complicity in the robbery.

Understanding the Nature of the Crisis

What began as a mechanical fault quickly evolved into a full-blown crisis driven by insecurity and amplified by social media outrage. The real danger originated from Lagos’s structural insecurity: the presence of extortionist street gangs who prey on stranded motorists. Yet, in the absence of context, online audiences interpreted the event through moral and emotional frames—trust, gender, and safety.

This shift from a security incident to a reputational conflict exposed a major challenge in digital mobility systems: how platform algorithms and users interpret events stripped of on-ground realities. In Lagos, where urban breakdowns often attract harassment, both drivers and passengers are vulnerable. However, because most platforms prioritize customer protection, drivers are often the first to be penalized when complaints arise, regardless of context. The Onipanu incident thus combined physical insecurity, procedural imbalance, and the volatility of online judgment into one cascading crisis.

Public Reaction and Platform Response

The story divided public opinion sharply. Many Lagos residents, drawing from lived experience, empathized with the driver and argued that area boys harassment is a common feature of the city’s transport life. Others criticized the ride-hailing company for suspending him without investigation, framing it as another case of platform bias against workers. Meanwhile, online debates expanded into questions about feminism, accountability, and the credibility of digital accusations.

In response to the growing uproar, InDrive issued an official statement clarifying that it had contacted the driver, reviewed his trip records, and found no inconsistencies in his account. The company stated that James Oluwatosin had been a driver-partner for over three years, maintained a high rating, and that safety and fairness remained its top priorities. This direct communication reversed the narrative almost instantly. The driver was publicly vindicated, and the platform regained credibility for demonstrating fairness after due process. Importantly, the tone of the statement was calm, factual, and neutral, which suggests avoiding defensive or accusatory language and instead reaffirming institutional values of safety and fairness.

From Insecurity to Corporate Crisis Management

The InDrive–Onipanu case indicates that insecurity on Nigerian roads is not merely a safety issue but a reputational risk factor for digital platforms. A car breakdown in a high-risk area after dark can easily turn into a viral crisis if interpreted as negligence or conspiracy. Platforms that rely on user feedback and automated discipline systems must therefore recognize the socio-urban realities of their operating environment.

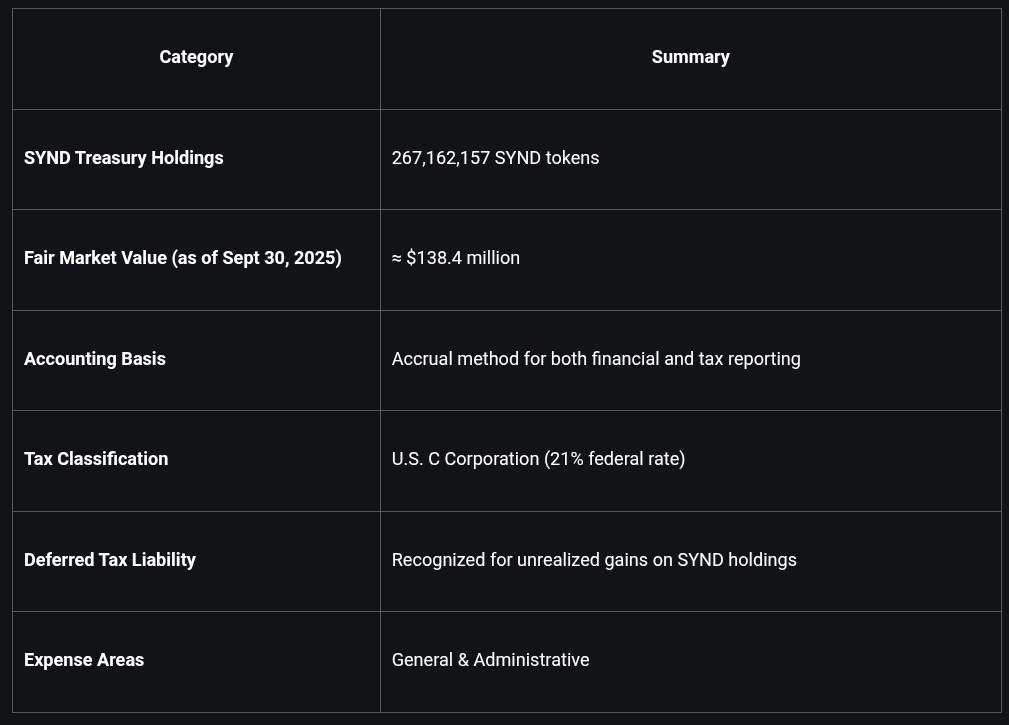

Exhibit 1: Lessons for managing insecurity-driven crises

InDrive’s eventual response demonstrated effective crisis management in four key ways: it verified the facts before taking a final decision, communicated its findings publicly, balanced empathy with neutrality, and highlighted the driver’s proven track record. These steps transformed a reactive suspension into a case of responsible corporate learning. Centering evidence over outrage reaffirmed InDrive’s legitimacy while subtly educating its audience about the real nature of Lagos insecurity.