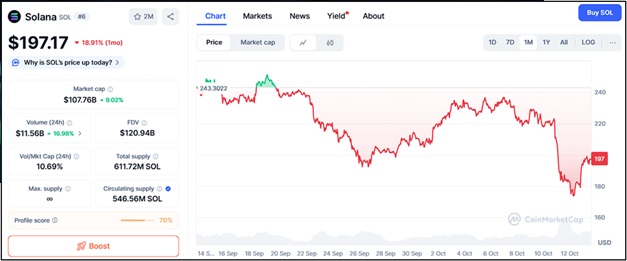

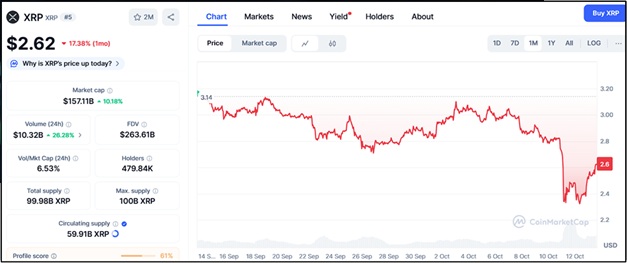

Solana and XRP are two of the strongest-performing altcoins as the 2025 bull run gains momentum. Solana is currently trading near $198, while XRP sits at $2.64, both enjoying renewed institutional interest and strong retail participation. Analysts predict Solana could rally toward $500 and XRP could climb beyond $5 in the coming months, offering investors steady and respectable returns.

But seasoned traders and early adopters know that the biggest fortunes in crypto aren’t made by simply holding blue-chip assets. Instead, they’re made by flipping a portion of those profits into early-stage tokens with explosive growth potential. That’s why many investors are rotating some of their Solana and XRP gains into Ozak AI—a presale project currently priced at $0.0012, with over $3.7 million raised and more than 945 million tokens sold. This kind of early entry could be the key to life-changing returns.

Solana and XRP Offer Strength

Solana continues to prove its strength as a high-performance Layer-1, with resistance around $235, $315, and $500, and support at $160, $130, and $110. Its ecosystem is expanding rapidly, fueling consistent growth.

XRP, meanwhile, remains a top choice for long-term holders due to its utility in global payments. It faces resistance at $3.15, $4.30, and $5.00, and support at $2.20, $1.85, and $1.40.

While both assets are primed for further appreciation, their upside is measured in multiples—not the kind of explosive 100x returns that define early-stage opportunities. For investors who already hold SOL and XRP, flipping even a small portion of their profits into Ozak AI could massively amplify their portfolio’s growth potential.

Ozak AI’s Flip Math Is Hard to Ignore

Ozak AI offers the kind of asymmetric risk-reward that experienced traders seek during bull markets. At $0.0012, a $1,000 investment secures approximately 833,000 tokens. If Ozak AI reaches $1, that $1,000 turns into $833,000. At $5, it grows to more than $4 million. And at $10, it surpasses $8 million.

This is why investors aren’t abandoning SOL or XRP—they’re simply strategically rotating a fraction of their gains into an asset with far greater upside. This move allows them to keep their blue-chip exposure while positioning early in a project with massive growth potential.

Ozak AI Sits at the Heart of the AI Megatrend

The driving force behind Ozak AI’s explosive potential is its position within the AI + blockchain megatrend, expected to define this bull run much like DeFi did in 2021 and ICOs in 2017. Ozak AI is building predictive AI agents, trust-based data layers, and on-chain intelligence, creating infrastructure that connects AI innovation with decentralized ecosystems.

Through partnerships with Perceptron and HIVE, Ozak AI has laid down a technological foundation that separates it from hype-only presales. It’s not just a token—it’s a platform designed to evolve with the AI narrative.

Early Credibility Builds Confidence

Presale projects often come with risks, but Ozak AI has made transparency and security a priority. The project has completed audits with CertiK and Sherlock and is listed on CoinMarketCap and CoinGecko. These early credibility markers have given both retail investors and whales confidence to enter before listings drive prices higher.

Flipping Early Could Be a Defining Move

Solana and XRP are excellent assets for steady gains, but they won’t deliver the kind of explosive returns that change portfolio trajectories entirely. Ozak AI, with its early entry price and AI narrative tailwind, offers that kind of potential.

By flipping a portion of their profits into Ozak AI now, investors position themselves ahead of the curve—before the listings, before the hype, and before the price runs away. In past cycles, early movers into breakout narratives have been the ones to write the next millionaire stories. In 2025, Ozak AI could be that story.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi