When analysts first started calling for $TAP to hit $14, most people didn’t believe it. After all, Digitap ($TAP) is a new project still in its presale phase. But the more investors look into what Digitap is building, the clearer it becomes: this isn’t just another altcoin; it could be the start of a financial revolution.

In every bull run, a handful of projects break away from the noise and create a new narrative. In 2017, it was Ethereum. In 2021, it was Solana. In 2025, that breakout could very well be Digitap as it’s bridging the worlds of banking and blockchain into a single platform.

The Banking Problem Everyone Ignores

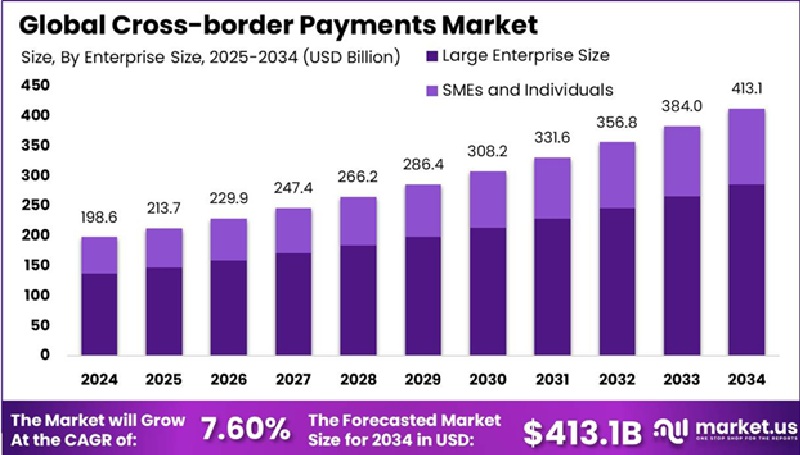

The worldwide financial system is enormous and still it takes 2-3 working days for the cross-border payments to be completed. The fees are very high, ranging from 6-7% for international payments.

Yet the dream of crypto becoming a means of daily payment is now a reality. Digitap combines the best of both worlds. Users get the freedom to use crypto with the convenience of banking-grade services. Its goal is very clear: to make money borderless, instant, and private again.

Digitap’s presale is already a huge success, with more than $675,000 raised so far. The present price of $0.0159 is going to increase to $0.0194 in the next presale round.

What Digitap Is Building

Digitap’s foundation is powerful yet elegant. The platform provides users with the integration of crypto wallets, bank accounts, and payment cards in one single interface.

Individuals may have crypto as well as fiat in the Digitap app. They can swap between them in real time and use a Digitap Card (a Visa-powered card) for spending.

Digitap does not put users in a position where they have to undergo KYC processes over and over again. It provides an onboarding facility without KYC, thus users may keep their anonymity, and enjoy instant payments and transfers. Here, privacy is not one of the features but one of the basic fundamentals.

Why Analysts Are Predicting a Huge Rise for Digitap

The prediction of the $14 price was not without reasons. It is based on math, market logic, and momentum. The $14 value at the presale price of $0.0159 seems very far to many users. But analysts forecast that Digitap will be able to achieve this huge increase if it can only capture a tiny share of the global payments market.

This is the reason:

The global cross-border payments market is expected to reach $250 trillion per year by 2027. The total value of remittances alone is $860 billion annually.

This represents a vast potential market for mobile-first financial apps like Digitap to grow exponentially in the coming days. This is a crypto project targeting markets with trillions of dollars of annual flow.

Digital Has AI and Banking-Grade Security

Digitap is more than just a crypto wallet. It operates on a Zero-Trust Security Framework to provide bank-level safety for the users. AI Smart Routing is applied to every transaction, which helps in locating the cheapest and fastest route.

By using this system, transaction costs are reduced to less than 1% of the total, compared to the global average of 6.2% charged by banks. This is a game-changer for freelancers, businesses operating globally, and cross-border workers.

What is even more impressive is that the platform’s multi-rail settlement engine can use both on-chain and off-chain payment rails. Thus, it is bridging the gap between DeFi and traditional finance.

This is the reason why some analysts refer to Digitap as the “very first real omni-bank.” Then there are staking rewards (early adopters can get up to 124% APR) and cashback incentives that have real utility.

The Shift Has Already Begun

Digitap’s momentum is undeniable. The presale has recently crossed the $675,000 mark with the thousands of new investors. They are seeing the same thing that the analysts are seeing: a project that has real-world use, low entry price, and huge growth potential.

The crypto market has had 100x winners in the past like Solana, Polygon, and Avalanche. What made them succeed was utility and timing. Digitap has both. It is coming into the market at exactly the point when people want to use crypto in their daily lives.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app