Snowflake CEO Sridhar Ramaswamy says he is determined to keep the company’s focus on long-term innovation and customer value amid the current wave of investor frenzy surrounding artificial intelligence.

The head of the $60 billion data cloud firm said on CNBC’s Squawk Box Europe that he refuses to be distracted by Wall Street’s shifting sentiment, even as Snowflake’s share price continues its steep climb.

“You don’t control the stock price,” Ramaswamy said. “My focus very much is on value creation. We have to earn dollars, every single dollar at a time, so we are focused on the quarter, focused on the year, but, much more, on the value we create with customers. Over the long term, the stock market will settle itself.”

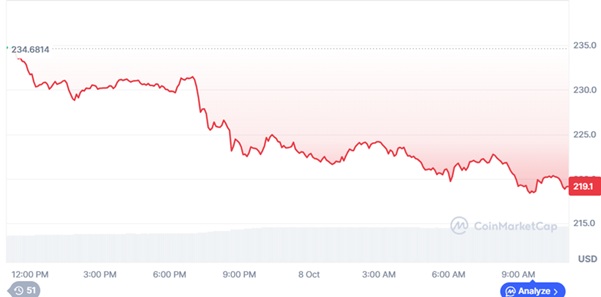

Snowflake, a cloud-based data warehousing platform that helps enterprises manage and analyze vast volumes of data, went public in 2020 in what remains the largest software IPO in history, raising $3.4 billion. Its stock has risen more than 60 percent this year, buoyed by the broader AI boom that has lifted companies like Nvidia, Microsoft, and Palantir. The company’s shares surged another 6.5 percent on Wednesday following renewed investor optimism over its AI integration plans.

Yet, as the AI wave fuels record market valuations, it has also triggered warnings of a potential speculative bubble. Analysts say valuations in the sector may be running ahead of fundamentals as capital floods into any company associated with artificial intelligence — reminiscent of the dot-com era when internet firms saw their stocks soar before the crash of 2000.

Ramaswamy, who previously led Google’s advertising business before joining Snowflake, has positioned the company as a key infrastructure provider for the AI economy — connecting corporate data warehouses to large language models and generative AI tools. He said his strategy remains to make AI practical and value-driven rather than treating it as a buzzword.

“One of the biggest opportunities we see is how quickly AI can accelerate the value that comes from data,” he said. “But we have to stay focused. Some are thinking of AI as a technology that can cure all problems. I think it’s a mistake. Definitely, there’s promise, but some areas are going to be much more amenable than others.”

Ramaswamy said companies adopting AI must do so gradually and strategically, warning that rapid, top-down implementation can backfire.

His comments come amid heightened scrutiny over insider trading activity at Snowflake. Investor Michael Speiser sold shares worth over $11 million last week, while senior vice president Vivek Raghu Nathan sold roughly $2.6 million worth of stock in late September. Ramaswamy, however, said he is not participating in any such sales.

“I am not selling any stock,” he said. “I’m very much in favor of the long-term value that Snowflake is going to be creating, and the sales tend to be very, very modest.”

Snowflake’s leadership transition earlier this year — following the departure of Frank Slootman, who led the company through its blockbuster IPO — has coincided with an accelerated focus on generative AI. Ramaswamy, who co-founded the search startup Neeva before it was acquired by Snowflake in 2023, has emphasized building what he calls the “data foundation for AI.” Snowflake’s AI initiative includes integrating its platform with large language models (LLMs) to help customers query their data more intuitively using natural language.

The company has also launched Snowflake Cortex, a suite of generative AI tools that allows clients to deploy custom AI models directly on their enterprise data. Analysts say this positions Snowflake as a bridge between the corporate world’s vast data repositories and emerging AI ecosystems dominated by firms like OpenAI and Anthropic.

However, Snowflake faces intensifying competition. Cloud giants such as Amazon Web Services, Google Cloud, and Microsoft Azure are rapidly expanding their data services, embedding AI capabilities to lock in customers. Still, Snowflake’s platform-agnostic model — allowing customers to move and analyze data across multiple clouds — continues to distinguish it in the market.

Some business leaders say the debate over whether AI is in a bubble may miss the broader point. Ashley MacNeill of Vista Equity Partners told CNBC’s Closing Bell that while speculative excesses are possible, AI’s adoption trajectory is far deeper and more sustained than previous tech waves.

“Is this a bubble that’s going to burst like it did in 1999? Or is this more like a balloon where we’re going to see it inflate and deflate as we go through the cycles?” she said. “Given the longevity of this technology and the waves that are going to adopt it, I’m more inclined to think we aren’t bursting, but rather inflating and deflating as this technology ebbs and flows.”

Ramaswamy echoed that sentiment, saying temporary market volatility should not obscure the transformation AI is driving across industries.

“Will there be turbulence along the way in the markets, with respect to how the stock market behaves? Absolutely,” he said. “But the value that is going to come out of this AI revolution is pretty firm, and we all need to stay focused on that.”

He concluded by reaffirming his ambition for Snowflake to become a cornerstone technology company in the age of AI-driven data.