Telegram, the popular messaging app, has announced the launch of an in-app crypto wallet that will allow its users to send and receive digital currencies. The wallet, called Telegram Wallet, is integrated with the app’s chat interface and supports multiple blockchains, including Bitcoin, Ethereum, and Telegram’s own TON network.

Telegram Wallet aims to provide a simple and secure way for users to access the world of cryptocurrencies and decentralized applications (DApps). Users can create a wallet with a few taps, without the need for any personal information or verification. They can then use their wallet to send and receive crypto payments, as well as interact with DApps and smart contracts on various platforms.

According to Telegram, the wallet is designed to be user-friendly and intuitive, with features such as QR codes, contact integration, and chatbot assistance. Users can also customize their wallet settings, such as choosing their preferred currency, network, and fee level. The wallet also supports biometric authentication and encryption to ensure the safety of users’ funds and data.

Telegram Wallet is the latest addition to Telegram’s ecosystem of services, which includes voice and video calls, group chats, channels, bots, stickers, and more. The app has over 500 million active users worldwide and is known for its focus on privacy and security. Telegram claims that its wallet will offer the same level of protection and anonymity to its users in the crypto space.

Telegram Wallet is currently available for Android devices and will soon be released for iOS devices as well. Users can download the latest version of Telegram from the Google Play Store or the App Store and start using the wallet right away.

Telegram trading bots have been making waves in recent months, attracting the attention of both investors and regulators. In this blog post, we will explore what these bots are, how they work, and what are the benefits and risks of using them. For the past ten weeks the Telegram bot narrative made waves. Unibot hit 85x, Loot bot moved to Base, unibot closed a partnership with OKX, Loot bot just partnered with FriendTech, these bots have handled over $190M in total trades.

Telegram trading bots are software applications that can execute trades on behalf of users based on predefined rules and market signals. They can help traders automate their strategies, save time, and optimize their profits. In this blog post, we will explore the benefits and challenges of using Telegram trading bots, as well as some tips on how to choose the best one for your needs.

Telegram trading bots typically rely on two types of inputs: market data and user commands. Market data can include price movements, volume, indicators, news, and other relevant information. User commands can include buy, sell, stop-loss, take-profit, and other trading parameters. You have an opportunity to Capitalize on this narrative.

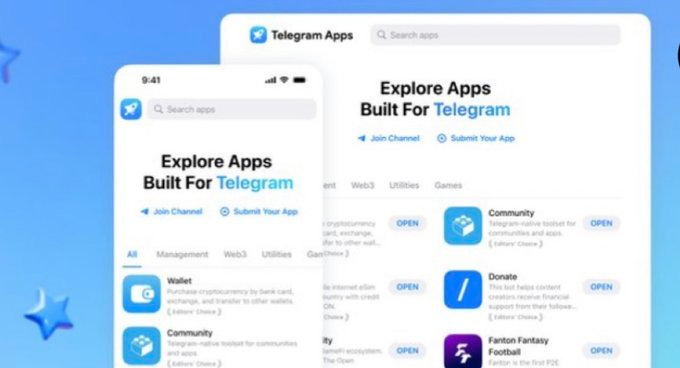

Telegram host almost twice the users on web3 on its platform, they’ve not just allowed this trading bots to run on their API, they’ve brought a web3 supper app to telegram. Telegram is following in WeChat’s footsteps by embracing a super app ecosystem. This move allows third-party developers to build mini apps within Telegram, eliminating the reliance on standalone websites Here’s what this implies 60% of CT traders can login to Dexscreen on telegram.

The bots use various algorithms and strategies to analyze the market data and generate trading signals. These signals can be either executed automatically by the bot or sent to the user for confirmation. The user can also monitor the bot’s performance and adjust the settings as needed.

Telegram trading bots offer several advantages for traders, such as:

Convenience: The bots can operate 24/7, without requiring constant supervision or intervention from the user. They can also access multiple markets and exchanges at once, increasing the opportunities for profit.

Speed: The bots can react faster than human traders to changing market conditions and execute trades in milliseconds, reducing slippage and latency.

Accuracy: The bots can eliminate human errors and emotions that can affect trading decisions, such as fear, greed, bias, and fatigue.

Scalability: The bots can handle large volumes of trades and data, without compromising their performance or accuracy.

Customization: The bots can be tailored to suit the user’s preferences, risk appetite, and trading goals. They can also be integrated with other tools and platforms, such as charting software, portfolio trackers, and social media.

Telegram trading bots are not without drawbacks, however. Some of the potential risks include:

Security: The bots may be vulnerable to hacking, phishing, malware, or other cyberattacks that can compromise their functionality or steal their funds. Users should always verify the legitimacy and reputation of the bot providers and use secure passwords and encryption methods.

Regulation: The bots may operate in unregulated or illegal markets that can expose their users to legal or financial consequences. Users should always check the local laws and regulations before using any bot service and comply with the relevant tax obligations and reporting requirements.

Performance: The bots may not perform as expected or promised by their providers, due to technical glitches, faulty algorithms, market manipulation, or unforeseen events. Users should always test the bot’s performance on a demo account before using it on a live account and monitor its results regularly.

Cost: The bots may charge fees for their services, such as subscription fees, commission fees, or withdrawal fees. Users should always compare the costs and benefits of different bot options and choose the one that offers the best value for money.