The debate over whether money can buy happiness was reignited this week by Elon Musk’s somber tweet on Wednesday. The tweet, accompanied by a sad-face emoji, reads: “Whoever said ‘money can’t buy happiness’ really knew what they were talking about.”

The post, from the world’s wealthiest individual with a net worth close to $1 trillion, quickly amassed over 92.8 million views, sparking widespread reactions and drawing a pointed response from fellow billionaire Mark Cuban. Cuban, ranked 372nd on the Bloomberg Billionaires Index with an estimated $9.62 billion fortune, countered: “Money doesn’t change who you are it just amplifies it. If you were happy when you were poor, you will be insanely happy if you get rich. If you were miserable, you will stay miserable, just with a lot less financial stress.”

Cuban’s perspective, rooted in his own rags-to-riches story as the founder of Broadcast.com and owner of the Dallas Mavericks, emphasizes that wealth magnifies inherent traits rather than inherently creating joy.

Musk, CEO of Tesla, SpaceX, and xAI, has echoed similar sentiments before. In a November 2025 appearance on Nikhil Kamath’s “People by WTF” podcast, he advised: “Aim to make more than you take. Be a net contributor to society,” suggesting that fulfillment stems from creating value, not accumulating wealth.

Despite his vast fortune, Musk has openly discussed personal struggles, including loneliness and the burdens of leadership, which may inform his view. Scientific research offers nuanced insights into this age-old question, generally affirming a positive but complex link between income and happiness. A seminal 2010 study by Nobel laureates Daniel Kahneman and Angus Deaton analyzed U.S. data and found that emotional well-being rises with income up to about $75,000 annually (adjusted to roughly $110,000 in 2026 dollars), after which it plateaus, while life satisfaction continues to increase.

They concluded that “high income buys life satisfaction but not happiness,” with diminishing returns beyond basic needs.

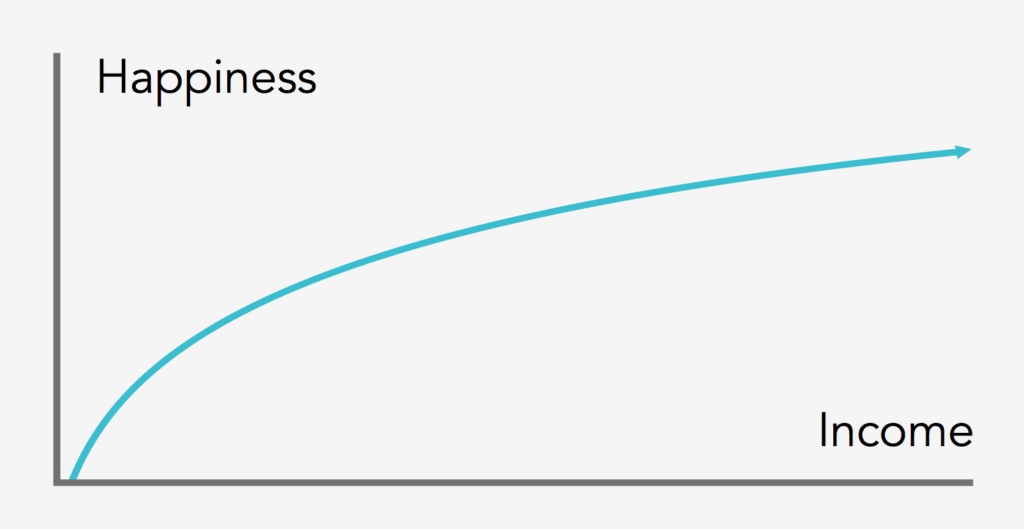

Subsequent research has challenged this threshold. In 2021, Wharton senior fellow Matthew Killingsworth, using a large U.S. dataset with real-time happiness tracking, found that both emotional well-being and life satisfaction rise continuously with income, even beyond $200,000 annually, following a log-linear pattern where each doubling of income yields similar happiness gains.

A 2024 follow-up by Killingsworth confirmed that for most people (about 80%), happiness increases without limit, though a minority (20%) experiences a flattening or decline at higher incomes due to personality factors. Killingsworth’s work suggests the $75,000 satiation point does not hold broadly, with happiness scaling log-linearly across income levels.

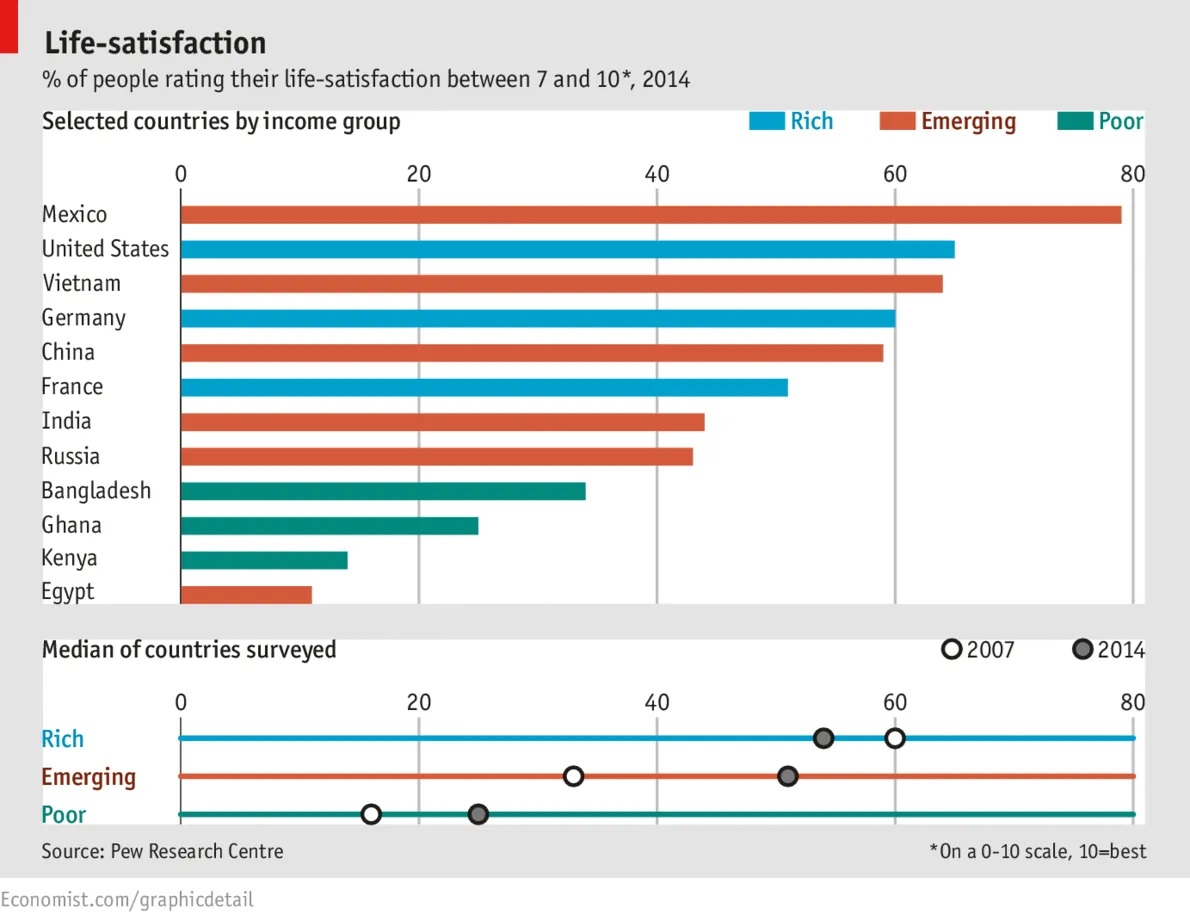

Studies from the Happier Lives Institute and others affirm that cash transfers significantly boost happiness in low- and middle-income countries, with effects persisting long-term, supporting that money “buys” happiness where basic needs are unmet. In richer nations, the link weakens but persists, with experiences (e.g., vacations) and prosocial spending (e.g., giving to others) yielding greater joy than material purchases.

University of Leicester’s David Bartram noted: “Once you’ve got a few million, anything extra is meaningless for happiness,” emphasizing purpose and relationships over wealth accumulation.

A 2023 collaborative paper by Kahneman, Killingsworth, and Barbara Mellers reconciled earlier debates, finding happiness rises continuously for most but plateaus for the unhappiest 20% around $100,000. Wharton’s 2024 study on millionaires showed happiness increasing even beyond $500,000, challenging complete satiation.

However, University of Nebraska-Lincoln research stresses that “doing” (experiences) trumps “having” (things), and prosocial spending enhances joy. Scientific American’s 2010 study found wealth impairs savoring simple pleasures.

Public discourse on X amplified the debate, with users sharing the Business Insider article on Musk and Cuban’s exchange, emphasizing personal experiences over blanket rules.

Ultimately, money facilitates happiness by meeting needs and enabling positive actions, but its impact diminishes at higher levels, where relationships, purpose, and generosity matter more. As Cuban suggests, wealth amplifies one’s baseline disposition—happy people get happier, while the miserable remain so, albeit with less financial stress.