On Thursday, Binance CEO, Changpeng Zhao popularly known as CZ-Binance recently expressed his admiration for a mystery individual who has been spreading the gospel of Bitcoin in an unconventional way.

In the ever-evolving world of cryptocurrencies, there are many unsung heroes who have made significant contributions to the ecosystem. Recently, CZ, the Co-Founder and CEO of Binance, took to Twitter to praise one such individual who found a unique way to promote the Bitcoin whitepaper.

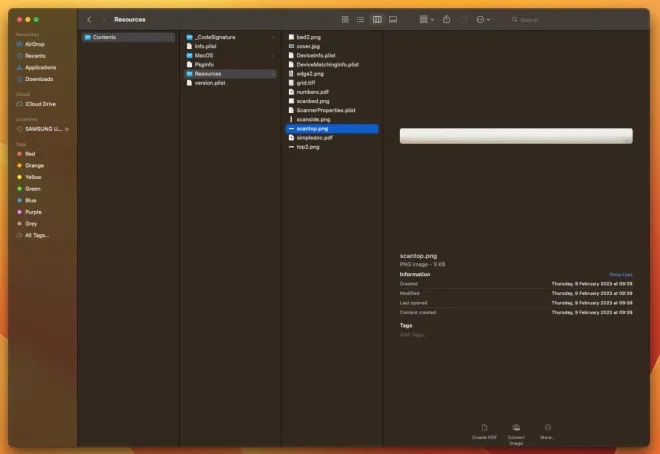

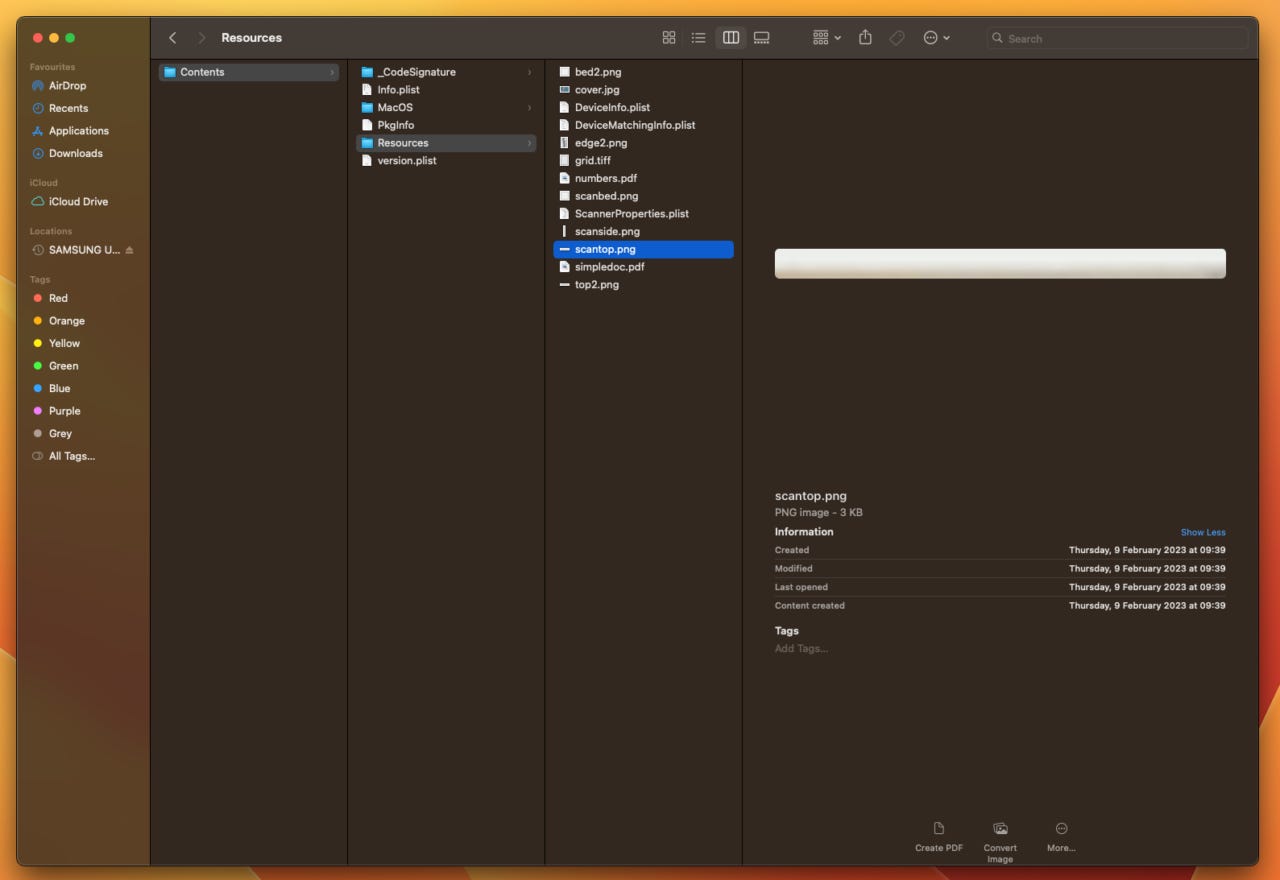

As you might already know, on April 5, Andy Baio, a former CTO of Kickstarter, published a blog post in which he said:

“While trying to fix my printer today, I discovered that a PDF copy of Satoshi Nakamoto’s Bitcoin whitepaper apparently shipped with every copy of macOS since Mojave in 2018. I’ve asked over a dozen Mac-using friends to confirm, and it was there for every one of them. The file is found in every version of macOS from Mojave (10.14.0) to the current version, Ventura (13.3), but isn’t in High Sierra (10.13) or earlier.”

On April 6th, CZ tweeted his appreciation for the person who managed to put the Bitcoin whitepaper on every Mac, saying, “Who is the guy that put the #bitcoin whitepaper on every Mac? I want to buy him a drink in person.” This interesting move has undoubtedly helped increase awareness about the foundational document of the flagship cryptocurrency.

Will also buy a drink for the bull who puts the #bitcoin whitepaper in every copy of Windows.?

Everyone should be carrying it. https://t.co/yOCINx7fy8

— CZ ? Binance (@cz_binance) April 7, 2023

Not content with just Mac users having access to the whitepaper, CZ followed up his tweet on April 7th, saying, “Will also buy a drink for the bull who puts the bitcoin whitepaper in every copy of Windows. Everyone should be carrying it.”

Meanwhile, on April 6th, crypto analytics firm Santiment reported on Twitter that Bitcoin traders are currently transacting at a loss at twice the rate of profit. They noted that this is the first time in five weeks that this ratio has been negative, suggesting that FOMO-driven investors might be losing faith in the rally.

? With #Bitcoin ranging after topping at $28.7k, traders are transacting at a loss at twice the rate of profit. This is the first time this ratio has been negative in 5 weeks, and is actually a good sign that the #FOMO'ers are giving up on the rally. https://t.co/gFNmX7ieqq pic.twitter.com/WuKxwNaDY3

— Santiment (@santimentfeed) April 6, 2023

On a more positive note, on April 5th, Michael Saylor, Co-Founder and Executive Chairman of MicroStrategy, announced the company’s acquisition of an additional 1,045 Bitcoin for approximately $29.3 million. This brings MicroStrategy’s total Bitcoin holdings to 140,000, acquired for around $4.17 billion at an average price of $29,803 per Bitcoin.

As of press time on April 7th, Bitcoin is trading at around $27,940 across crypto exchanges, representing a slight 0.06% decrease over the past 24 hours. However, the year-to-date performance remains strong, with a 67.81% increase.

CZ’s tweets about the Bitcoin whitepaper exemplify the ongoing efforts to raise awareness and promote understanding of digital currencies. As more people become familiar with the technology behind Bitcoin, the potential for mainstream adoption continues to grow, making this an exciting time for cryptocurrency enthusiasts everywhere.