American artificial intelligence company OpenAI has rolled out the latest version of its large language model, GPT-4, which it claims exhibits human-level intelligence and can beat most people’s SAT scores.

The company disclosed that the GPT-4 is an improved version of its previous language models, which has been trained with more data and has more weights in its model file, making it expensive to run.

The company also added that it can solve difficult problems with greater accuracy, thanks to its broader general knowledge and problem-solving abilities.

The large multimodal model is reported to have scored 93rd percentile on a simulated SAT reading test, and hit the 89th percentile on a simulated SAT math exam. GPT also scored in the 90th percentile on a simulated bar exam.

OpenAI disclosed that it has been using GPT-4 in its company functions such as support, sales, programming, and content moderation, and it is also using it to assist humans in evaluating AI outputs.

Like previous GPT models, the GPT-4 base model was trained to predict the next word in a document, and it was trained using available data. When prompted with a question, the base model can respond in a wide variety of ways that might be far from a user’s intent.

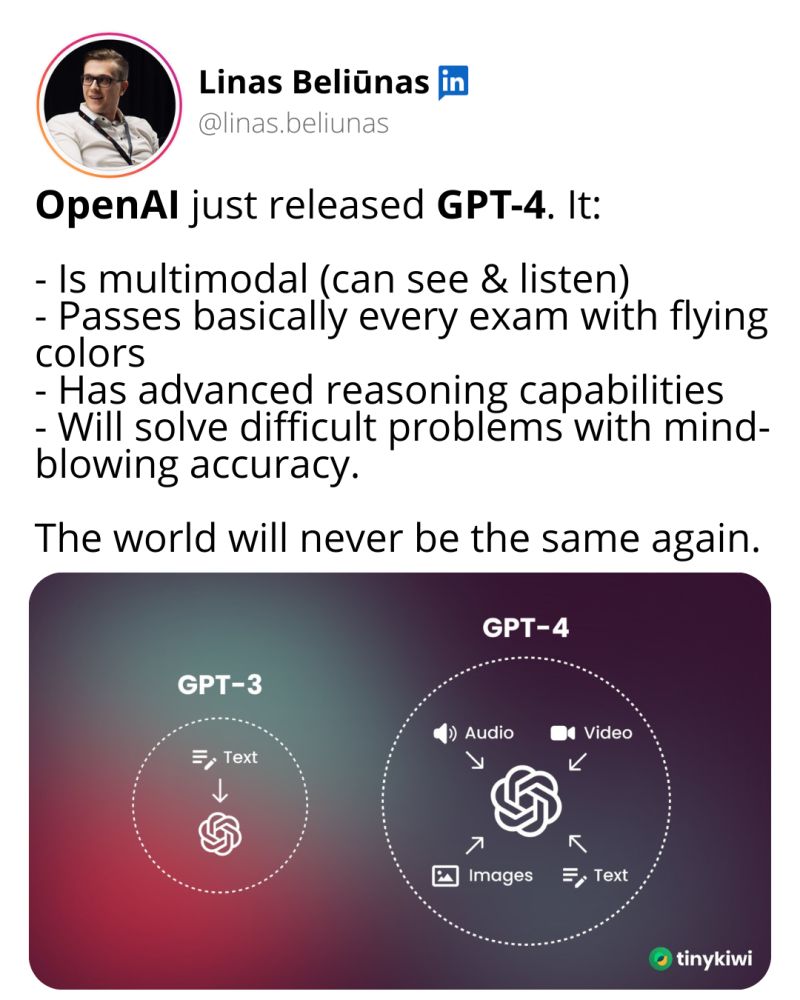

OpenAI’s long-awaited GPT-4 was released on Tuesday. The new iteration of ChatGPT is multimodal — able to respond to images and text — and it’s more accurate, more knowledgable and is able to “see” images and “reason,” per OpenAI, further intensifying the artificial intelligence race. In fact, GPT-4’s release happened hours after Google announced generative AI features were coming to its suite of Workplace apps. GPT-4 isn’t perfect and occasionally still “hallucinates,” according to The New York Times. It’s also unable to form new ideas or hypothesize about the future. (LinkedIn News)

The company disclosed that the new model will produce fewer factually incorrect answers, go off the rails, and chat about forbidden topics less often. Despite its huge potential, the company revealed that the technology isn’t perfect yet.

It warned that the technology still has a major problem with hallucination or making stuff up, and isn’t factually reliable. It is still prone to insisting it is correct when it is wrong.

“In a casual conversation, the distinction between GPT-3.5 and GPT-4 can be subtle. The difference comes out when the complexity of the task reaches a sufficient threshold—GPT-4 is more reliable, creative, and able to handle much more nuanced instructions than GPT-3.5,” OpenAI wrote in a blog post.

Meanwhile, OpenAI disclosed that to cut down on some of the language model potential problems, it would fine-tune the model’s behavior using reinforcement learning with human feedback.

The new model will be available to paid ChatGPT subscribers and will also be available as part of an API that allows programmers to integrate AI into their apps. OpenAI will charge about 3 cents for about 750 words of prompts and 6 cents for about 750 words in response.

It is interesting to note that OpenAI GPT’s large language model remarkable ability has wowed a lot of people and tech entrepreneurs, which have seen it incorporated into different tech products. Tech companies such as Microsoft, and Google, have incorporated the language model into their products to enhance users’ experience.

With OpenAI’s latest upgrade of GPT-4, it will no doubt heighten the level of integration among tech companies seeking to use and incorporate the technology to stay ahead of competitors.