The Federal Deposit Insurance Corp [FDIC] announced that all depositors, both insured and uninsured, at Silicon Valley Bank [SVB] and Signature Bank, will be made whole while equity and bond holders are wiped out. Why, I wonder, will equity and bond investors remain loyal to regional banks? This is how the Fed intends to backstop other liquidity issues through a new facility called the Bank Funding Term Program.

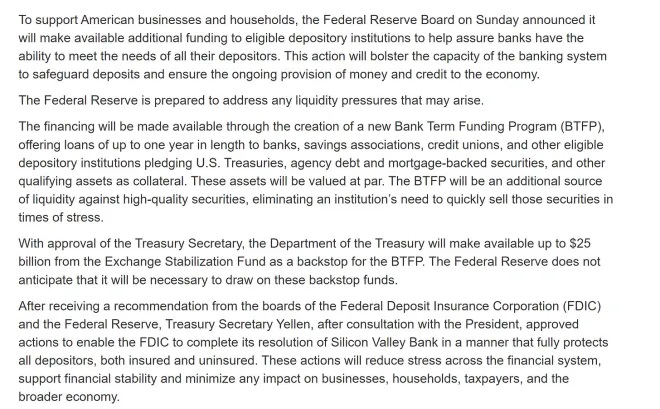

The idea is to provide banks with an alternative to liquidate their bond holdings when in need of raising liquidity to meet deposit outflow.

All depositors of SVB and Signature Bank made whole, and a new facility to provide liquidity to banks under stress.

“Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Depositors will have access to all of their money starting Monday, March 13.”

Basically all HQLA bonds and not only Treasuries are eligible – banks can post them to the Fed to raise money. And bonds will be valued at par, so all the negative mark-to-market from unhedged bonds is not considered with this facility.

What are the terms?

Funding is at 1-year OIS (basically 1-year market-implied Fed Funds) plus a meager 10 bps spread on top. One year guaranteed liquidity at Fed Funds plus 10 bps posting collateral deep in the mud but valued at par. no bailout for equity owners, uninsured depositors compensated as much as possible.

The new facility basically provides very reasonably priced funding to banks under stress if deposits go away. These banks were paying basically nothing for these deposits and if they must access the BFTP they will end up paying 4-5% for their funding now. But that is still a much better proposition than going belly up in a regional bank run.

USDC has been making insane profits for Circle recently. They make interest on ~$40B of deposits and that interest rate has gone from .1% to 5% (a 50x) over the last couple years. That gives them lots of float to make up for bank failures. That’s $2B a year interest. Amidst USDC Depegging against the dollar, Nansen reported Circle burned $314 million $USDC which was sent to a bunner Wallet.

Cross River Bank is Circle USDC’s new partner for automated settlements. Not too long ago Cross River Bank integrated Ripple for real-time international payments. Circle will no longer mint USDC through Signature Bank after its shutdown, CEO Jeremy Allaire said Sunday. The bank failure complicates USDC’s ongoing recovery process after losing its peg on Friday.

Cathie Wood is of the view that US demand deposits – which make up the vast majority of M2 – have been falling since last August. Now we are seeing the consequences of the yield curve inversion that began last July, which I feared last September and described in the thread below. The inversion has worsened. Many banks parked the COVID stimulus gusher in long term bonds at record low 1-2% interest rates, never expecting the Fed funds rate to surge a record-breaking 19-fold to 4.75% in less than a year. Now deposit outflows are forcing them to sell “safe” securities at losses.

Deposits are leaving banks to take advantage of higher yields in the money market and other funds. At Silicon Valley Bank, start-ups were responding to a drought in venture capital funding by draining deposits to fund their operations.

If the Fed continues to focus on lagging indicators like the CPI, and does not pivot in response to the deflationary forces telegraphed by the inverted yield curve, then this crisis will devour more regional banks and further centralize, if not nationalize, the US banking system.

Regulators have focused investors on the threat that crypto poses to users, but this weekend turned that theory upside down. As a single point of failure in the US banking system, SVB became a threat to stablecoins and the DeFi ecosystem when it broke Circle’s USDC peg to the $. The Fed always follows the fixed income market. The bond market now is demanding that the Fed ease, dramatically.