2022 is an unexpected year for the Crypto Industry. From the peak market value of nearly 3 trillion at the beginning of the year, it has been going down all the way. Under the complex background of global monetary tightening and epidemic, LUNA crashed, FTX and other famous institutions bankrupted.

Many far-reaching black swan events have caused the value of the crypto market to plummet. Bitcoin fell drastically below $15000, and the ecosystem has been severely damaged.

In addition to the haze, there is also light in 2022. Ethereum completed merge this year and successfully switched from PoW to PoS, establishing a foundation for subsequent expansion; Ecosystems are united in the industry: BAYC acquired CryptoPunks and Meebits; Stepn set off the M2E wave and promoted the development of GameFi; Bankruptcy-triggered industry regulation provides a new foothold for industry compliance development and consumer protection.

As the New Year approaches, we will review the top ten major events in the crypto industry in 2022, and once again feel the development of crypto market that is both magical and realist.

First, Federal Reserve Raised Interest Rates Multiple Times

Despite the frequent occurrence of black swans in 2022, there is immediate cause of Terra, FTX and Three Arrows Capital bankruptcy. But the root cause is inseparable from the tight cash flow caused by the global monetary tightening.

The Federal Reserve has continued to implement monetary tightening policy this year, and the interest hike’s frequency has increased as well, especially when crypto market has been impacted.

The current inflation rate in the United States has reached the highest level since 1980, and the benchmark interest rate has reached the highest level in eight months since 2008. The interest rate has been raised to 3.75-4.00% since the Federal Reserve announced an interest rate hike of 75bps on November 3, but the interest hike is still expected to happen in the future.

Lawrence Summers, the former US Finance Minister, said that since the US economy is still strong, the Federal Reserve may need to raise the interest rate to 6% or higher.

In the second half of 2022, the crypto market will be mainly affected by CPI data. Historically, the trading volume and Bitcoin price yield of the entire crypto market will fluctuate dramatically in the days before the CPI data is released.

The Bankruptcy of FTX (FTT)

On November 4, CoinDesk tweeted Alameda’s financial document. This financial document showed that Alameda’s balance sheet under SBF, the founder of FTX, had huge risks, and the amount of related transactions with the FTX exchange that was controlled by SBF was huge. Alameda has $14.6 billion of assets, mostly are FTX platform token FTT. Once Alameda went bankrupt, FTX’s capital operation would be affected.

On November 6, the founder of Binance, CZ tweeted that as part of Binance’s exit from FTX’s equity last year, Binance received approximately $ 2.1 billion equivalent in cash BUSD and FTT. Binance decided to liquidate FTT on its books due to recent revelations.

On November 7, Binance began to sell FTT, which triggered a chain reaction in the market. More than $1 billion of funds were transferred out of FTX and Alameda’s address.

On November 8, SBF tweeted to reassure the market and users, claiming to have the ability to cover all user assets, but users did not buy it. Many customers were still transferring funds, and stablecoins on FTX rapidly exhausted. FTX quickly suspended withdrawals when facing a sudden withdrawal run. The panic that had continued to accumulate and ferment finally exploded, and FTT and SBF-related sector tokens fell sharply.

On November 9, SBF and CZ successively announced that Binance would completely acquire FTX. FTT ushered a short pullback, yet Binance’s acquisition of FTX failed due to the violation of antitrust law, which also confirmed FTX’s liquidity crunch. FTT started liquidation mode and its lowest price fell to % 2.5 USD.

In the end, the equity loophole of FTX’s bankruptcy reached billions of dollars, affecting millions of users. SBF and FTX have gone from $26 billion to nothing in just a few days. SBF has been arrested by the Bahamas police, and he’s facing trails in the United States.

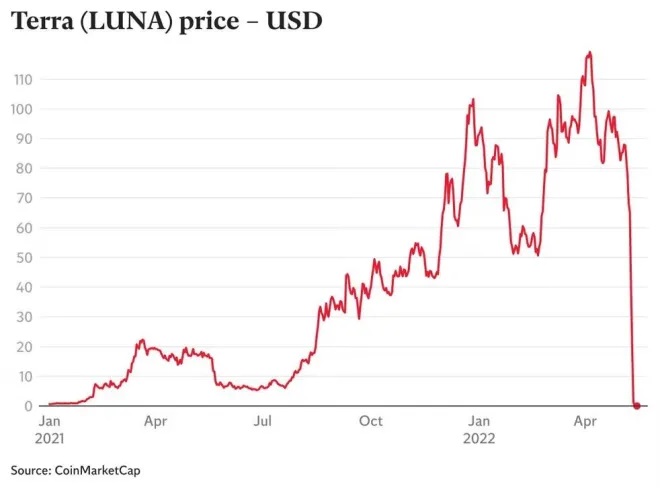

The Collapse of USTC? Bankruptcy of Terra

Before May 2022, Terra was still one of the cryptocurrencies with the most market value in the world. The price of governance token, LUNA has risen nearly a thousand times in two years, with a market value of more than $41 billion. This project plummeted in less than a week, LUNA fell from nearly 100U to 0.000001u, resulting in countless people lost their money.

Terra created a fiat-pegged stablecoin, USTC, which relied on algorithmic mechanism to align with US dollar. The system allows users to mint new USTC tokens by burning an equivalent amount of LUNA tokens or redeem new LUNA tokens with USTC.

The lending platform Anchor Protocol on Terra provided 20% of the income for USTC, which made USTC very attractive under the current market background. As market participants flocked to USTC continuously, LUNA burn increased and its price rose.

The story ushered in a dramatic turn. Three weeks before the crash, Terra Development Company irresponsibly sold more than $450 million of USTC in the market.

On May 7, 2022, Terra’s USTC capital pool collapsed due to huge sell off by whale.

On May 9, 2022, USTC loses its peg again, triggering a full-blown users run. USTC holders are eager to redeem their tokens with LUNA, thereby increasing the supply of LUNA and devaluing the token, resulting in more redemptions by USTC holders. Terra’s algorithm promoted many additional issuances of LUNA, and LUNA & USTC entered a death spiral, which eventually led to a collapse.

The decline of LUNA somewhat led to the decline of the entire crypto market. The crypto market fell by more than $600 billion in 6 days. Many institutions such as Three Arrows Capital and Celsius experienced various chain reactions and went bankrupt one after another. The crypto crisis triggered by the collapse of LUNA was later compared to the 2008 financial crisis triggered by the collapse of Lehman.

The Merge of Ethereum to Proof of Stake

2022 is a year of hardships for the crypto industry. Despite negative things happened frequently, Ethereum brought hope to the crypto field.

On September 15, Ethereum merged successfully, marking the official conversion of the consensus mechanism of the Ethereum mainnet from Proof of Work (PoW) to Proof of Stake (PoS).

At the end of January this year, the Ethereum Foundation announced that it would stop using “Ethereum 1.0” (ETH1) and “Ethereum 2.0” (ETH2) and replace them with “execution layer” and “consensus layer”. The merging of ETH is also the biggest technical upgrade of Ethereum after EIP-1559.

The merge of Ethereum not only affected the price of ETH token itself, but also boosted the price of Ethereum ecosystem project tokens, the acceleration of the issuance of the Layer 2 project tokens. ETC has become an alternative for PoW miners, and some miners wanted to hard fork Ethereum.

According to the latest data from ultrasound, Ethereum network has burned a total of 2,773,236.99 ETH up to now. Since the Ethereum blockchain was successfully upgraded on September 15, Ethereum’s token supply has only seen a net increase of 1,305.24 ETH. It is worth noting that on October 27, ETH entered monthly deflation for the first time, and the 30-day average new increment was already negative.

The $550 million USD stolen from Ronin Multi-Chain Bridge

In March of this year, the Ronin multi-chain bridge was hacked, and the loss amounted to about $620 million USD, which once became one of the largest hacking incidents in the history of the crypto industry.

Ronin is the Ethereum sidechain of the popular NFT game, Axie Infinity. For many Axie Infinity players, they usually do not operate in just one blockchain ecosystem, for which Axie Infinity has developed the multi-chain bridge Ronin Bridge. This allows players to deposit Ethereum or USDC into Ronin, use it to buy NFTs or in-game currency, and also sell their in-game assets and withdraw funds.

At the beginning of this year, the hacker group pretended to be a fake company and sent job advertisements to the development team of Axie Infinity through the professional social networking site LinkedIn, inviting development engineers to work in their company. After the hackers controlled 4 Ronin validator nodes through the spyware implanted in the fake offer, they used the backdoor of the RPC node to obtain the signature of Axie DAO, thereby realizing the control of 5 node signatures and finally realizing asset theft.

The outrageous part is that the hack occurred on March 23, but it was not discovered until March 29, when users were unable to extract 5,000 ETH. During this week, no one managed the bridge or provided liquidity, and no one realized that the capital had been withdrawn.

2022 is a year of frequent hacking attacks. According to the statistics of the blockchain security company PeckShield, the major losses caused by hacking attacks and protocol loopholes in 2022 have exceeded $3 billion, and it was $1.55 billion in 2021, only $250 million in 2020. Hopefully, there will be no more hacks in 2023!

Stepn Listed, Chain Games Went Viral

The most popular chain game in the GameFi market in 2022 is undoubtedly STEPN, which is built on the Solana chain and is known as the world’s first Move To Earn game. The growth path of STEPN is bright. Only over a month after the project was established, it won the fourth place in the chain game section of the Solana Hackathon, and won the official Grant reward. Soon after, it received a $5 million seed round of financing led by Sequoia.

In early April, STEPN officially announced that its market value exceeded $1 billion, becoming a unicorn company. At its peak, STEPN had 1 million users and 4.72 million registered users and was able to earn up to $122.5 million in profits in a quarter.

According to Dune Analytics, StepN’s monthly active users surged in May and June, surpassing 700,000 in May and approaching 500,000 in June. In July 2022, due to policy implications, STEPN announced the retirement of Chinese mainland users, which became a turning point in its development. Since then, under the influence of bear markets and its tokenomics, STEPN has lost its glory. According to the data, STEPN’s monthly active users have fallen below 25,000 since December and fell 96.4% in May this year.

According to CoinMarketCap data, GMT also underperformed. The token fell 91% from its highest point. Although the project has basically been declared a failure, STEPN, as one of the typical Web3 applications that went popular this year, has led the public groundwork of X to Earn to a new height. Many traditional investment institutions have also entered the market and strongly promoted the future development of GameFi.

Public Sale of Otherside and its Gas War

Bored Ape Yacht Club— BAYC! Yes, this event is related to it.

On March 23, Yuga Labs, the parent company of BAYC, received $450 million of seed funding from a16z, which is the largest fund for NFT seed round so far. The fund would be used for the construction of the new project OthersideMeta, leaving expectations for the market.

On April 29, Yuga Labs was worried that the Otherside public sale would cause a Gas war. It did not only cancel the Dutch auction, but 305 ApeCoin was sold at a fixed price, and also sellers were allowed to pre-approve 12 hours in advance. At the beginning of the sale, there was an enforced limit of minting a maximum of 2 NFTs per wallet.

In the end, these measures still could not change the network congestion and the Gas fee war. On May 1, Otherside went public sale. In a short period of time, the ETH Gas fee rose rapidly, and the highest exceeded 8000Gwei. Many buyers made transactions with a Gas fee exceeding 2ETH. The Gas fee is maintained at more than 5000Gwei, which usually requires only a small double digit.

Otherdeed NFTs were all minted, and finally used up 62,423 ETH (worth about $170 million USD at the time), accounting for about 79% of the total gas consumption of Ethereum in the past 3 hours. This results to a new record of ETH burn in the past 24 hours.

The Sanction of Tornado cash by US Treasury Department

On August 8, the U.S. Treasury Department’s Office of Foreign Assets Control announced that Tornado cash protocol will be added to the sanctions list.

Tornado cash is a Privacy Protection Agreement that helps users obfuscate their on-chain transaction history. Cybercriminals including hackers supported by North Korea, use Tornado cash as a tool for money laundering, the agency claims.

As soon as the news came out, Circle and Infura and other institutions complied with the sanctions, and immediately blacklisted the Ethereum address that interacted with Tornado Cash, followed by some DeFi protocols, blocking the wallet from its front end.

In August 2022, Alexey Pertsev, the core developer of Tornado Cash, was arrested by the Dutch authorities on suspicion of assisting in money laundering. His appeal was rejected in September, and he is still in prison. It is reported that he will remain in prison until February next year.

Tornado cash’s ban is unprecedented, marking the first time a government agency has sanctioned open-source code rather than a specific entity, and reflects concerns about Ethereum’s ability to remain anti-investigation.

It is noteworthy that the cryptocurrency community has taken various measures to change this situation. The most notable is the lawsuit filed by Coinbase, Coin center and other crypto organizations against OFAC, saying that OFAC has no right to restrict sanctions on software programs, because software code is an expression of speech, and may violate the citizen’s freedom of speech rights and personal privacy under the First Amendment of the U.S. Constitution.

Blue-Chip NFTs Fell into Liquidity Crisis

In the NFT field, collectors are used to referring the head projects as “blue chip” projects. BAYC, the protagonist of the last event, is a representative project of blue chip NFT. Since 2021, a group of well-known people such as hip-hop artists, NBA stars, football players and listed companies have all purchased Bored Ape NFT. On May 1, the floor price of Bored Ape reached the astronomical price of 153.7ETH and then began to call-back.

On August 24, the floor price of BYAC NFT fell to 66.9ETH, fell more than 56% from the peak.

Since NFT market has lost trading heat, and weekly trading volume has repeatedly hit new low. The floor price of Bored Ape NFT fell all the way and the existing financial risks was exposed at the same time. The sharp fell in price led to a liquidity crisis of all major NFP lending protocols. The liquidation of BAYC triggered a chain reaction of other blue chip NFTs, which had a huge impact on the entire NFT market.

Yuga Labs Acquired CryptoPunks

The most well-known NFT in 2022 is BAYC. Since January, Yuga Labs, the development team of BAYC, has been marketing frequently. Brian Roberts, the chief financial officer of OpenSea, Neymar, the football star, Justin Bieber, Musk, Jay Chou, senior executives of Goldman Sachs Group and other celebrities have announced that they hold BAYC, or changed to BAYC avatars on Twitter and other social platforms as their digital identity.

Under a series of operations, the floor price of BAYC exceeded 100ETH for the first time. On March 12, Yuga Labs announced the acquisition of CryptoPunks and Meebits, which shocked the entire crypto industry.

CryptoPunks is a milestone project in the NFT industry, was issued in 2017 and has always been considered as the Bitcoin of the NFT industry.

In 2021, BAYC emerged as a new upstart in the industry. Mainly focus on brand, ecology and expansion, and is considered as the Ethereum of NFT industry by the market. This acquisition was ridiculed by the community’s “Ethereum” in the NFT industry, which acquired “Bitcoin” and gave a “Litecoin” as a bonus.

Most of the family members are witnesses to these events, and some even experienced them. In 2022, some people are joyful, some people are woeful. After summarizing the stories of 2022, what new narratives will appear in 2023? Do you think the crypto market will rebound in 2023, usher in a big reversal or continue to fluctuate downward.

Like this:

Like Loading...