The financial sector accounts for a quarter of the global economy, yet the industry remains inaccessible to most of the population.

The concept of a financial system that is free and open to everyone was born in 2009 with the release of Bitcoin and was formalised in 2018 by a group of Ethereum developers.

Since then, one simple idea of people being in control of their finances turned into a 40 billion dollar industry with an all-time high just shy of $200,000,000.

The growth that started with Maker introducing an alternative to centralised stablecoins was later spearheaded by Compound and their liquidity mining campaign, Aave and their borrowing algorithms, Uniswap and their revolutionary decentralised exchange and many others.

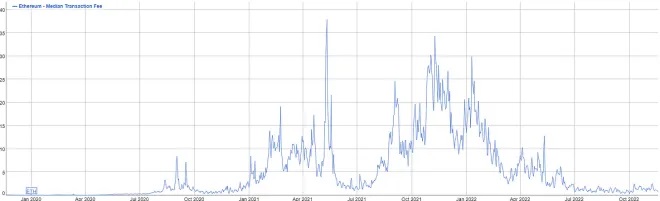

This growth was somewhat stifled by rising Ethereum transaction fees, making the whole system inaccessible to regular users, and violating its core principles. Vitalik Buterin himself famously said that “the internet of money should not cost more than 5 cents per transaction”.

With Ethereum median fees regularly sitting well above $1 and often above $10, many users were priced out of accessing DeFi. As a result, a lot of attention shifted to fast and cheap chains like Avalanche that offered the same idea of true digital ownership at a much more affordable cost.

Transparency and Self-custody in 2022, has proven to be a challenging year for Crypto, as the total marketcap shrank by more than two-thirds and the prices of many tokens took a deep dive.

However, all the failures and collapses: Terra, 3AC, Celsius, FTX, Alameda Research and others, weren’t caused by DeFi. In fact, they were caused by the things DeFi was designed to eliminate – backroom deals, a complete lack of transparency, and irresponsible gambling with user funds. Through all the crises and black swans, DeFi operated smoothly and without fault, as designed.

Alameda Research even famously repaid their DeFi loan before going into bankruptcy, and DEXes across all chains have recorded record volumes.

Decentralised finance was able to weather the storm and prove its value. Everyone can see the reserves of a DEX in a real-time without having to trust audits and self-disclosures. There is no way to fake volume, syphon the funds out or use them against users.

Anyone with minimal technical knowledge can audit the state of their favourite DEX, and with new dashboards being released, this information becomes even more accessible.

Accessibility and openness. When people think of Traditional Finance, they usually think of Banks. Banks are slow and expensive, they can regularly take days to process transactions and take hefty fees.

Moving funds from one wallet to another on Avalanche takes a few seconds and costs a couple of cents. Banks are also slow to adapt – many still lack proper mobile and web applications, relying on outdated technology and in-person visits to branches. Banks are also far from being accessible.

More than a billion adults worldwide don’t have a bank account, and even in the most developed countries, many have limited or no access to the modern financial system. To access DeFi, one only needs a device with an internet connection.

On top of making finance accessible to users, DeFi opens it to developers as well. They can publish their code permissionlessly, and most software running DeFi Prototype is open-source and free for anyone to copy, modify and improve. Some of the most significant innovations resulted from the gradual improvements of existing products.

Innovation and Democratization

Regarding real-world usecases, DEXes often offer some of the best foreign currency exchange rates and settle trades almost instantly. Users can already buy tokenised versions of silver and gold with a few clicks on Trader Joe. With the advancement of tokenization efforts, more commodities will be brought on-chain.

For a long time, derivatives were a gated market inaccessible to retail investors. Indeed, they are risky and complicated, but they also offer some of the best returns when used correctly. On-chain derivative exchanges have seen rapid growth over the last year as users seek ways to trade without giving away any control.In general, interest in complex strategies has increased as the DeFi ecosystem matures.

There is an apparent demand for instruments like options and perpetual futures, and Decentralized Finance can provide them cheaply, openly and efficiently.

Derivatives and RWAs (Real-World Assets) aren’t the only use cases for DeFi, as the space for new possibilities is almost limitless. We’ve already seen experiments with stablecoins, synthetics, insurance and other instruments fostered by space’s dedication to innovation and collaboration.

Like this:

Like Loading...