American multinational technology company Apple has resumed advertising on Twitter, days after Musk had alleged that the company had cut down on its ads spending on the platform.

The Tesla billionaire accused Apple of pausing its ads on the platform, which he asked if the company hated free speech.

Meanwhile, despite Musk’s allegations, few Twitter users disclosed that they could still see Apple’s ads on their feeds.

Musk also at one point alleged that Apple had threatened to remove Twitter from its AppStore, which he suggested that he was willing to develop an alternative phone if the tech company goes ahead to do such.

In a recent development, Musk seems to have backtracked on his allegations by disclosing that Apple never considered pulling down Twitter from its app store, after he had a meeting with the company’s CEO Tim Cook.

In his words, “Tim was clear that Apple never considered doing so”.

Musk disclosed that Cook had shown him around Apple’s headquarters, which he posted a video on Twitter, strolling around the firm’s stunning 1 Infinite Loop global headquarters in Cupertino, California. He noted that they had a “good conversation,” which led to Apple resuming its Twitter ads.

Thanks @tim_cook for taking me around Apple’s beautiful HQ pic.twitter.com/xjo4g306gR

— Elon Musk (@elonmusk) November 30, 2022

Reports also disclose that Amazon is set to resume its ads on the platform at about $100 million a year. The return of these companies spurred Musk to openly thank them on Twitter.

He Tweeted, “Just a note to thank advertisers for returning to Twitter”.

Apple’s resumption of its ads on Twitter will no doubt give Musk a feeling of ecstasy, considering the fact that Apple is consistently one of Twitter’s top advertisers, spending $100 million annually.

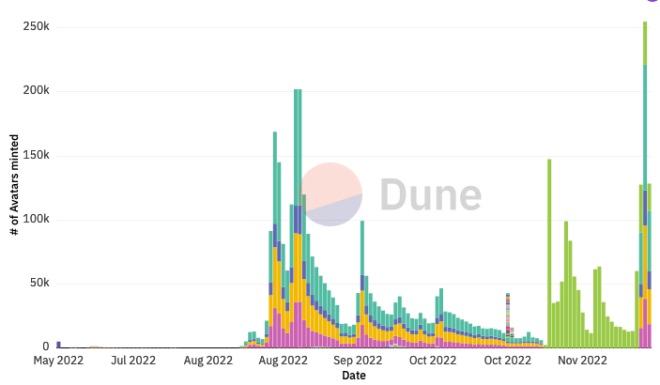

After Musk acquired the company in October, Apple spent roughly $131,600 on Twitter ads between November 10 and 16, down from $220,800 between October 16 and 22.

In the first quarter of 2022, it spent $48 million, accounting for 4% of Twitter’s total revenue for the period.

Recall that after Musk completed the $44 billion Twitter deal, several companies halted their ads spending on the platform to assess any new changes in the site’s direction.

Several automobile companies such as Audi and General Motors suspended their ads on Twitter. Food company General Mills, known for the breakfast cereal Cheerios and ice cream Haagen-Dazs, also stopped ads on Twitter, as well as pharmaceutical company, Pfizer.

CEO of Mondelez International, one of the largest food and beverage companies, Dirk Van De Put, disclosed that the company felt there is a risk their ads would appear next to the wrong messages, which was why the company decided to pause until the risk is as low as possible.

This prompted Musk to make a public pledge to advertisers that the looser content moderation policies he had in mind for the platform would not tolerate hate speech and turn Twitter into a “free-for-all hellscape.”

Musk disclosed that the impact of the pullback saw Twitter have a massive drop in revenue, blaming what he called “activist groups” who he said were pressuring advertisers.