The price of SONM ($SNM) has increased by 5261% from $0.2035 to $13.91 in the past 24 hours and 14000% ($0.0008) in two days. $SNM token is an internal currency on the Sonm computing power marketplace. SONM launched its Initial Coin Offering (ICO) on June 15, 2017. The ICO raised a total of $42 million and minted a total of 331,360,000 $SNM with ICO Price tagged at $0.1268 per Token. Holding the $SNM token you can get access to the unlimited resources provided by Sonm.

The Sonm team has control over maximum Circulation Supply and they just keep pouring dollars into it, which indirectly goes back to them. And when some retail investors start investing their money the price might eventually increase or decrease. The total supply of SNM tokens will be switched from 444 million to 44.4 million and the issuance of SNM BEP-20 tokens during the course of the project.

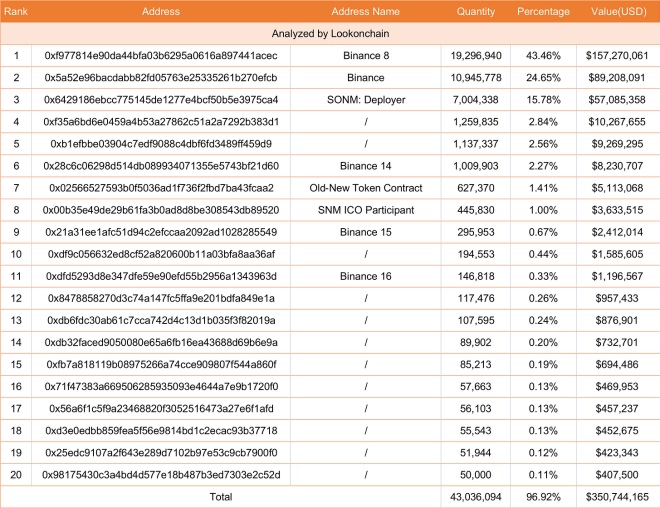

Top 20 holders of $SNM.

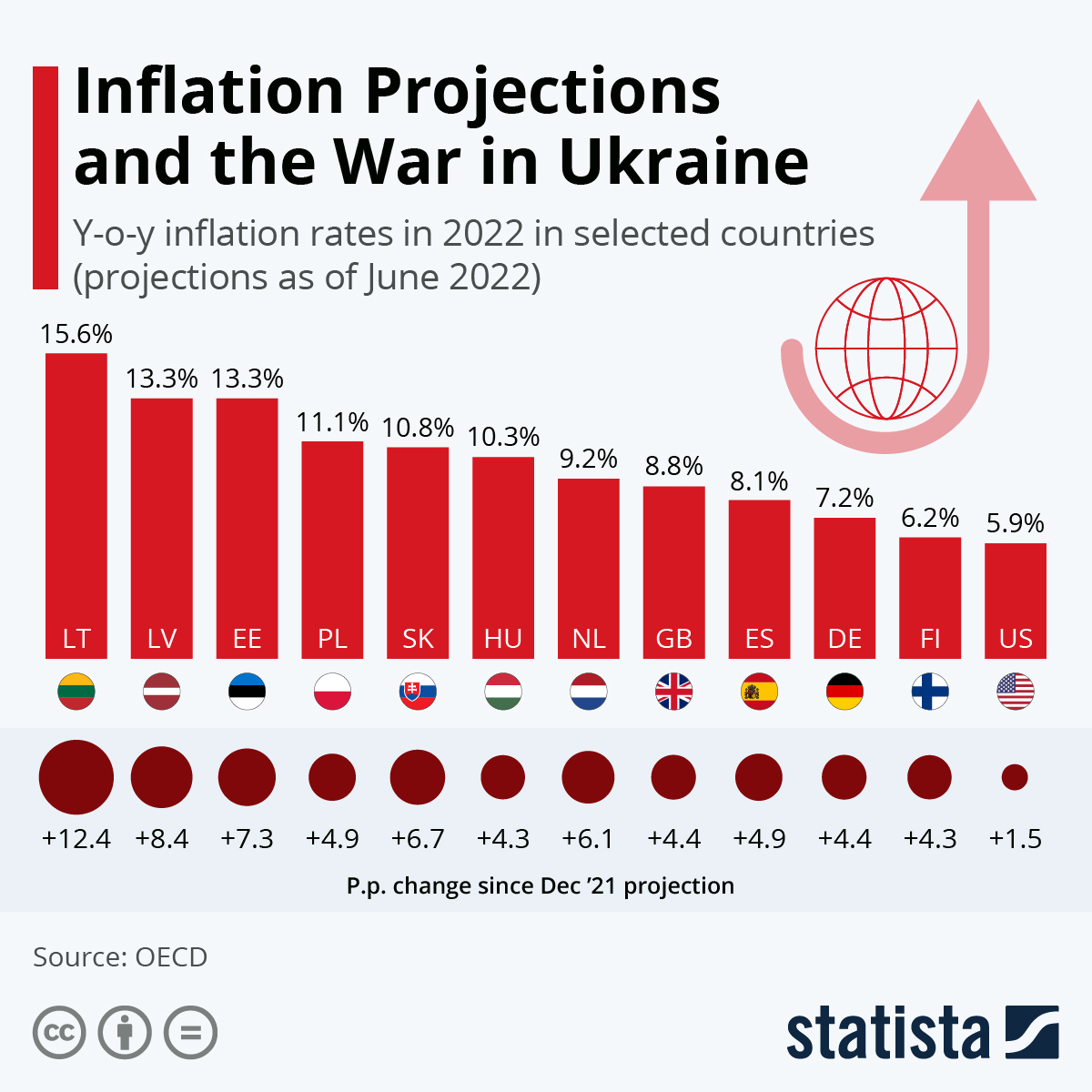

The top 20 holders hold a total of 43M $SNM ($351M), accounting for nearly 97% of the total supply. Among them, Binance holds 31.7M $SNM ($258M), accounting for 71.4% of the total supply. Is the pump and dump season back on Binance? Because frankly, there is no reason for the ??$SNM?? currency to rise insanely with no clear utility Instituted – more like an Insider trading metrics which presumably 90% of the liquidity is owned by 20 portfolios.

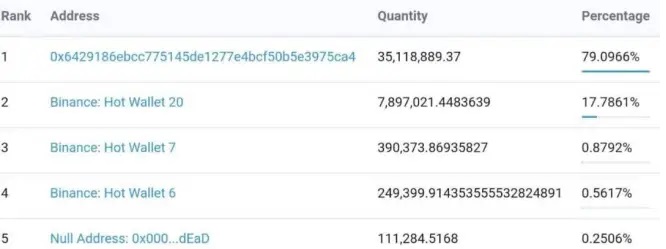

Next, we will analyze the SNM ERC-20 token data on-chain and share some who made SmartMoney degening on $SNM over the weekend. $SNM is mainly listed on Binance with entire supply in circulation. One wallet holds 79% of the total supply which look like team/treasury wallet as received coins from minting only, while three Binance wallets hold 19% of the supply.

SmartMoney

0x25edc9107a2f643e289d7102b97e53c9cb7900f0: Bought 102,244 $SNM ($11,627) at an average price of $0.1137 from Binance this year. Then successively transferred $SNM to Binance for sale after the price rose. If he sold $SNM at $7, he will make $700K.

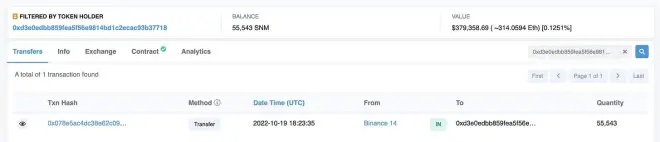

0xd3e0edbb859fea5f56e9814bd1c2ecac93b37718: bought 55,543 $SNM for ($11,307 at that time) at $0.2036 on Oct 19, 2022. According to the current price, he can get a profit of 368K, and ROI is 3300%.

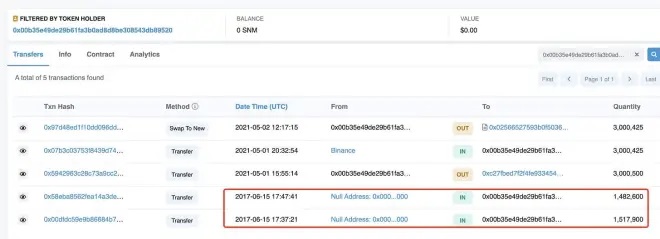

SNM ICO Participant: 0x00b35e49de29b61fa3b0ad8d8be308543db8952 spent 1,000 $ETH ($344,680 at that time) to participate in SNM ICO in 2017 and got 3M old $SNM. He provided liquidity on Uniswap and now holds 445,830 $SNM ($3.14M), worth 2,620 $ETH, he’s ROI is 262%.

Information is indeed the new money in the Crypto World, a lot of people don’t get the right information because of the noise everywhere and the little people who have access to vital information hoards it. Longterm, a TA expert tweeted. However, lets say there are 1,000,000 oranges in total. You hold 999,999 of them. You buy the last one for 10,000 USD. The price shows 10,000 USD per Orange [even though it’s not a real price with liquidity at that price point] Of course this is a simplified example to prove a point more clearly.

$SNM made 14000% in two days ? This was definitely my best call in 2022. I feel honored and humbled ?? https://t.co/sO95zOiIVF pic.twitter.com/wLo2N8Xa7x

— ????????®?? (@LongtermR) November 20, 2022

SNM Coins which have Circulated Supply vs. Total Supply ratio one or close to one will be pumped because they have been accumulated 3 years back and no serious retail buyers remained at their current price. They will hold prices at higher levels for a while and will sell step by step. SNM token was listed on Binance in 2017 when the listing process was much easier than nowadays. The project is made by Russians who got $42M from ICO and immediately stopped developing it.

SNM price is almost dead from its ATH of $13 within the last 24hrs. They tweet some unrelated shit just to make an illusion of an “alive” project IMO the team or the project just decided to find exit liquidity through pumping their shit coin to the moon, and it seems like their plan worked well. $SNM price went up to $13 over the last 24 hrs and currently trading around $1.3, this reeks of a manipulated effort. $SNM has grown widely over the weekend, Binance closed the SNM/BUSD isolated margin trading pair, and did not allow currency of the margin account to be transferred to spot account which is somewhat manipulative.

SONM, social volume is way up but engagement can’t remotely keep up, meaning a ton of empty posts from non-influential accounts. The founder of SonmDevelopment asked on 2ch (a forum for Russians similar to 4chan) what he should do with millions of dollars that he got from $SNM ICO. If you bought $SNM at $13 after it did 5000%, I’m sorry to say but then you deserve to lose money for trading along FOMO.

I’m glad SNM is not yet listed on Binance Leverage, if not lots of people would have been liquidated trying to short $SNM, -7000% within 24hrs in a bear market is unbelievable right? the Crypto market is highly Volatile. More coins will pull 100x, Whales are still in the market. Be careful not to FOMO on tops- Buy Early, Sell Top = SmartMoney.