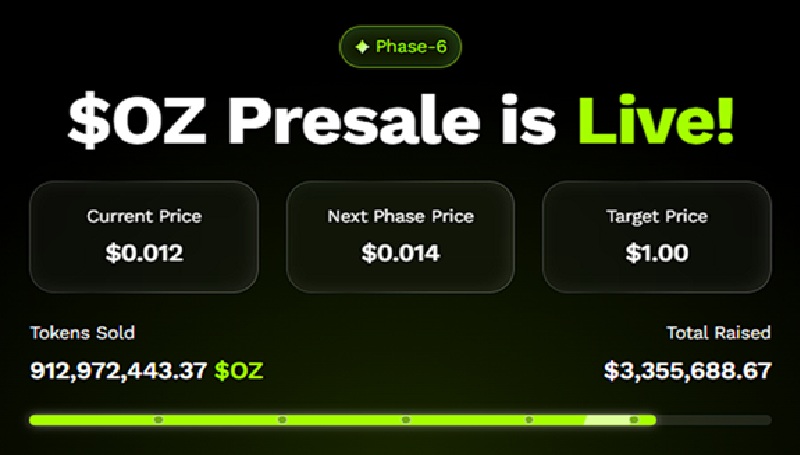

Ozak AI has quickly captured the eye of the crypto network, raising over $3.3 million in Stage 6 of its presale. The rapid uptake demonstrates strong investor confidence in the project, which mixes blockchain technology with artificial intelligence. At a presale price of just $0.012 per token, Ozak AI is attracting both retail traders and large contributors looking for early-level possibilities with high growth potential. This early fulfillment positions the project as one of the most promising presales heading into 2025.

The Allure of Early-Stage Investment

One of the biggest benefits of making an investment in a presale like Ozak AI’s is the low entry point. Early investors can gather tokens at a fraction of their future price. For example, if Ozak AI reaches $1 or more in the next one to two years, the returns for early participants could exceed 80x, turning modest investments into life-changing gains. The strong presale momentum is a clear indication that both seasoned traders and newbies apprehend the token’s potential.

Why Ozak AI Stands Out

Unlike many speculative crypto projects, Ozak AI brings tangible utility to the market. The token is designed to power an AI-based surroundings, providing predictive analytics, statistics modeling, and decentralized solutions for buyers, agencies, and different market participants. By integrating artificial intelligence with blockchain, Ozak AI addresses real-world demanding situations, which gives it a more potent long-term price proposition compared to meme coins or merely hype-driven tokens.

Whales and Institutional Interest

The OZ presale has no longer only attracted retail investors but also whales—crypto traders with massive capital. Their involvement provides credibility to the mission and signals confidence in its long-term potentialities. Historically, presales with whale participation generally tend to enjoy strong post-launch performance, as early accumulation regularly results in accelerated market liquidity and momentum once tokens are listed on exchanges.

Market Timing and Growth Potential

Ozak AI’s presale comes at an opportune time. With AI adoption accelerating globally and blockchain technology persevering to benefit mainstream acceptance, the project sits on the intersection of two of the quickest-developing sectors.

Analysts propose that 2025 will be a pivotal year for AI-powered crypto tokens, and Ozak AI is already constructing the market presence to capitalize on this trend. Its early positioning in the presale ought to make it one of the breakout projects in the upcoming bull run.

Ozak AI Roadmap and Exchange Listings

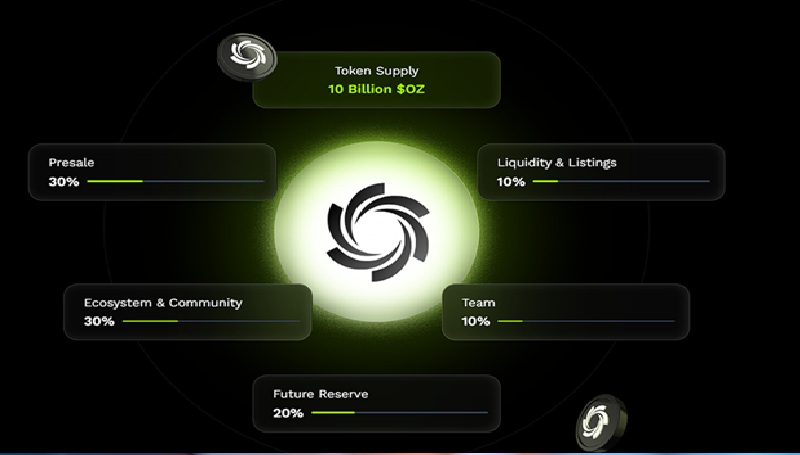

The team behind Ozak AI has genuinely outlined its roadmap, which includes listings on fundamental centralized and decentralized exchanges right now after the presale concludes. This strategy ensures accessibility for a much broader target audience and helps maintain liquidity. As demand grows, the token is predicted to revel in price appreciation, making early participation even more appealing.

With $3.3 million already raised, a low presale fee of $0.012, and strong basics pushed by AI-powered blockchain utility, Ozak AI is rising as one of the top presale picks for 2025. Its mixture of early-stage affordability, real-world application, and developing market interest sets it aside from limitless different projects competing for attention. For traders in search of excessive-growth opportunities with asymmetric upside capability, Ozak AI presents a compelling case—an early entry nowadays could translate into life-changing returns in the next bull cycle.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi