What happens when whales, progressive tokenomics, and meme coin firepower collide? Markets pay attention. In September 2025, BullZilla ($BZIL) hit a remarkable milestone, raising over $500,000 in its trending presale with 100x ROI, a number that’s been climbing faster than most analysts projected. Meanwhile, Polkadot (DOT) just capped its supply at 2.1 billion tokens to combat inflation, and Cardano (ADA) edges closer to its long-awaited scalability milestones. Together, they showcase how very different narratives are reshaping the crypto market this quarter.

Among them, BullZilla ($BZIL) is sparking the loudest conversation. Its presale isn’t just another funding round; it’s designed as a living saga where the price rises every 48 hours or when $100,000 is raised, whichever comes first. For financial students, crypto analysts, and blockchain developers, this makes the BullZilla 100x presale one of the most closely watched top early stage crypto investments right now.

BullZilla (BZIL) – Why This Presale Could Deliver Maximum Gains

Could a single presale mechanism rewrite meme coin history? That’s what BullZilla ($BZIL) aims to prove. The progressive price engine ensures that the token price never stalls; it climbs every 48 hours or instantly when $100,000 pours in. Early buyers secure cheaper tokens, while latecomers face higher entry costs. This is the momentum engineered for maximum gains in crypto investment potential.

The presale stages are already racing forward. With over $580,000 raised, 28 billion tokens sold, and 1,900+ holders, the momentum is undeniable. At the current Stage 3D price of $0.00007908, a $4,500 buy nets approximately 56,925,993 $BZIL tokens. At the projected listing price of $0.00527, that bag would be worth around $299,000, a jaw-dropping 6565.92% ROI. This is where meme coin whales are making decisive moves in the BullZilla presale 100x rewards, accelerating the timeline for everyone else.

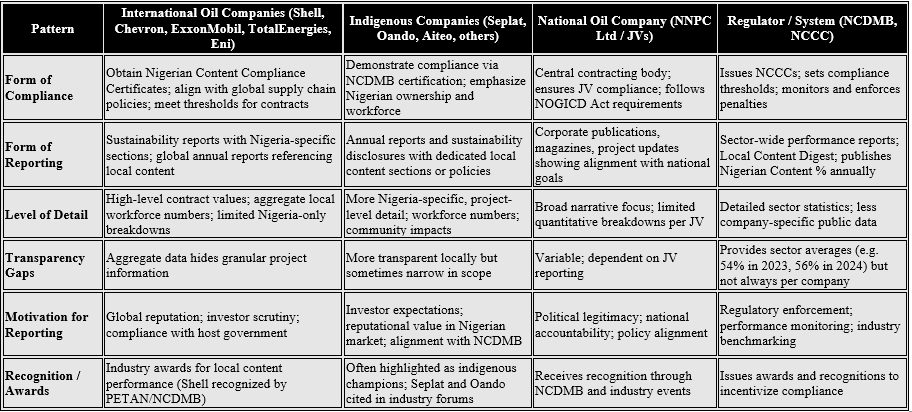

BullZilla Presale Snapshot

| Metric | Current Value | Future Value Target |

| Stage | 3rd (404: Whale Signal Detected) | Listing at $0.00527 |

| Current Price | $0.00007908 | +8.42% in 4A ($0.00008574) |

| Tokens Sold | 28B+ | – |

| Presale Raised | $580,000+ | – |

| ROI Potential | 6565.92% | – |

The sheer affordability makes this round rare. $1,000 secures 12.64 million tokens, while larger positions are already locking in BullZilla’s explosive upside. With whales stepping in on the best 100x meme presales, these rounds don’t last.

How to Buy $BZIL – Claim Your Stake in the Beast

Joining the BullZilla presale means stepping into a meme coin presale built on Ethereum’s battle-tested chain. Here’s how investors can secure tokens before the next stage shift:

- Set Up Your Wallet

Compatible options: MetaMask, Trust Wallet, or Coinbase Wallet.

- Load Up With Crypto

Buyers can use ETH, USDT, USDC, or BNB. Always keep a little extra for gas fees.

- Connect to the Presale

On the presale site, click “Connect Wallet” and approve the link. You’re in.

- Join the Presale

Select your amount of $BZIL, confirm, and lock it in. Each second counts before the price ticks up again.

- Confirm the Hunt

Approve the transaction and watch your balance appear on the dashboard. From there, it’s just holding on until launch.

The beast is moving, and each stage grows more expensive. Secure your tokens today, don’t wait for whales to set the pace.

Polkadot (DOT) – A Supply Cap Changes the Game

Polkadot (DOT) has introduced a crucial change that could reshape its long-term value. The community approved a cap of 2.1 billion tokens, shifting DOT from inflationary uncertainty to controlled scarcity. Currently trading near $3.98, DOT is navigating heavy resistance between $4.35–$4.60. Analysts warn of a potential dip if resistance holds, but breakthroughs could carry DOT higher.

Polkadot 2.0 also continues to gain traction, with elastic scaling and JAM protocol upgrades on the horizon. While DOT’s growth may feel conservative compared to meme coin theatrics, its foundation and staking rewards continue to attract long-term holders. This positions DOT as a steady play in contrast to Bullzilla presale beast mechanics.

Cardano (ADA) – Scalability Dreams Edge Closer

Cardano (ADA) remains locked in its slow-and-steady approach, trading between $0.82–$0.90 with a market cap of around $30 billion. The next step for ADA is tied to Hydra layer-2 and Mithril improvements, aimed at scaling the network. For ADA holders, the key levels to watch are resistance at $0.94 and potential upside targets of $1.20–$1.25 if bulls gain traction.

Still, whale selling has recently delayed momentum, with reports of nearly 560 million ADA sold over four days. While ADA’s fundamentals remain intact, this selling pressure underlines how meme-driven projects like $BZIL can pull attention away from established giants.

Conclusion – Why BullZilla’s Presale Stands Apart

Based on market trends and presale data, BullZilla ($BZIL) emerges as the best presale with 100x potential, while Polkadot and Cardano focus on gradual, structural improvements. DOT’s capped supply and ADA’s upcoming scalability upgrades show strength, but they move at a measured pace. By contrast, BullZilla thrives on speed, progression, and whale-driven surges that demand immediate attention.

The narrative is clear: while ADA and DOT refine their ecosystems, investors chasing high-octane returns are already locking in Bull Zilla. The presale’s progressive engine ensures there’s no pause button; the beast climbs whether investors act or not. With stages ending every 48 hours or at each $100K mark, this presale is racing forward. Join now, or watch from the sidelines as others ride into the top early stage crypto investments history.

For More Information:

Follow BZIL on X (Formerly Twitter)

Frequently Asked Questions for the Best Presale with 100x Potential

What is BullZilla ($BZIL)?

BullZilla is a meme coin project built on Ethereum, designed with progressive pricing, staking, and burn mechanics to drive value.

How does the presale price mechanism work?

The $BZIL price rises every 48 hours or instantly when $100,000 is raised. This creates constant upward pressure.

What’s the ROI potential of $BZIL?

At the listing target of $0.00527, current investors could see up to 6565.92% ROI from today’s stage.

How does BullZilla compare to ADA and DOT?

While ADA and DOT focus on long-term infrastructure, $BZIL offers immediate upside through its meme coin presale mechanics.

Is investing in $BZIL risky?

Yes. Like all cryptocurrencies, $BZIL carries risk. This article is informational only and not financial advice.

Glossary

Progressive Price Engine – Mechanism where token price increases by time or capital raised.

Roar Burn – Token supply reduction tied to presale chapters.

HODL Furnace – Staking system offering up to 70% APY.

Hydra – Cardano’s layer-2 scalability solution.

Mithril – Cardano upgrade for faster node syncing.

Elastic Scaling – Polkadot scalability protocol in development.

JAM Protocol – Polkadot’s planned performance upgrade.

Whale Signal – On-chain data showing large buyers entering.

Listing Price – Target exchange price post-presale.

Chapter Presale – BullZilla’s 24 stages tied to lore and mechanics.

Summary

BullZilla ($BZIL) has raised over $500,000 in September 2025, racing through presale stages with a progressive price engine that lifts the token’s cost every 48 hours or after $100K in buys. At the current stage, a $4,500 buy could grow to nearly $300,000 by listing, promising a 6565.92% ROI. Meanwhile, Polkadot capped its supply at 2.1 billion tokens, while Cardano is advancing toward Hydra and Mithril upgrades. Both ADA and DOT signal stability and evolution, but BullZilla dominates the conversation as the best presale with 100x potential. With whales accelerating stage shifts, investors are urged to act now before this meme coin giant roars into its next phase.

Keywords Group

best presale with 100x potential, meme coin presale, BZIL presale early rounds, maximum gains crypto investment, Bullzilla presale beast, Bullzilla explosive, Bullzilla presale analysis, top early stage crypto investments, BullZilla ($BZIL), Polkadot (DOT), Cardano (ADA)

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and risky. Always conduct independent research and consult with a licensed financial advisor before investing.