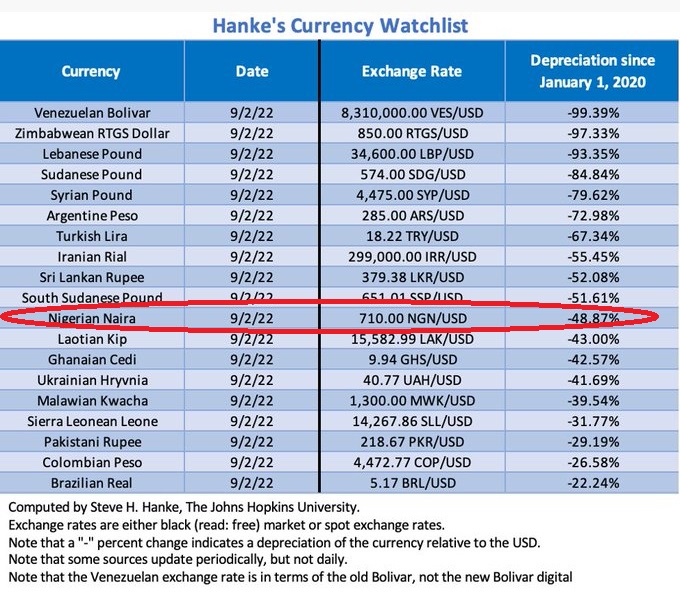

The family invited me to speak at Musa Yar’Adua Center in Abuja shortly after Buhari took over. I had made a case that Nigeria must return to Yar’Adua’s budgetary brilliance. I had called his budgets the finest in Nigeria since 1999. (Sani Abacha was a dictator but he crafted really good budgets; I recalled how students in FUTO jubilated in their dorms after his 1997 budget. His disciplined approach kept Naira stable for years.)

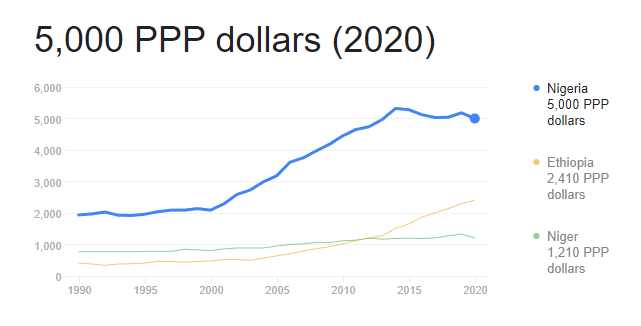

Obi, Atiku and Tinubu must revisit Yar’Adua’s short era. His budgets were evidently Keynesian with a sharp focus on how aggregate demand could influence economic output; sure, he needed to do that since he led the nation during a global recession. And that is the beauty of Yar’Adua because during the Great Recession, he grew the economy! Between 2008 and 2010, his GDP average growth was 7.98% (OBJ, GEJ, and Buhari* averaged 6.95%, 4.8% and 0.81% respectively). Nigeria did not experience the Great Recession except in the stock market. People, in the main markets, from Onitsha to Kano to Ife to Uyo the economy was okay.

Another component was also his vision for building new centers of growth. His budget for the Niger Delta was so big that when he died, the next administration had to cut it! Reading his budget, he believed that the Niger Delta, if well invested in, could unlock more growth for the nation, well ahead of what oil & gas was providing.

When a man can grow an economy during recession this big, a nation cannot allow his legacy to be forgotten. Some of the recent budgets we have seen are paddles of ephemeral political hacks. I am hoping that Obi, Atiku and Tinubu will give us economic visions for the future that all Nigerians will unite for.

Indeed, even in a global recession, Nigeria can keep growing because we’re very far from the optimal state. No excuses; we want growth. I hold seven degrees and very privileged to understand many things, from finance to engineering to management: I will be looking at the manifestoes as the campaign season begins. We will provide guidance here, with facts. I challenge everyone to vote for #growth and #competence.