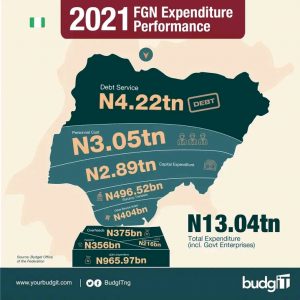

The Budget Office of the Federation recently reported that a total expenditure of N13.04trn was made at the 2021 fiscal year ended as against N13.08trn that had earlier been proposed at the beginning of the fiscal year. The Budget Office of the Federation provides budget functions, implements budget and fiscal policies of the Federal Government of Nigeria.

According to the 2021 Federal Government of Nigeria’s expenditure performance as reported by the Budget Office of the Federation, N4.22trn were spent on debt servicing, that is about 32 percent and largest fraction of the total expenditure for the year. This is followed by personnel cost at N3.05trn and Capital expenditure at N2.89trn. The remaining N2.88trn was distributed among statutory transfers, overhead, pensions, other operating expenses, other service expenses etc.

The 2021 expenses recorded 20 percent increase from the 2020 expenditure which was put at N10.81trn. The Federal Government of Nigeria had earlier proposed N11.9trn for the 2021 fiscal year to absorb the macroeconomic and domestic economic realities observed in the 2020Q2. The budget later increased to N13.08trn in the beginning of the fiscal year and N14.57trn after a supplementary budget of N982.7bn was included and approved on 26 July 2021.

Discussing the proposed 2021 budget, Zainab Ahmed, Nigeria’s Minister of Finance, Budget and National Planning was reported to have made the following remarks:

- With the current global economic conditions, key parameters and other macroeconomic projections driving the medium term revenue and expenditure, frameworks have been revised in line with emerging realities.

-

The Crude oil price benchmark in 2021 would be revised from $28 per barrel in 2020 to $40 per barrel while crude oil production capacity would be reviewed from 1.8million barrels per day to 1.86million barrels per day.

-

The exchange rate of the Naira would be left unchanged at N360 to a dollar during the year with inflation rate expected to drop from 14.15 percent in 2020 to 11.95 percent in 2021.

-

The non-oil GDP was projected to grow from N131.16trn to 132.6trn; oil GDP from 88.69trn to 101trn; national GDP from 139trn to 142.19trn and Nominal consumption to rise from N117.9trn to 118.89trn with GDP growth rate projected to improve from a negative 4.2 percent to positive 3 percent.

As at November 2021, the FGN’s total revenue was N5.51trn, about 30 percent shortfall from the projected N7.89trn. Oil price reached $79.31 per barrel against the $40 benchmarked, while oil production was put at 1.56million barrels as against 1.86million barrels earlier planned for. Also, Naira exchanged at N410.15 for a dollar as against N360 to a dollar budgeted and inflation rate was put at 15.4 percent vs 11.95percent that was also earlier budgeted for. However, the GDP growth rate hit 4.03 percent as against 3.0 percent earlier expected. This was a significant win recorded for the year.

For the 2022 fiscal year, the FGN’s total expenditure was projected at N17.13trn which is 18 percent higher than the 2021 budget. Of this, the recurrent non-debt spending was put at N6.91trn, capital expenses at 5.96trn and Debt servicing at 3.61trn. Oil production is projected to increase to 1.88million barrels per day and oil price to hit $62 per barrel. Also, Naira exchange rate is expected to maintain N410.15 to a dollar and inflation rate is expected to climb down to 13 percent. Furthermore, Nominal consumption was to increase to 119.28trn and Nominal GDP to increase to 184.38trn and GDP growth rate expected to hit 4.20percent .

According to the Budget office of the Federation, the 2022 budget which was prepared using zero-based budgeting approach based on the policies/strategies contained in the 2022-2024 Medium Term Expenditure Framework (MTEF) and Fiscal Strategyy Paper (FSP) seeks to continue the reflationary policies of the 2020 and 2021 budgets.

Currently, the Naira has further decreased in value against the dollar, exchanging at N418 to a dollar at the official market and around N700 to a dollar at the unofficial market. As of June, inflation rate climbed up to 18.86 percent months-on-month increase. Furthermore, the cost of servicing debt surpassed the Federal Government’s retained revenue by N310 billion in the first four months of 2022, according to the minister of finance Zainab Ahmed.

While the Government’s institutions including the pro-Government individuals have continued to attribute the current economic recession of the country to several factors ranging from increasing demand for dollar, massive exodus of people from the country to other countries, the hideous activities of the cryptomarket, and the Russian-Ukrainian war, critics have not failed to decry the current unproductive state of the country influenced by the increasing culture of borrowing and waste in the Government which has shot the country’s public debt portfolio up above N41trn, thereby creating a huge debt to revenue disparity.

Sanusi Lamido, former Central Bank of Nigeria Governor and former Emir of Kano is a strong critic of the Nigerian Government and advocate of economic-driven policies. Sanusi Lamido was reported to have said Nigeria’s bankruptcy is masterminded by its inability to cash in on the oil windfall orchestrated by the Russian-Ukrainian war. The former CBN Governor believe Nigeria is sitting on a keg of gunpowder, noting it is the only oil-producing country that is grieving at the moment when oil prices have gone up as a result of the war.