What is innovation? And what is an “interest”? For the second one, I will explain using data from INEC registrations in Sokoto and Zamfara States. The two states which have been unable to register secondary school students, in public schools, to take WAEC exams, for two years running, are outperforming many states on voter registration per capita. In other words, Sokoto and Zamfara States can mobilize people to register to vote but cannot find ways to register students to take WAEC exams despite the students having prepared for the same exams for 6 years!

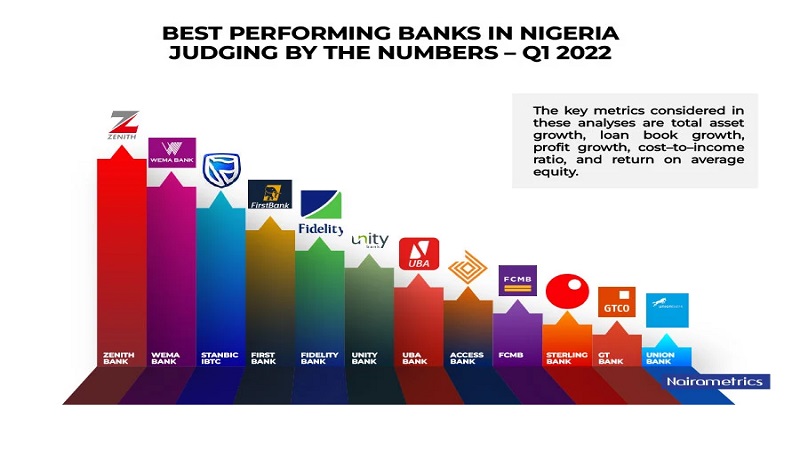

For the first part, I take you to the performance of Nigerian banks, using Nairametrics data. Interestingly, the old innovator and the god-zilla of excellence, GTBank*, seems to have lost grounds. It is unbelievable that you can have a plot in Nigerian banking where GTBank* is not in the top three on the innovation side.

Below are the leading banks between March 2022 and December 2021.

Total Assets growth

- First position – Fidelity Bank (+22.9%)

- Second position – Zenith Bank (+18.9%)

- Third position – Stanbic IBTC (+13%)

- Fourth position – Unity Bank (+9.7%)

- Fifth Position – Wema Bank (+7.7%)

Customer Deposits growth

- First position – Zenith Bank (+27.8%)

- Second position – Fidelity Bank (+18%)

- Third position – Unity Bank (+17.4%)

- Fourth position – Wema Bank (+8.8%)

- Fifth Position – Access Bank (+7.8%)

Customer Deposits growth

- First position – Zenith Bank (+27.8%)

- Second position – Fidelity Bank (+18%)

- Third position – Unity Bank (+17.4%)

- Fourth position – Wema Bank (+8.8%)

- Fifth Position – Access Bank (+7.8%)

Loan book growth

- First position – Fidelity Bank (+28%)

- Second position – Zenith Bank (+25%)

- Third position – Unit Bank (+11.9%)

- Fourth position – UBA (+7.1%)

- Fifth Position – Stanbic IBTC (+6.4%)

Profits After Tax (PAT) growth

- First position – Wema Bank (+119%)

- Second position – First Bank (+108%)

- Third position – Sterling Bank (+47.9%)

- Fourth position – FCMB (+44.6%)

- Fifth Position – FBNH: (+33.9%)

Cost-to-income ratio performance

- First position – First Bank (-12.48%)

- Second position – FCMB (-6.83%)

- Third position – Wema Bank (-5.5%)

- Fourth position – Stanbic IBTC (-5.4%)

- Fifth Position – Sterling Bank (-2.1%)

Return on Equity (ROAE)

- First position – Access Bank (21.39%)

- Second position – UBA (20.4%)

- Third position – GT Bank (19.3%)

- Fourth position – Zenith Bank (19.2%)

- Fifth Position – Wema Bank (15.96%)

From what we can see here, the following are evident

- Fidelity Bank is looking amazing, outflanking to outperform.

- Wema Bank – the preferred bank for Nigerian fintech startups – is showing great promises. This bank could be exceedingly profitable when most of its leverages begin to compound.

- Zenith Bank has solidified its position as Nigeria’s leading banking institution.

The past is history, the future is unborn and full of promises. Commit to innovate, with the right interest, because the future is unbounded.

Comment on LinkedIn Feed

Comment: Prof Ndubuisi Ekekwe, Great insight! I particularly love the discuss on innovation. What amazes me is how Wema Bank Plc. has carved a good spot for themselves in the Nigerian fintech space effectively being the banking layer for a lot of startups. Their position means as these startups grow in revenue, they grow in profits.

Quick question prof, is Wema bank’s strategy part of your fintechnolocalization postulate?

My Response: Since it is a bank, we cannot use fintechnollization for it. It is already a financial services provider. Nonetheless, I see “two companies” in Wema Bank – the bank with those buildings and the Wema Platform which powers fintechs. If Wema Platform is a seperate company, it can command more than $1 billion in New York. At Tekedia Capital, we will be open to invest in it at a valuation of at least $1 billion.

The fintechs of the future live on Wema Platform and what that means is that Wema will extract the profit layers of many fintechs, “taxing” them at scale. That is where you want to be. Wema is a “software-banking” company which is a solid platform. I admire it. But it has to unlock leverages and compound them better.