The African Development Bank (AfDB) has moved to tackle the hunger crisis emanating from the Russia-Ukraine conflict. The African Development Bank Group’s Board of Directors on Friday approved a $1.5 billion facility to help African countries avert a looming food crisis.

The impact of the conflict has spiked food prices globally, instigating inflation and urgent need for proactive measures to curtail the rising cost of food. The bank noted that the disruption of food supplies arising from the Russia-Ukraine war puts Africa in a shortage of at least 30 million metric tons of food, especially wheat, maize, and soybeans imported from both countries.

“African farmers urgently need high-quality seeds and inputs before the planting season begins in May to immediately boost food supplies. The African Development Bank’s $1.5 billion African Emergency Food Production Facility is an unprecedented comprehensive initiative to support smallholder farmers in filling the food shortfall,” it said.

Between 2018 and 2020, Africa imported $3.7 billion in wheat (32% of the continent’s total wheat imports) from Russia and another $1.4 billion from Ukraine (12% of the continent’s wheat imports). The AfDB is now looking at diversifying African wheat and other food sources by upping the continent’s farming capacity. The goal is to attain $12 billion increase in food production in just two years.

The Bank said the African Emergency Food Production Facility will provide 20 million African smallholder farmers with certified seeds, increase access to agricultural fertilizers and enable them to rapidly produce 38 million tons of food.

“Food aid cannot feed Africa. Africa does not need bowls in hand. Africa needs seeds in the ground, and mechanical harvesters to harvest bountiful food produced locally. Africa will feed itself with pride for there is no dignity in begging for food…” African Development Bank Group President Dr. Akinwumi Adesina said.

This move follows experts’ calls on African leaders to take proactive measures to mitigate the food shortage impact of the Russia-Ukraine war.

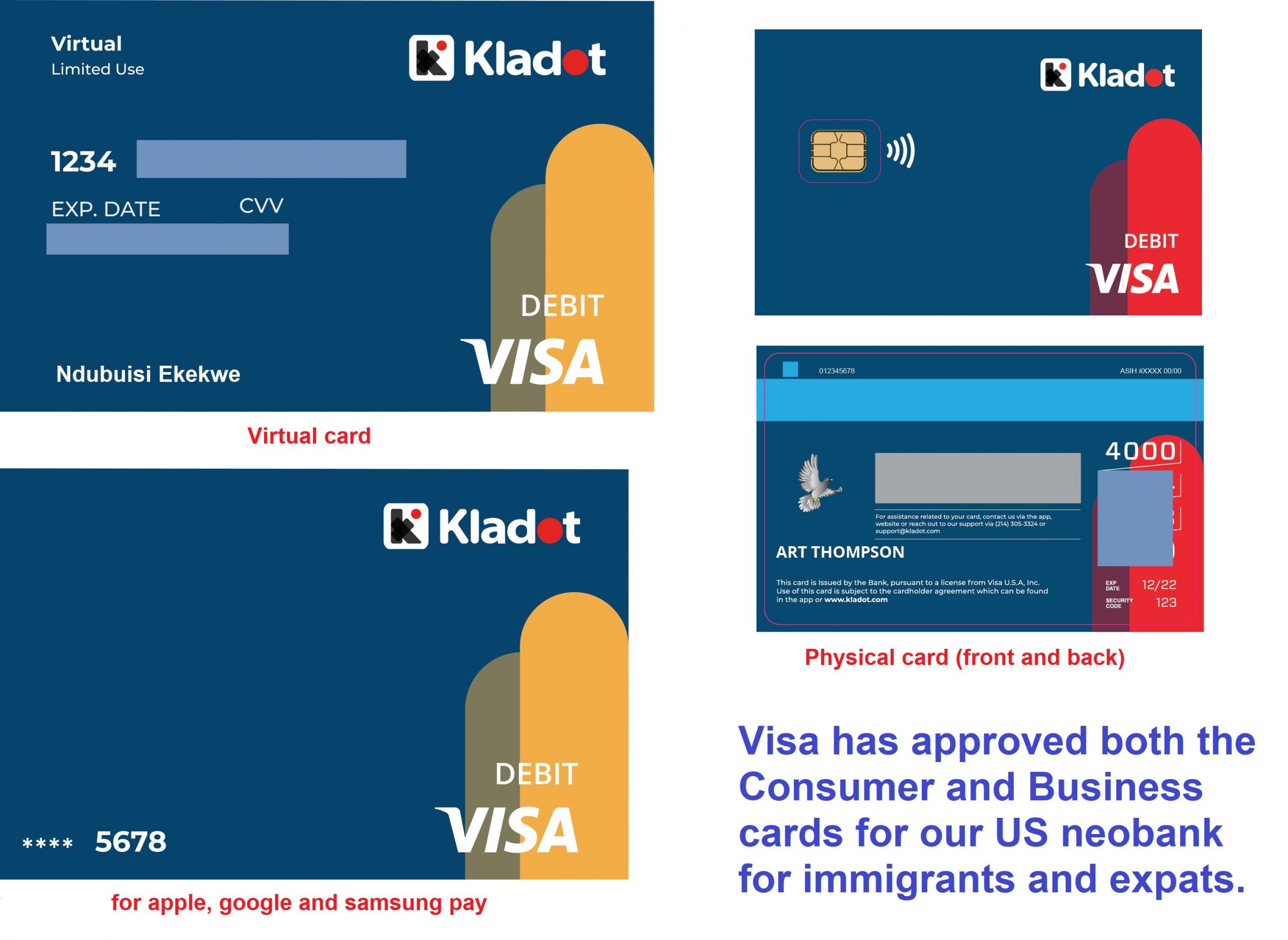

“Many families have been overtaken by hunger, undue inflationary pressure, etc, and we cannot throw a baby away with the bathwater. Helping Ukraine must not bring pain to all nations and I seek for a better strategy because bad things are brooding. I call on the African Union to show leadership urgently. If not, we may fight wars of extreme hunger in coming months, even with no visible military tanks on African streets,” Prof. Ndubuisi Ekekwe, Tekedia Institute, said in a note.

The AfDB said it has been consulting with finance ministers and other stakeholders to facilitate modalities, which includes efficient fertilizer production, to boost food production.

Read the ministers’ agreement and the AfDB’s long-term plan to make Africa food-sufficient below.

The ministers agreed to implement reforms to address the systemic hurdles that prevent modern input markets from performing effectively.

The price of wheat has soared in Africa by over 45% since the war in Ukraine began. Fertilizer prices have gone up by 300%, and the continent faces a fertilizer shortage of 2 million metric tons. Many African countries have already seen price hikes in bread and other food items. If this deficit is not made up, food production in Africa will decline by at least 20% and the continent could lose over $11 billion in food production value.

The African Development Bank’s $1.5 billion strategy will lead to the production of 11 million tons of wheat; 18 million tons of maize; 6 million tons of rice; and 2.5 million tons of soybeans.

The African Emergency Food Production Facility will provide 20 million farmers with certified seeds, fertilizer, and extension services. It will also support market growth and post-harvest management.

The African Development Bank will provide fertilizer to smallholder farmers across Africa over the next four farming seasons, using its convening influence with major fertilizer manufacturers, loan guarantees, and other financial instruments.

The Facility will also create a platform to advocate for critical policy reforms to solve the structural issues that impede farmers from receiving modern inputs. This includes strengthening national institutions overseeing input markets.

The Facility has a structure for working with multilateral development partners. This will ensure rapid alignment and implementation, enhanced reach, and effective impact. It will increase technical preparedness and responsiveness. In addition, it includes short, medium, and long-term measures to address both the urgent food crisis and the long-term sustainability and resilience of Africa’s food systems.

Over the past three years, the Bank’s Technologies for African Agricultural Transformation initiative has delivered heat-tolerant wheat varieties to 1.8 million farmers in seven countries, increasing wheat production by 2.7 million metric tons, worth $840 million.

Long-term sustainability to wean Africa off wheat and other food imports

A five-year ramp-up phase will follow the two-year African Emergency Food Production Facility. This will build on previous gains and strengthen self-sufficiency in wheat, maize, and other staple crops, as well as expand access to agricultural fertilizers.

The five-year phase will deliver seeds and inputs to 40 million farmers under the Technologies for African Agricultural Transformation program.

In April, UN Secretary-General António Guterres appointed Adesina to a select Steering Committee of the Global Crisis Response Group.

The U.S. Senate Appropriations Subcommittee on State and Foreign Operations recently invited Adesina to make a presentation about the African Emergency Food Production Facility.

The Global Alliance for Food Security spearheaded by the Government of Germany provides an excellent forum for the African Emergency Food Program Facility, which is part of a coordinated and collective effort by development partners and countries to accelerate food production in the short term while remaining focused on medium- and longer-term actions to build resilience.

For the Food and Agriculture Resilience Mission (FARM) supported by the Government of France, the African Development Bank (AfDB) is partnering with IFAD and has agreed to be part of the coordination team and steering committee of FARM. The African Emergency Food Program Facility lays out the foundation and complements FARM activities which aims to strengthen local production systems in Africa and reduce food loss to support development of sustainable and resilient food systems.