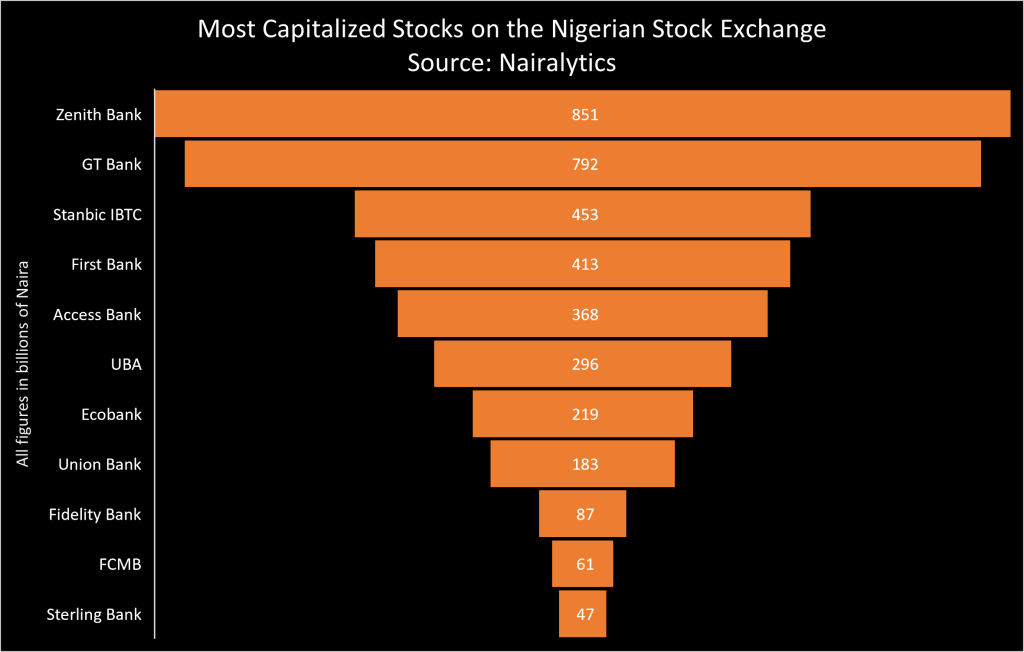

There is no argument – Zenith Bank Plc is at the zenith of Nigerian banking: “Zenith Bank Plc has released its 2021 full-year audited financial statement reporting a profit after tax of N244.5 billion the highest on record. This reflects a 6.07% increase year on year.” I expect Zenith Bank’s number to top GTBank’s GTCO by at least N40 billion.

This company is separating itself from other players and the gap is widening quarterly. We used to be this bullish with GTBank, but it seems very soon any comparison may be academic. Left and right, Zenith Bank is the category-king on making money in the banking sector of Nigeria!

Anything it is doing is working, and other banks should learn from its playbook. From Nairametrics, here are the key metrics.

- Net Interest income which it earns from its lending business rose 7% to N320.8 billion.

- However, a 51.6% spike in loan losses meant net interest after impairments was flat at just N260.8 billion.

- Zenith Bank, however, made up for it with income from commission and fees rising 31% to N103.9 billion year on year. It also raked in N167.4 billion in net trading income representing a 37.6% increase year on year.

- Zenith Bank also grew its deposits by a whopping 21.2% to N6.4 trillion while its total assets is now N9.4 trillion. Net assets rose 14.4% to N1.27 trillion.

- Zenith Bank Plc last traded at N27.10 per share and its market capitalization stands at N850.84 billion as at Monday, February 28, 2021. Year-to-date performance shows that the share price of the company has gained 7.75%.

- The bank has proposed a dividend per share of N2.8 per share up from N2.7 per share a year ago. Based on its current share price, Zenith Bank’s dividend yield is about 10%.

As Zenith Bank dances atilogwu, owambe, etc for this result, Dangote Cement is sharing an amount that is more than some states’ budgets as dividend. When you can distribute N341 billion as dividend in a year, the overriding trajectory is that everything has converged: the customers are buying and the company is executing at a high level.

The Nigerian people are truly resilient to be powering these results for these companies despite the paralysis in the land. As they say in our churches, my turn MUST come. Say Amen somebody! But you have to invest and take risks first!

The hotels are also doing fine: “Transcorp Hotels Plc has announced its Audited Financial Statements for the full year ended December 31, 2021.?The?results published on the Nigerian Group Exchange showed?a 114% growth in Revenue to N21.74bn from N10.16bn as of December 2020,?while Gross Profit rose by 143 %?to N16.23bn from N6.67bn.

The Company’s results show an impressive growth in its performance signalling its strong recovery from the impact of the COVID- 19 pandemic in 2020. The performance also reflects the Company’s resilience and nimbleness, as it consistently leverages innovation to achieve an outstanding performance, breaking occupancy, and revenue records in 2021.”

GTCO of GTBank

Guaranty Trust Holding Co (GTCO) Plc has released its first Full-year financial result as a group which revealed a profit of N175 billion in 2021. This reflects a 13.21% decrease year on year….The statement revealed that in FY 2021, interest income fell by 12.77% from N288.28 billion to N251.47 billion in the current period. GTCO’s profit performance is on the back of all margin decline as income from interest and trading income all depreciated year on year.

UBA

United Bank for Africa (UBA) Plc has announced its audited results for the full year ended December 31, 2021.. gross earnings rose significantly to N660.2 billion representing an increase of 7 percent compared to N616.8 billion recorded at the end of the 2020 financial year. UBA’s Profit Before Tax was impressive with a 20.3 percent growth to N153.1 billion, compared to N127.3 billion at the end of the 2020 financial year; while Profit After Tax rose grew by 8.7 percent to N118.7 billion in 2021, compared to N109.2 billion recorded the previous year.

Note: This post was updated with more results, from Nairametrics reports