Crypto traders in 2025 are once again drawn to meme coins, with tokens like Dogecoin, Shiba Inu, and Pepe fueling speculation of 15× to 20× rallies in the next bull run. While those projections excite retail traders, the real buzz is around Ozak AI (OZ)—a presale project priced at just $0.01 that has already raised over $3 million. Unlike meme tokens that thrive on hype alone, Ozak AI combines artificial intelligence and blockchain, with bold forecasts of a 100× return, turning even modest allocations—like $250—into potentially $25,000.

Meme Coins Still Attract Traders

Meme tokens remain one of the most popular segments of the crypto market, thanks to their viral appeal and community-driven culture. Dogecoin, Shiba Inu, and Pepe have all delivered explosive gains in past bull runs, with some early investors seeing thousands of percent in returns. Analysts now predict these coins could deliver another 15× to 20× surge, pushing them to new highs if social sentiment heats up.

Yet, while meme coins can generate quick profits, their growth remains tied to hype cycles and market mood swings. For many investors, the question isn’t whether meme coins can run again—it’s whether there are better opportunities for sustainable exponential growth elsewhere.

Ozak AI Presale Momentum

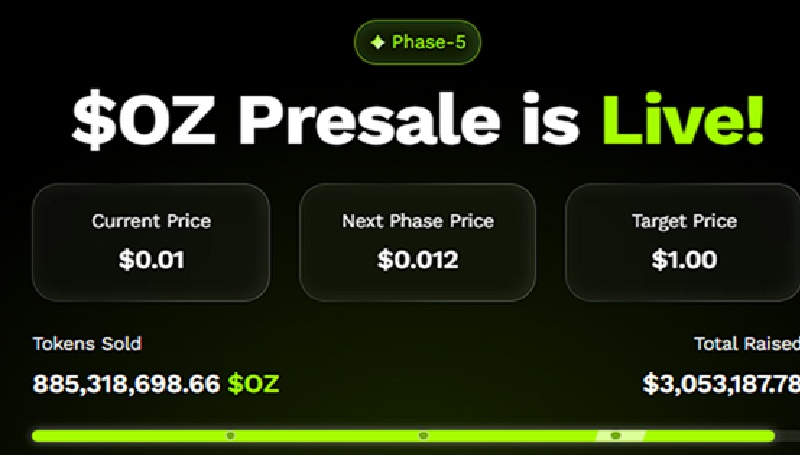

This is where Ozak AI (OZ) is attracting serious attention. Currently in Stage 5 of its presale, OZ is priced at just $0.01 per token and has already raised over $3 million, a clear sign of investor demand. Positioned at the intersection of AI and blockchain, Ozak AI offers innovation-driven potential that meme coins often lack.

The presale hype is being fueled by comparisons to early-stage projects like Solana and Polygon, which started small before delivering life-changing returns to their early adopters. Investors are rushing to secure OZ at its ground-floor price before later stages drive it higher.

From $250 to $25,000—The 100× ROI Example

At just $0.01 per token, Ozak AI offers the kind of asymmetric upside investors dream of. A $250 allocation today secures 25,000 tokens. If Ozak AI climbs to $1 in the coming years, that same $250 could be worth $25,000.

This math highlights why investors are experiencing FOMO (fear of missing out). Unlike meme coins, where the upside might cap out at 20×, Ozak AI offers the possibility of 100× or more, making it one of the most talked-about presales of 2025.

Why Ozak AI Stands Out

The difference between Ozak AI and meme tokens comes down to vision and utility. By embedding AI into decentralized applications, OZ aims to create smarter, adaptive blockchain systems with real-world use cases. This innovation gives it staying power, while its low presale entry point makes it highly accessible. Whales accumulating alongside retail investors further validate the project’s credibility and potential.

While meme coins may chase 20× rallies in the next bull run, Ozak AI’s $0.01 presale price and $3 million raised offer investors the chance at 100× returns. The possibility of turning $250 into $25,000 is fueling massive interest and positioning Ozak AI as one of 2025’s breakout projects. For those chasing life-changing upside rather than short-term hype, Ozak AI is quickly becoming the presale to watch.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides an innovative platform that focuses on predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized community technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto lovers and corporations make the perfect choices.

For more, visit

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi