On behalf of Tekedia Capital, I want to congratulate Transtura for the complete acquisition of Wàzó Money to accelerate the launch of the payment and marketplace in the broad transportation sector. I also welcome Stephen Ilori and his Wazo team to Transtura. To CEO Transtura, Vincent Adeoba, well done. The frictions are huge, building this operating system will be catalytic in the industry.

— Full press release

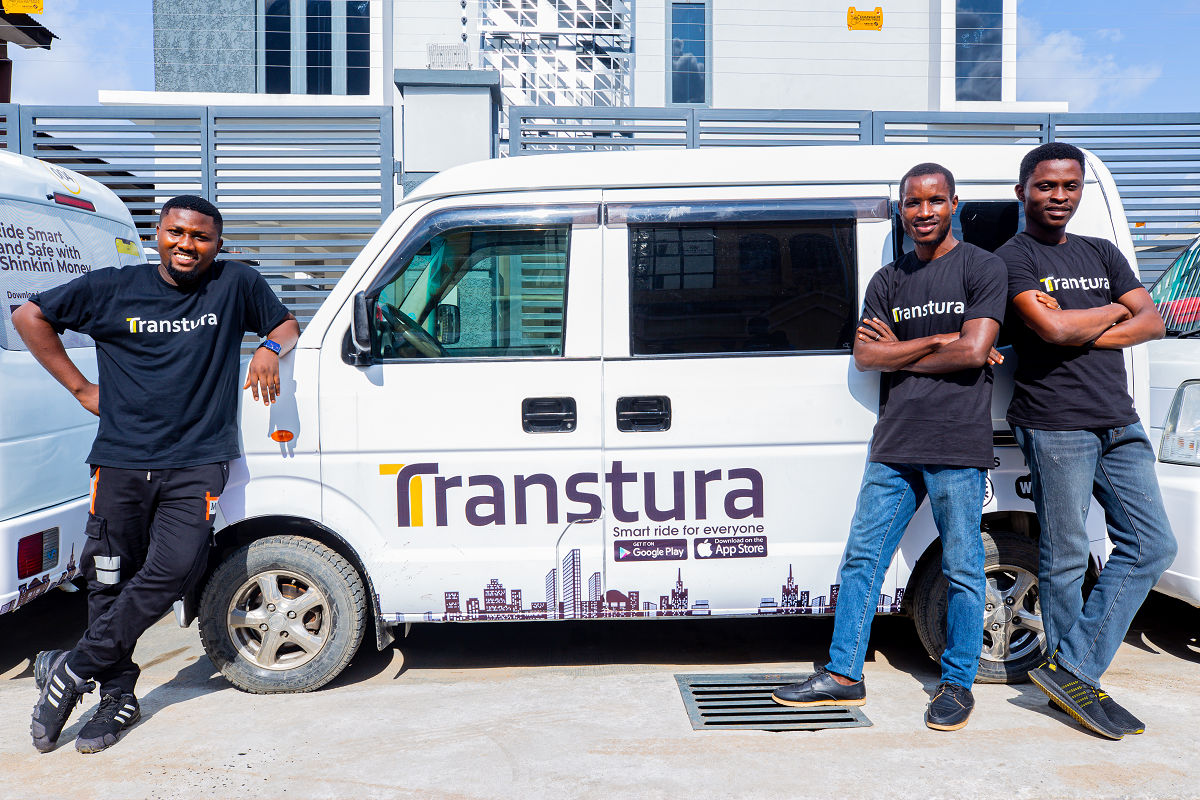

Transtura Acquires WazoMoney; Set to Launch Payment and Marketplace Solutions for the Mobility Sector.

Nigeria ride-hailing and shared mobility startup, Transtura has completed the acquisition of WazoMoney, a fintech startup which provides simplified payment solutions as it sets to launch its payment and marketplace solutions for the mobility sector. The company believe this will help unlock the enormous opportunities in the transportation value chain in Nigeria and other Africa countries.

Transtura commenced full-scale operations in October 2021, launching its shared mobility service in Lagos. The company has continued to record massive traction since launching, with thousands of riders queuing in its three major routes to use its shared ride service.

The startup is now expanding services across its platforms to include payments and a marketplace solution which is a one-stop shop for vehicles and mobility needs.

According to Vincent Adeoba, Transtura CEO, “our vision as a customer-centric company is to become Africa’s everyday mobility super app by providing shared mobility, payment service, and marketplace solutions for the over 1 billion people on the continent. We are on a mission to improve the way people commute and travel around the continent and how payments are made in the transportation value chain.

“We are leveraging on technology and automation to facilitate and improve the way people ride, travel and pay for service while also supporting companies in the mobility sector with spend management solutions.”

In the coming months, Transtura users will be able to leverage their payments solution to pay for transactions on the Transtura marketplace — a one-stop for vehicle registration, documents renewal, auto insurance, vehicle parts and accessories purchase, auto repairs, car care and other related vehicles and mobility needs — pay for intracity rides and interstate travel, automate bills payment, and manage expenses. The technology and solutions are expected to help remove some of the bottlenecks stiffening the growth of the transportation sector.

Transtura CTO, Philips Olajide said in a press release, “Africa is a home of enormous opportunities, with several local and innovative solutions. This is evident in the ways startups on the continent have continued to play important roles in solving problems across different sectors.

“For us at Transtura, we want to continue to innovate local solutions to the challenges facing the transportation sector. We are not afraid to make mistakes and learn from them as we continue to solve important problems in the mobility space.

“We believe only Africans can develop Africa, and we want to play an important role in building the Africa we want by unlocking and creating opportunities for people in the transportation sector.”

Transtura is on an exciting journey to redefine the way people commute, travel, pay, and manage expenses in the transportation space. The payment service and marketplace will help to deepen and improve financial inclusion across the continent.