For the last three decades, building collapse has been one of the primary critical infrastructure incidents in Nigeria. Out of the 36 states and Abuja, the Federal Capital Territory, Lagos State has always been the only state which records significant number of cases every year. In one of the previous analyses, our analyst reported that the Lagos would continue to have cases, if appropriate measures and controls are not established and followed by every stakeholder. Existing measures and controls, according to our analysts, are not really bad, but the failure of the concerned stakeholders to do the needful whenever the need arises has continued to be the key contributing factor to the incessant building collapse in the state.

The Ikoyi building, a 21-storey, which collapsed on November 1, 2021, furthers reinforced the call for better processes and qualified people for ensuring sustainable built environment in the state. From the physical to the digital sphere, residents and non-residents expressed their feelings about the building. Several stakeholders were accused of failing those who lost their lives in the building.

This piece is not about x-raying what the conventional newspapers and broadcast stations have reported. The piece aims at pointing out how the state government, concerned public officials and political leaders in the state can explore comment section of the state government’s official Facebook page for ‘instant policy making’ in times of crisis such as building collapse.

From November 1 to November 6, 2021, the early period of the incident, the Lagos State Government used her official Facebook page extensively for disseminating latest happenings about it to the public. Our analysis shows that during the days, the state government posted 10 messages, which most relevant comments to all the messages were 85. The number of comments represents netizens, who reacted to the management of the incident by the state government.

Similar to what is obtainable when governments and other stakeholders in the policy making are seeking the views of the public, our analysis reveals that the netizens vehemently expressed views that were within the critical to high and medium to the low impact on the state’s built environment. With this, our analyst notes that the netizens remind the policymakers how powerful they [netizens] could be telling them [policymakers] what should be done in times of crisis.

The Exchanged Words

Collective examination of the posts and comments indicates a total of 5,608 words were used by the state government and the netizens during the six days. From the both actors, building, state, Lagos, collapse, governor, site, government, Sanwo-Olu and Ikoyi were predominantly used to narrate the incident, particularly the ordeals of the victims who were trapped under the rubbles. They equally employed these words to pinpoint what should be done and who should be prosecuted.

When the views of the netizens were specifically subjected to corpus analysis, it was found that 3,847 words were employed. Building, Lagos State, collapse and Lagos State Government were copiously used to attack the concerned stakeholders in the government, especially the governor and members of the regulatory agencies, including the State Emergency Agency, which according to them failed to organize quick rescue activities on the site. They specifically emphasised regulations, control, emergency and corruption in their views.

Exhibit 1: Emerged Dominant Words in Lagos State Government’s Posts and Netizens’ Comments

Exhibit 2: Emerged Dominant Words in Netizens’ Comments

What Netizens Told Lagos State Government During Early Stage of Managing Ikoyi Building Collapse

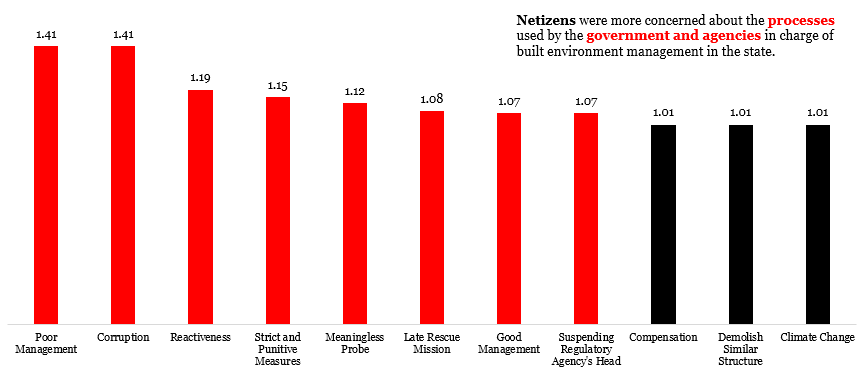

From our analysis, poor management, corruption, reactiveness, strict and punitive measures, meaningless probe, late rescue mission, good management and suspending regulatory agency’s head were the salient issues among the netizens. When they mentioned poor management, they vehemently referred to how the regulatory agency failed to ensure proper checks of the site and give approval based on the ability and capacity of the developer to handle such building.

Apart from these, poor management also referenced to the failure of the government in handling of the emergencies during the rescue operations. They largely noted corruption among the professionals, regulatory agencies and individuals as the core issue of incessant building collapse in the state. In our data, we also learnt that the netizens considered visitation of the governor, deputy governor and political leaders as reactive. According to them, the leaders failed to act when it is necessary, that is, ensuring proper management of regulation and control of the built environment in the state.

Ordering and setting up probe panel were also considered as reactive by the netizens, our analyst examined. Late rescue mission as a salient issue to the netizens was mainly found to be associated with the ways the state emergency agency handled rescue operations. They were of the view that the responders responded late. However, our checks of the state emergency agency’s Facebook page reveal a number of efforts of the responders on the site. The agency posted series of activities of its personnel on the site. Despite this, analysis shows low communication of supportive and collaborative messages to the public, which are usually needed during emergency situations such as the Ikoyi building collapse.

Exhibit 3: Netizens’ Early Salience Issues about Ikoyi Building Collapse

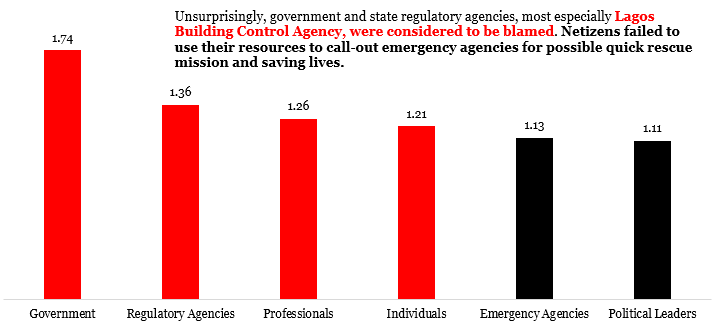

Who should be blamed for the incident? In our analysis, we discovered government, regulatory agencies, professionals and individuals as the stakeholders who failed to do the needful at one point or the other. As it is applicable to every state or national issue, especially an issue that connects with the political elites and public servants, the state government was fingered as the main stakeholder worthy of blame during the early stage of the crisis. According to our analyst, it is really surprising that the netizens considered the Lagos State Building Control Agency as the second stakeholder.

The astonishment lies with the fact that an agency saddled with approval of building construction should be first seen as the culprit before considering the state government. However, the netizens position could be viewed from the issues that have been identified with the agent-principal relationships over the years in management. It means the agent prioritised its own benefits over the benefits of the state government and the residents of the state.

Exhibit 4: Blame Worthy Stakeholders

In what context did the netizens consider these stakeholders blameworthy? Our analyst explored this question with the examination of the posts of the state government. When their salient issue was reactiveness, they mentioned the state government more than 3 times before considering professionals, which was less than 1 time.

Unsurprisingly, the state government was referenced more than 7 times when poor management was the brunt burner issue before referencing emergency agencies, which was more than 4 times. While the emergency agencies were not seen as critical stakeholders worthy of blame within the poor management issue, the netizens predominantly referenced the agencies, especially LASEMA more than 14 times before mentioning the state government.

It is really surprising that the netizens failed to mention the state government as the main stakeholder that should ensure strict and punitive measures in the built environment. Instead, they deployed their resources towards significant identification [more than 8 times reference] of the state government when corruption was the salient issue to them followed by professionals and regulatory agencies. Considering the impact of the collapse and public outcry that trailed it during the period of the analysis, our expectation that the head of the regulatory agency would be copiously referenced was not met.

Salience Issues in Which Contexts

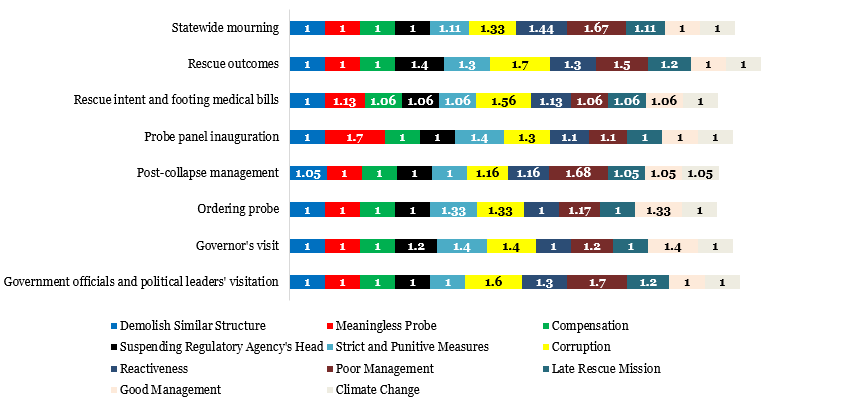

Similar to the contexts in which the netizens found the stakeholders worthy of blame, our analyst also examines the contexts in which the netizens used to express the salient issues. Demolish similar structure, climate change and poor management were significant issues to the netizens when the state government disseminated information that addresses post-collapse management. In our data, the state government mainly posted messages that established specific information about casualties in the hospital and activities of the emergency agency.

Meaningless probe was an issue when messages that focused on the probe panel inauguration, and rescue intent and footing medical bills were posted by the government. Suspending regulatory agency’s head was an issue when rescue outcomes, and rescue intent and footing medical bills were the most appropriate by the state government to communicate. As captured in Exhibit 5, it is obvious that the netizens utilized the state government’s intended elements and meanings before expressing their salient issues.

Exhibit 5: Contexts appropriated by Netizens for agendas setting

The emerging insights have several implications for the policy making in the state and Nigeria in general. Our analysis has shown that political leaders and public servants have numerous benefits to gain from exploring netizens’ behaviour in times of crisis for early management strategy development and execution.

One of the significant implications is that rescue mission could be initiated and coordinated via social networking sites. In terms of posting messages, the state government performed well. However, the handlers of the Facebook page failed to react to the comments of the netizens. This is not a behaviour that should be exhibited and nurtured in terms of crisis.