Amidst the criticism following Nigeria’s FX crisis and the decision of the Central Bank of Nigeria (CBN), to go after online FX rates publisher, AbokiFX, the CBN governor Godwin Emefiele has said the apex bank is ready to compromise on the approved forex transaction limits if applications meet stipulated requirements.

The current FX policy limits transactions to $5,000, which highly falls short of consumers need and has been fuelling consumers’ patronage of the parallel market.

Poor liquidity has been largely fingered as the bane of the current FX crisis in Nigeria, which has seen the naira nose-dived from N540/$1 to N570 /$1 and N412.88/$1 on Friday from N412/$1 the previous week in Investors and Exporters (I&E) window.

To curtail the whirlwind, Emefiele said the CBN was ready to approve requests from commercial banks to exceed the limit if it is proven that the extra demand for FX is for legitimate purposes.

“Indeed, I want to put it on record; if the amount you want is even above the limit that is recognized and we find that the reason you are making those demands is legitimate, your bank will speak to us and we will give you more than what is even the limit,” he said.

The financial regulator had placed FX restrictions on many import items, which are part of the transactions categorized as illegitimate. Since they cannot access the Investors and Exporters (I&E) Window, importers who deal on the restricted items have embraced the parallel market.

Emefiele said the I&E Window of the central bank remains the major market which anyone seeking to procure or sell foreign exchange should patronize. He urged customers to approach the banks for their FX transactions.

“The only exchange rate that I recognize today in the Nigerian foreign exchange market which is the dominant market remains the Investors and Exporters (I&E) window.

“I am sorry to say that I do not and I do not intend to recognize that there are any other rates in the market,” he added.

However, experts have blamed CBN’s policies for the naira’s plunge, alleging that the apex bank’s determination to fix market price is responsible for Nigeria’s FX woes.

Former Director-General of the Lagos Chamber of Commerce and Private Sector Advocate, Dr. Muda Yusuf, said the regulator should suspend the pegging of exchange rate so that the market would determine the value of the naira, upholding the admonition given on Friday by former deputy governor of CBN, Kingsley Moghalu.

Yusuf said during an interview with ARISE News Channel, that the CBN’s intervention is not only discouraging suppliers of foreign currency, becoming a disincentive to export spooking Foreign Direct Investment (FDI), it is also stymieing the chances of stabilizing the naira, which lies largely on the demand and supply market principle.

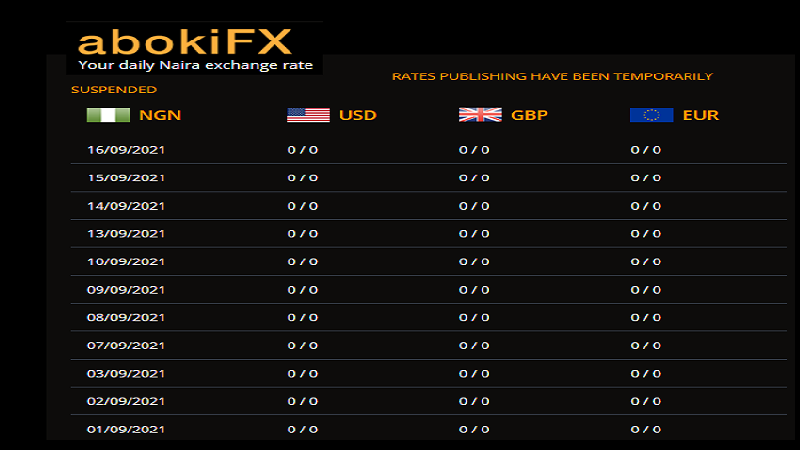

While rebuking the CBN for attempting to scapegoat AbokiFX, who he said has no power to jolt the market, Yusuf said the CBN, instead of treating the ailment, is rather concentrating on the symptoms by trying to control the demand of forex. When the major challenge with Nigeria’s FX is inappropriate pricing of the exchange rate and the gap in the window between the parallel market and the Nigerian Autonomous Foreign Exchange Rate Fixing (NAFEX), which officially pegged the dollar at N420.

“You don’t have to fix a rate in the market which cannot be supported by demand and supply. The gap between the parallel market and NAFEX window is about 30 per cent, which is big. It could be managed if it is about five to 10 per cent. The major demand is on the parallel market because NAFEX window can only meet about 20 per cent of the demand. The high demand is putting pressure outside the official window.

“So it is like subsidy, which cannot work, so we should deal with the fundamentals of the problem. If we don’t deal with the cause of the problem and continue to treat the symptoms, we create greater problem for the economy.

“By fixing the rate, CBN is blocking free supply to the economy because those who are willing to supply to the market will not do so when the rate is pegged. Apart from oil, we have FDI, we have embassies and the Diaspora that can supply foreign currency to the market. What are we doing to encourage them to supply to the market? People are doing business under the table because CBN fixed a rate that is not sustainable. There is premium of 30 per cent between the official and parallel market. This regime is creating the problem. We are doing fractioning.

“If you have a system that functions well, CBN cannot be selling forex because it should be sourcing its own forex. The critical factors of demand and supply, if well managed, will create incentive for people who want to bring in forex. CBN should allow a system that works. You can never win when you are confronting the market. One of the major problems in the market is the insistence that people should sell at a fixed rate. That policy has created a problem of compliance,” he said.

Like this:

Like Loading...