The Central bank of Nigeria (CBN) has postponed the much anticipated launch of its Digital Currency, the eNaira.

The disappointing announcement was made on Friday by the financial regulator’s spokesman, Mr Osita Nwanisobi, who explained that the planned launch has been canceled because it coincides with Nigeria’s 61st Independence Anniversary, which has many key activities that the e-naira’s unveiling could not get along with.

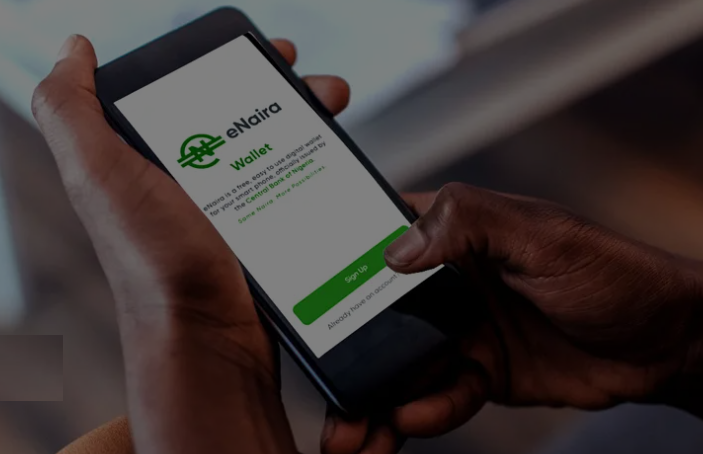

Last week, the e-naira website went up live to the excitement of Nigerians who couldn’t wait to see the platform power their digital currency transactions, making the news that the launch has been postponed, heartbreaking.

But explaining further on the development, Mr. Nwanisobi assured Nigerians that the e-naira project remains intact. He said the CBN and stakeholders have worked round the clock to ensure a seamless process that will be for the overall benefit of the customer, particularly those in the rural areas and the unbanked population.

Mr. Nwanisobi also explained that the decision to postpone the launch of the Central Bank Digital Currency (CBDC) is in deference to the mood of national rededication to the collective dream of One Nigeria.

The launch had been slated for October 1, which would have made it part of the Independence Day activities.

No new date was announced for the launch of the digital currency, which has got many wondering if there is more to it.

Could there more be to it?

On Tuesday, a cease and desist document sent to the CBN over the use of the name eNaira, was published online.

The document titled: “Infringement of Trademark & Violation of Corporate Name cease and desist Notification to the Central Bank of Nigeria,” signed by Olakule Agbebi Esq for Olakule Agbebi & Co., was reportedly sent to the apex bank, warning it to cease the use of the eNaira name.

The notice, which was sent on behalf of “ENAIRA PAYMENT SOLUTIONS LIMITED (RC 508500)” said the company has been incorporated since 7th April 2004, registered in class 36 and class 42.

The document stated that the scheduled launch of the eNaira is a threat and shows willful infringement of his client’s trademark. The notice also added that “ENAIRA PAYMENT SOLUTIONS LIMITED has now been exposed to damages, loss of business and loss of goodwill due to CBN’s infringement.

“For this reasons, our client has approached the Federal High Court in Suit No: FHC/AB/CS/113/2021 between ENAIRA PAYMENT SOLUTIONS LIMITED vs CENTRAL BANK OF NIGERIA to seek a restraining order including an order to restrain CBN from proceeding in the launch on 1st October 2021,”? the Notice stated. “In the interim, the CBN is hereby warned to cease and desist from using or purporting to use the name eNaira for its product or in any way,” it added.

It is therefore believed that the postponement of the CBDC launch is in connection with the unexpected issue of trademark infringement by the CBN. Many Nigerians are concerned that the central bank would ignorantly use a name registered by a business entity without their approval.

Like this:

Like Loading...