Courtesy of Nairametrics, this is the 2015 Central Bank of Nigeria (CBN) circular that is causing problems for forex-trading fintech companies (companies which enable Nigerians to buy foreign stocks): “For the avoidance of doubt, any Authorized Dealer that is found to have used funds from interbank, export proceeds and bureau de change to consummate these items classified as Not Valid for Forex or undertakes money wire transfer for a BDC shall be sanctioned appropriately.”

The apex bank has used a court order to freeze the bank accounts of Chaka, Bamboo and related companies in the nation as it examines forex-related transactions.

The circular was issued on July 01, 2015, titled: “RE- Inclusion of some imported goods and services on the list of items not valid for foreign exchange in the Nigeria foreign market.”

The circular itemized a list of 41 products not valid for foreign exchange at the Nigerian foreign exchange widow, and the 41st product was Euro bond/ foreign currency Bond/ shares. This gave the CBN a formidable footing to tackle these companies whose sole business was to provide Nigerians with access to foreign financial instruments.

“For the avoidance of doubt, any Authorized Dealer that is found to have used funds from interbank, export proceeds and bureau de change to consummate these items classified as Not Valid for Forex or undertakes money wire transfer for a BDC shall be sanctioned appropriately.” – CBN.

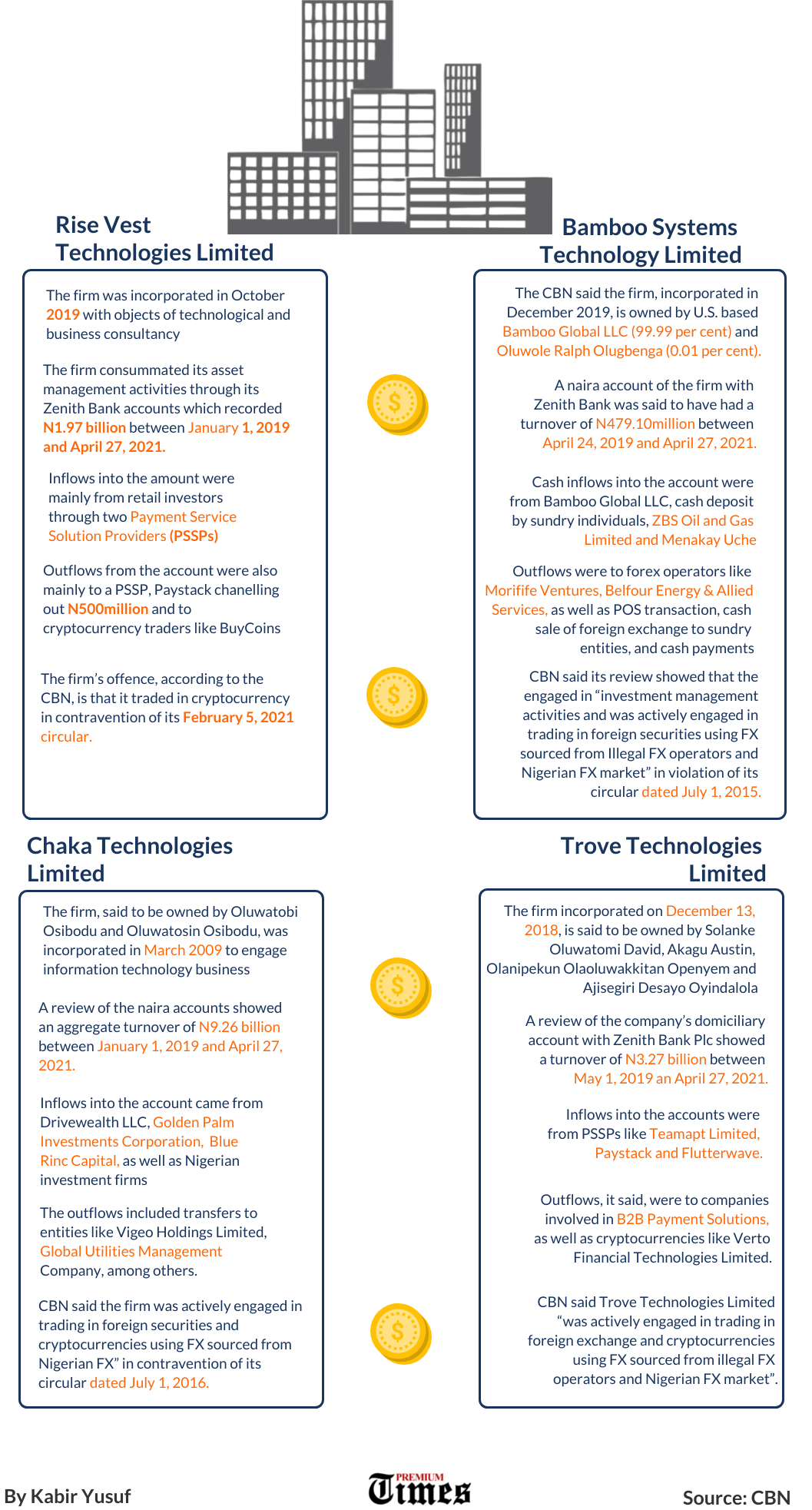

Therefore, the CBN sort to penalize those that violated its directives as it filed a motion with the Federal High Court sitting, Abuja. The Defendants are Rise Vest Technologies Limited, Bamboo Systems Technology Limited, Bamboo Systems Tech. Ltd OPNS, Chaka Technologies Limited, CTL/Business Expenses, and Trove Technologies Limited.

Meanwhile, the court has (temporarily) unfrozen the bank accounts of some of the companies to enable them pay rents and salaries: “The Federal High Court, Abuja, on Tuesday, granted the request of Bamboo Systems Technology Limited and Bamboo Systems Tech. Ltd., to temporarily unfreeze their accounts.

The order from the court follows the filing of an application by both firms asking for a variation of the order made by the court to allow the companies have access to its funds to pay rent and workers’ salaries.”

I remain of the opinion that Nigeria can investigate these companies while they are operating at full capacity. If not, after 6 months, the duration of the freeze, some may be financially incapacitated to be relevant.