I cast my mind back to the end of last year… the date? December 18, 2020. Nigeria’s Apex Bank made a seismic shift in FOREX policy.

It no longer permitted foreign forex trade actors to transfer remittances resulting in credits to Nigeria based commercial bank accounts in Naira. Moving forward, all remittances have to meet the commercial banking gateway in US dollars.

I wrote about this back in April amidst the climax of India’s COVID Crisis. Nigeria had been slow to react with measures to manage the potential spread to Nigeria through flight restrictions.

80%+ of the annual Nigerian budget capable of being met by Diaspora remittances.

I described remittance arriving in dollars (unable to be accessed by ATM) and an imported COVID Crisis causing a lockdown that closed in-person banking, as speculatively – ‘the perfect storm‘

Moving forward from this development, the next major change came on 28 July, when CBN banned the sale of Forex to Bureau de Change. The aim in this apparently, is to regulate the ‘alternative’ market so that the ‘official’ and ‘alternative’… (i.e. Black Market aka, ‘Mallams’) will converge.

Well no they won’t! If the Mallams cannot find a flexible means to top up their foreign currency via the apex bank, then they will be completely dependent on Diaspora remittances for Forex.

The Mallams won’t want to give up their business without a fight, and scarcer forex will mean more divergence between rates, not less.

There will always be business people under pressure to get ingredients, raw materials and various supplies from abroad to support their business and they will be willing to pay a premium to source the forex to make it happen.

So what we have here is two divergent CBN policies with contradictory objectives.

The ban on Cryptocurrency as of 5 February this year, hasn’t worked either, and trading volumes from Nigerians have continued unabated.

Paxful are now operating out of UAE, while Patricia have moved to Estonia. There is no information about the Nigerian teams that earned a living from this but it’s reasonable to assume many lost jobs.

Skills need to be built for the growing generation to master the tools of the future, and the CBN ban has been a huge own goal in ensuring that Nigerian expertise is ahead of the game especially in giving the youth experience.

Do they think that the moment Nigeria has e-Naira, they can suddenly wave a magic wand and have an instant digitally aware trade population on tap?

This comes amidst today, leading International Electronic Funds Transfer and Card Payment institution, VISA Inc, decides to buy a ‘CryptoPunk’ NFT for $150K in Ethereum

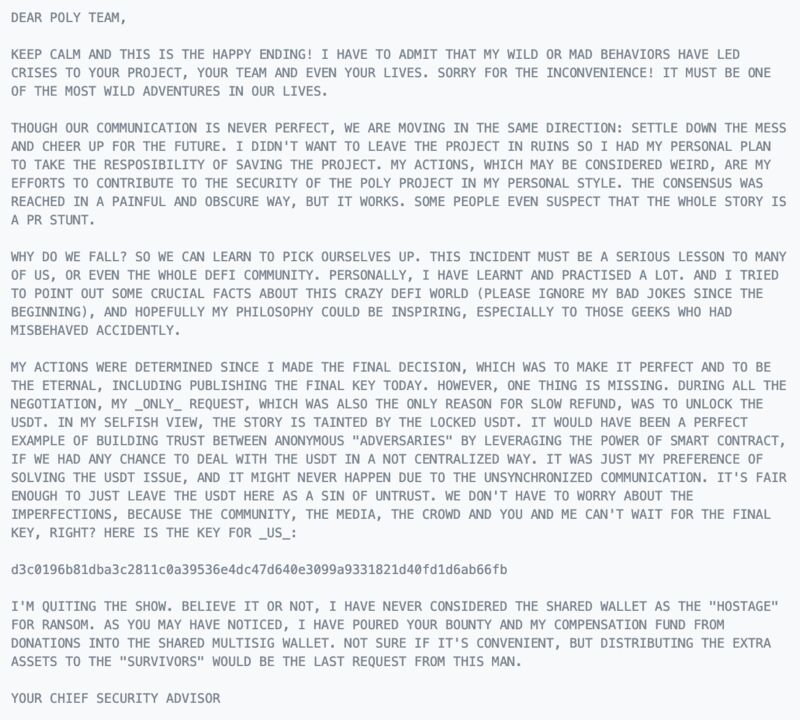

Today, Tom Robinson, Chief Scientist & Co-Founder at Elliptic lets us know on Twitter that the Poly Network Hack issue has been resolved to reasonable satisfaction resulting in a security learning experience with no significant losses…

While Bloomberg heralds Bitcoin heading for a new milestone of USD$ 50K.

CBN seems very much to be travelling on a one way traffic system in the opposite direction to that in which the whole rest of the world is going. That, in currency stewardship terms is a car crash.

We then have the actions against Rise Vest Technologies Limited, Bamboo Systems Technology Limited, Bamboo Systems Technology Limited OPNS, Chaka Technologies Limited, CTL/Business Expenses, and Trove Technologies Limited, adding pepper in the mix.

In such a very short period of time, an enormous amount of unnecessary uncertainty has been created around how Nigerian International Commerce is managed.

Social Media and Chat Board Pundits are quick to bring out the virtual guillotine, and the head they all seem to be looking for is Godwin Emefiele, while the name ‘Lamido Sanusi’ is being whispered as if it is a sign of ‘the second coming’ …but is this clamour a reasonable one?

Well, there are two points I would like to make about this. Let’s tell a story about a fateful day – 20 June 2016

Mallam Sanusi Lamido Sanusi (CON) was governor from 3rd June 2009 to 20th February 2014 and a close political ally of President Muhammadu Buhari. Despite being left office, Sanusi lobbied heavily for a break of the Naira from being pegged to the dollar.

The argument had been that oil prices had been declining steadily since 2014. At a rate of 197 Naira to the dollar, the currency balance was difficult to service. The cheap cost of dollars was also encouraging too much luxury good import activity causing capital flight.

There was some support for this by Nigerians with the perspective of an ‘informed view’. “Devaluation is definitely policy movement in the right direction as the economy was beginning to haemorrhage,” said Henry Obi, Chief Operating Officer ; Helios Investment Partners.

Since salaries were paid in Naira, resulting devaluation saw salaries bill for forces and civil servants get cheaper since revenue from oil saw more Naira available to FGN for the same amount of dollars.

This was a pay-cut in disguise as the lower valued Naira caused inflation and within a few months the purchasing power of salaries dropped by one third.

But around midway in the last decade, something amazing was happening. Nigeria was maintaining its GDP position in Africa despite oil prices heading in the wrong direction. Why? Because of the emergence of a strong ‘intermediate goods’ capacity being generated by ‘Light Manufacturing’ These began to emerge all along the arteries from Lagos to Abeokuta and Ibadan. The big internationals were expanding in Ogun and Oyo.

Though what was even more profound was not the progress with mature MNC Conglomerates of European or North American origin, but the myriad of smaller but significant operations being started up by entrepreneurs from other emerging markets and Nigerians indigenes in Edible FMCG, Household Goods, Pharmaceuticals and Plastics.

In anticipation of increased business from some of these industries the #1 Flavour and Fragrance House in the world, Givaudan had expanded its Lagos operations, while the #2 at the time, Firmenich , ended its long history of working with locally established partners such as the Turkish, Orkila Chemicals, and the local group, Mikado, and established their own state of the art R&D and production.

At the point of Naira free-float, the Intermediate Goods Export was worth one third of Nigeria overseas revenue.

The ‘other’ impact of 20 June 2016:

The important thing to understand is that ‘Intermediate Goods’ manufacturers were for the most part not producing those exclusively. They were producing FMCG for the Nigerian domestic market as well. A company that manufactures masterbatch resin can sell it regionally, but can also use it to make plastic bottles or beer crates, and many other things domestically. If a company creates a milk powder portfolio for the export market, it can also make products such as MILO, Bournevita and SMA Pro (baby formula) for local consumption. The combination of ‘Intermediate Goods’ with domestic FMCG was symbiotic and purpose built for profitable scaling.

As the Naira went into relative freefall, domestic FMCG demand shrunk drastically due to inflation, while supply chain costs on overseas purchases impaired the ‘profitability from scale’ model. The increased costs of production also made the ‘Intermediate Goods’ less competitive in regional markets. 20 June 2016 had simply priced them out. In a very short time, one third of Nigeria’s export revenue simply jumped off a cliff.

Could the Buhari Administration have foreseen this? Well for a start, all the policy noises had been a tunnel vision on oil. But was the strongly leveraging position of Mallam Sanusi Lamido Sanusi (CON) the decider?

Well firstly, Sanusi had a lot of reputational capital on his side. He spearheaded banking reform on his watch. No less than sixteen senior bank officials faced charges that included fraud, lending to fake companies, giving loans to companies they had personal interests in and conspiring with stockbrokers to boost share prices. He also attacked the many powerful and interrelated vested interests that were exploiting the financial system.

If the late Umaru Musa Yar’Adua were a vehicle, Mallam Sanusi Lamido Sanusi (CON) was its engine!

On balance, Muhammadu Buhari.might have also been casting his eyes forward to an election in 2019, and realizing that he will need Sanusi’s influence as Emir of Kano.

It is clear that the exchange rate between Naira and Dollar has been consistently on a downward trend since 20 June 2016

This now leads to my second point about the tenure of Godwin Emefiele.

In an article October last year, ‘Relaxation of Select CBN Forex Use In A Post #ENDSARS Nigeria’, I quoted from ‘The Bridge’ in March 2019:

‘The Central Bank of Nigeria in June 2015 excluded importers of 41 goods and services from accessing foreign exchange at the Nigerian foreign exchange markets in order to encourage local production of these items. Subsequently, with the addition of fertilizer and textile products, the list grew to 43.

This action by CBN was taken in its efforts to sustain foreign exchange market stability and ensure the efficient utilization of foreign exchange as well as ensuring that optimum benefit is derived from goods and services imported into the country’

tinyurl.com/9ja-endsars-forex-LI

One of the directions of this policy was to stimulate agricultural activity to meet ‘Light Manufacturing’ demand for ‘Intermediate Goods’ and FMCG ingredients.

However, much of the fertile arable land, capable of supplying this agricultural activity has separately been commandeered under a federal directive, to create 368 (agriculturally inefficient) grazing sites, across 25 states in the country.

On May 11, 2021, in Asaba, Delta State, 17 Southerner governors under the umbrella of Southern Governors’ Forum met and staunchly opposed the establishment of open grazing sites. The governors also kicked against the latest move by Buhari. The governors said the control of land doesn’t belong to Buhari. “The law gives the Certificate of Occupancy to every individual and allows them to have full ownership of the land,” said the governors. (reported by BAYO OLUWASANMI, Sahara Reporters, yesterday).

So what we have here is two divergent policies with contradictory objectives (again). This is indicative of the same lack of joined up thinking between the diaspora remittance decision and the BDC forex denial decision exhibited earlier in the article.

Well, there is a crypto called ‘DOGE’ coin but realistically, the closest CBN is going to get to cattle is to create their own DeFi product called ‘MOO’. You can’t pin this one on Emefiele, this one is all Aso Rock!

When we look at Godwin Emefiele, a mild mannered, deliberate, measured individual with an exemplary track record leading Zenith Bank, we have to start asking a question… does the similarity between this, and the earlier contradictory decisions then raise concerns that throughout his leadership of CBN, he may have been operating with a hand tied behind his back?

He doesn’t strike as the kind of person incapable of joining dots!

Meanwhile in other news, Ghana’s Digital Currency (E-CEDI) will pilot next month.

CBN really does needs to try harder to get ahead.

References and Acknowledgements (not in the main text body) :

www.linkedin.com/posts/ndubuisi-ekekwe-36068210_nigerias-court-freezes-bank-accounts-of-activity-6833554413370576896-rM2x

parrotnigeria.com/cbn-warns-microfinance-banks-against-forex-transactions/

www.nairaland.com/6671844/cbn-stops-sale-forex-bdcs/2

www.tvcnews.tv/millions-trapped-as-court-freezes-bank-accounts-of-forex-trading-platforms/

en.wikipedia.org/wiki/Nigerian_naira

von.gov.ng/2021/07/28/cbn-bans-sales-of-foreign-exchange-to-bureau-de-change-operators/

technext.ng/2021/07/20/cbn-crypto-ban-aftermath-patricia-relocates-headquarters-from-lagos-to-estonia/

nypost.com/2021/08/23/visa-buys-digital-artwork-token-cryptopunk-for-150k/

www.newsweek.com/nigerias-naira-devaluation-not-day-too-soon-471523

nigerianimage.com/2020/05/12/profile-of-mallam-sanusi-lamido-sanusi/

saharareporters.com/2021/08/23/grazing-sites-buhari%E2%80%99s-political-madness-bayo-oluwasanmi

www.withinnigeria.com/news/2021/08/19/buhari-approves-review-of-grazing-reserves-in-25-states/