Nigeria’s labour market is shifting quickly as states implement industrial policies, attract private investment and reposition for a post-subsidy economy. From the examination of gross state product, sectoral hiring, and the credibility of government initiatives between January 1 and September 8, 2025, Infoprations identifies 10 states Nigerians and other nationals could migrate to for better opportunities and career advancement in 2026. Our analyst notes that professionals weighing relocation need a clear view of which states combine real earning power, sector diversity, and policy follow-through.

Understanding the 2025 Signals

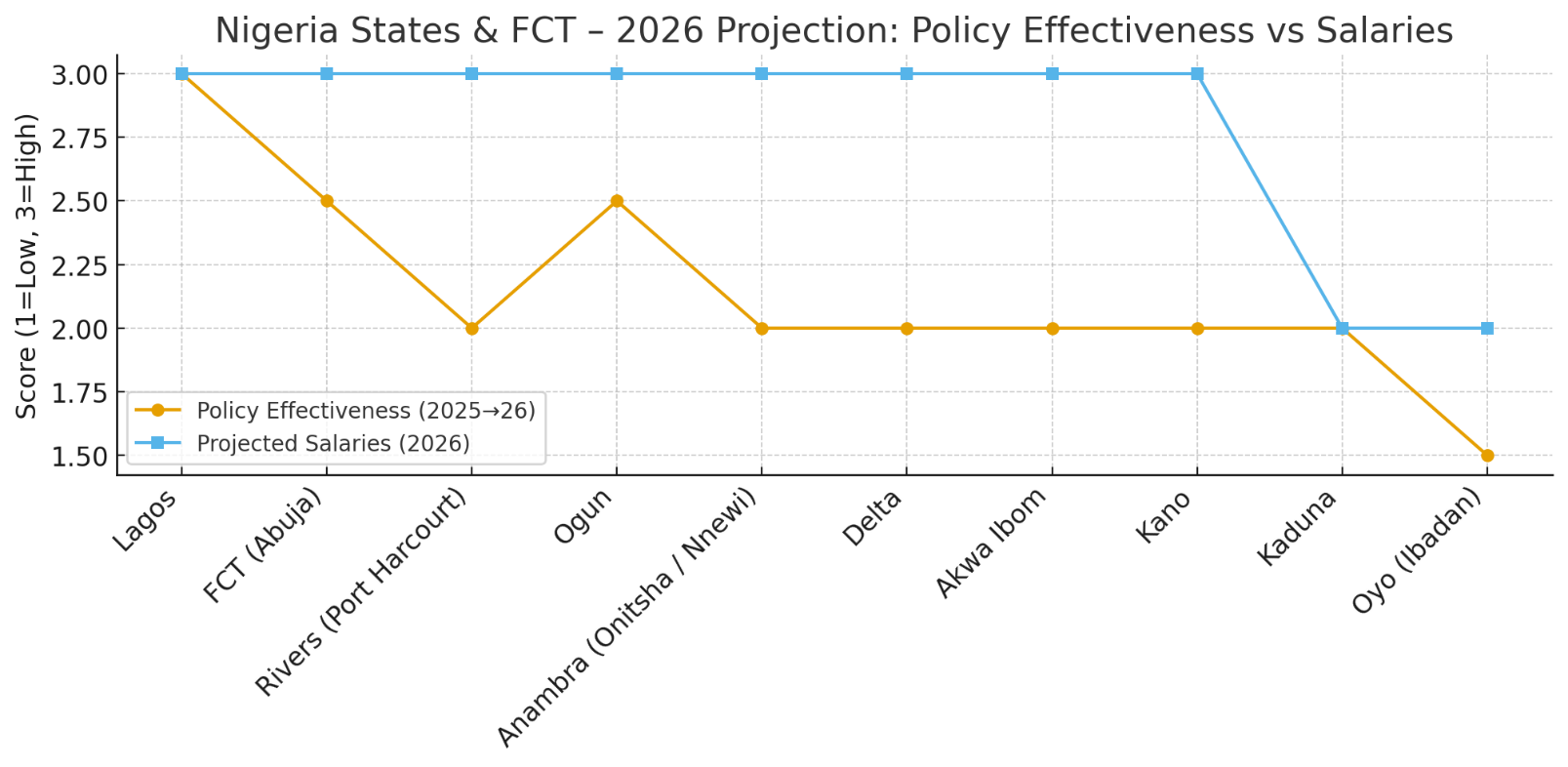

Three indicators define the opportunity landscape: employer density, policy implementation, and sector wage potential. Lagos posted the country’s strongest technology and finance signals in 2025 with record venture activity and a steady flow of product, fintech, and creative industry roles. Abuja maintained steady recruitment in public service, NGOs, and consulting, while oil-producing regions recorded renewed upstream and service contracts following federal security interventions in the Niger Delta. Manufacturing corridors in Ogun, Anambra, and Kano benefited from state-level industrial incentives and a revival of garment and agro-processing clusters.

Policy intent alone does not guarantee jobs. Analysts focused on concrete developments such as new factory openings, export-zone licensing, or funded infrastructure projects. These signs, alongside wage benchmarks and cost-of-living data, offer the clearest clues to 2026 conditions.

States Leading on Salaries and Sector Depth

Lagos remains the undisputed economic capital. Its fintech, logistics, and media ecosystems reward skilled labour with the country’s highest private-sector wages. Hiring remains brisk due to continuous inflows of capital and talent. Professionals in engineering, software, and business development find abundant roles despite premium housing and heavy commuting.

The Federal Capital Territory, anchored by Abuja, provides stable middle to senior-level income streams through ministries, multilateral agencies, and development projects. Consultants and policy specialists see consistent contract renewals. Though salaries are less explosive than Lagos, the relative predictability and access to decision-makers make Abuja attractive to professionals in governance and NGO operations.

Oil hubs continue to deliver exceptional wages for technical experts. Rivers State, particularly Port Harcourt, benefits from renewed government attention to pipeline security and investment in service facilities. Delta and Akwa Ibom share similar advantages, pairing upstream activity with new downstream and energy transition projects. These states carry sector-specific risk, yet the remuneration for geologists, engineers, and project managers often surpasses national averages by a large margin.

Rising Industrial and Commercial Frontiers

Manufacturing growth is shifting the conversation beyond the coast. Ogun’s industrial parks, supported by tax incentives and its logistical proximity to Lagos, create fertile ground for plant managers, supply chain officers, and quality control professionals. Mid-level salaries are improving as foreign and local firms scale operations. Anambra, with its legacy in trading and light industry, is accelerating market modernization and attracting logistics and SME investment. Business owners and experienced supervisors will see wider opportunity here than in previous cycles.

Northern industrial centers are also staging a comeback. Kano launched a garment industry expansion targeting tens of thousands of new roles, signalling serious intent to rebuild its once-dominant textile base. While starting wages remain moderate, the breadth of hiring opens pathways for supervisory staff and operational leads. Kaduna complements this with agro-processing and defense-linked manufacturing, appealing to professionals comfortable with steady but incremental progression. Both states offer lower living costs and room for entrepreneurship.

Oyo, particularly Ibadan, leverages its large educational base to expand service, healthcare, and light manufacturing sectors. Growth here is slower in absolute terms but attractive to those prioritising affordable housing and a strong academic environment. Steady hiring in education and public health, coupled with private SME expansion, produces moderate wages with sustainable career ladders.

Planning for a Competitive 2026

Migration decisions should be anchored in sector fit. A fintech analyst or cloud engineer thrives in Lagos due to network effects and salary competition. A development economist or policy adviser positions strongly in Abuja. Petroleum engineers weigh Port Harcourt, Delta, or Akwa Ibom where projects sustain lucrative pay packages. Industrial engineers and factory supervisors should examine Ogun, Anambra, or Kano for advancement without the Lagos cost burden.

Cost of living, security, and lifestyle considerations remain important. Lagos offers income premiums but also steep rents and congestion. Niger Delta cities provide elite compensation yet carry environmental and security risks. Interior states trade lower pay ceilings for calmer living and affordable housing. Verifying claims from state investment agencies, reviewing company announcements, and networking with industry insiders will prevent unrealistic expectations.

Professionals targeting 2026 should also invest in upskilling. Certifications in project management, data analytics, or sector-specific software can turn a relocation into a genuine promotion. Connecting with alumni networks, attending state-sponsored career fairs, and aligning with chambers of commerce increases visibility in emerging hubs.