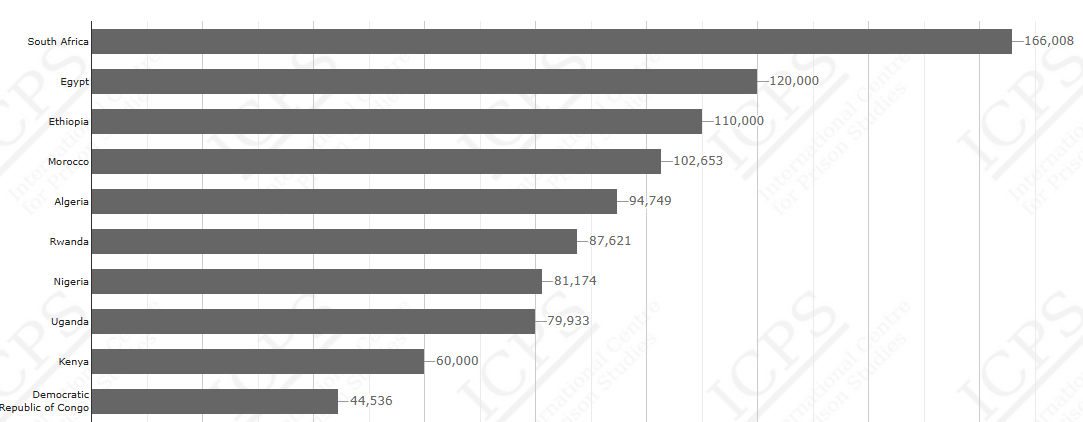

Across Africa, the way people think and talk about crime and justice is changing. Not just in government offices or courtrooms, but online, where search engines have become a window into public concern. Analysis of top 10 African countries with the highest number of people in prison by Infoprations indicates that the number of people in prison doesn’t always match how much people are searching for information about crime or prisons.

Take South Africa, for example. It has the highest prison population on the list, with over 166,000 people behind bars. But Nigeria, with less than half that number, shows the most online interest in both crime and prisons. That tells us something important: people’s curiosity and concern about justice aren’t just shaped by how many people are locked up. They’re shaped by what’s happening in society, what’s being reported in the news, and how free people feel to ask questions.

This gap between prison numbers and public interest challenges the idea that bigger problems always get more attention. In reality, attention is driven by awareness—and awareness is often driven by access, freedom, and a desire for change.

What the Numbers Are Really Saying

When we compare the data, a few patterns stand out. Countries with more people in prison don’t always have more people searching about prisons or crime. In fact, some countries with smaller prison populations, like Nigeria and Morocco, have much higher search interest than expected. That means people in those places are actively thinking about justice, even if the prison system isn’t the largest.

Exhibit 1: African countries with the highest number of people in prison

On the other hand, countries like Rwanda and the Democratic Republic of Congo have relatively high prison populations but very low search interest. That could be due to limited internet access, fewer news stories about justice, or cultural factors that make people less likely to search for these topics.

One thing is clear: when people search for information about crime, they often also search about prisons. These two topics go hand in hand. It shows that people aren’t just curious about what’s happening on the streets, they’re also thinking about what happens afterward, in the justice system.

Why This Matters for Leaders and Citizens

Search behavior might seem like a small thing, but it reflects what people care about, what they worry about, and what they want to understand. In countries where search interest is high, it’s a sign that people are engaged. They’re asking questions, seeking answers, and trying to make sense of the world around them.

That’s an opportunity. Governments, journalists, and civil society groups should pay attention to where curiosity is growing. These are the places where public education can make a difference, where reform efforts might gain support, and where transparency can build trust.

In places where search interest is low, it’s worth asking why. Is it because people don’t care or because they don’t feel safe asking? Is it because they lack access to information, or because the topic feels too distant from their daily lives? These questions matter, especially for those working to make justice systems more fair and responsive.

Turning Curiosity Into Change

The data shows that people are thinking about crime and justice. They’re searching, reading, and trying to understand. That’s not just a trend, it’s a signal. It means the public is ready to be part of the conversation. Leaders should respond by making justice systems more open and easier to understand. That includes sharing data, explaining policies, and listening to public concerns. It also means investing in digital access and civic education, so more people can join the conversation.

Researchers and journalists have a role too. They can turn numbers into stories, highlight what’s working and what’s not, and give voice to those who are often left out. When curiosity meets good information, change becomes possible.