Access Bank Nigeria has commercial centers in Gambia, Sierra Leone, Rwanda and Democratic Republic of Congo. It recently added South Africa (Grobank), Kenya (Transnational Bank ) and Zambia (Cavmont Bank) via acquisitions. Within 8 months, the bank added those three banks. I am a fan of Access Bank CEO, Herbert Wigwe, but when you look at what is happening, you will notice one thing: most Nigerian banks did not see the future a long time ago. Largely, only UBA saw the future and went all the way to create it. Today, UBA operates in at least 20 African countries, outpacing all its peers including GTBank, Zenith Bank, First Bank and of course Access.

With AfCFTA, the trade agreement on the horizon, winning Africa becomes the race, not just Nigeria. Magically, the decision of UBA becomes amazing. Access is working hard to be part of that big picture since a network of banking operations will help it compete against Standard Bank (South Africa) and Ecobank.

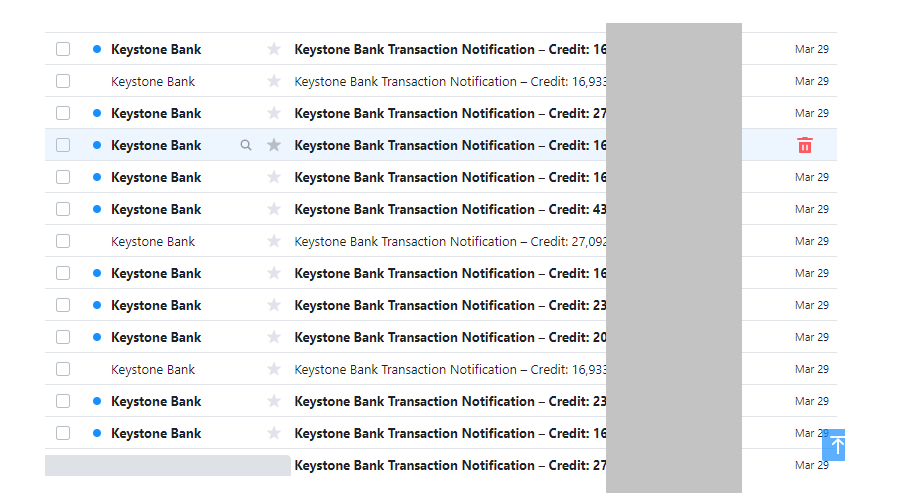

I hold Ecobank, UBA, First Bank, Sterling, Fidelity, Unity Bank, and Access – and indirectly Union Bank. (I used to have Zenith Mutual Fund but exited due to cost.) Provided they pay dividends, I don’t really care if the stocks are appreciating or not. The bank sent alerts on March 29 that I am yet to have time to check the dividend credits – they could be many (see photo). So, I am for these banks.

Looking at what is happening today, UBA might have been the best positioned bank of last decade in Nigeria, when you see how it inserted itself on Africa. So, going into the near future, while the FUGAZ (First, UBA, GTB, Access and Zenith) will continue to do well in Nigeria, the African exposure gives UBA an edge.

NB: Please see this as part of education, not recommending stocks or de-marketing any bank. If you buy with 15% of your salary these dividend paying banks, within a decade, you would earn more than extra free 3-5 years! They are consistent.