The CBN’s New Playbook – And Why Tax Holidays On Investment Will Be Better

As the Central Bank of Nigeria (CBN) policy of Naira 4 Dollar Scheme kicks off tomorrow, we would be looking at how the policymakers respond when live data begins to arrive. I have called it a “quasi-devaluation” of the Naira, but with the understanding that it is a short-term experiment, we should wait for the data to hit the CBN headquarters. But before that happens, this is what I expect to happen across most countries: remittance inflow will improve but most may not be real!

The Central Bank of Nigeria (CBN) needs US dollars desperately to help cushion the nation’s balance of payment, and fight deterioration of the Naira, and is going to Nigeria’s best export: the diaspora community. Yes, the apex bank has unveiled a really ingenious scheme called “Naira 4 Dollar Scheme”. Largely, if you wire US dollars to Nigeria via the approved IMTO (international money transfer operators) like Western Union, the payout bank will pay your recipient N5 per $I besides the recipient receiving the full amount you wired in US dollars. The CBN Governor mentioned in a Diaspora Series organized by Fidelity Bank Plc.

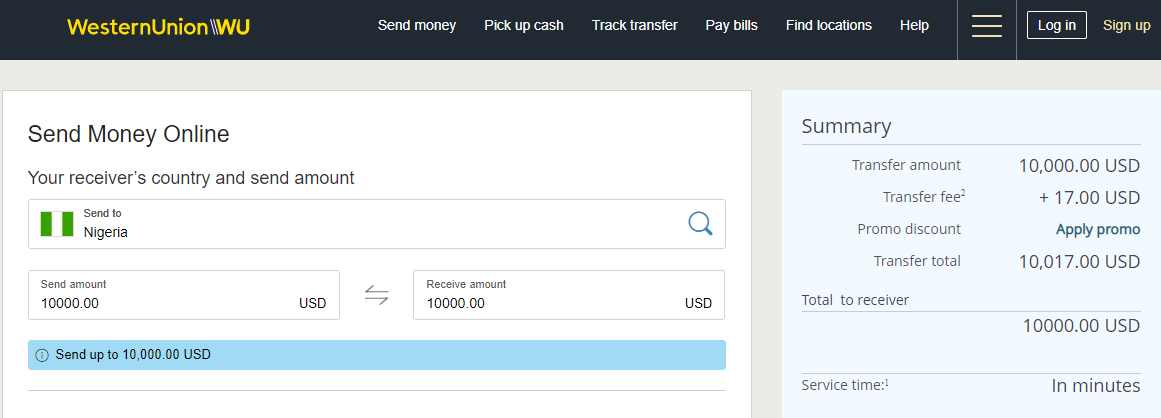

Yes, expect someone to wire $10,000 from New York, gets paid $10,000 in Lagos, and then the N50k bonus. The cost of wiring that money is never going to be more than N50k ($120); the cost to wire $10k from US to Nigeria is $17 via Western Union. Some do think they can use peer-to-peer platforms to move that $10k back to New York, and send it back again for another N50k in Nigeria. This loop can continue, and they will rip big bonuses from the Nigeria treasury!

But note one thing: CBN is aware of this potential risk and that is why it has this requirement that people use the approved IMTOs like Western Union and MoneyGram. Those entities most times will not allow anyone to wire more than $10,000 in a month. And by the time you start shopping for who to help you make extra N50k on your $10k, you can lose that $10k entirely! Yes, a snake can swallow that money, big time, even in New York.

I do think that this policy is designed to incentivize Nigerian diasporas to send money home. It is too early to know if that will improve remittance over long-term; I mean after the program ends later in the year. Personally, my choice, as I noted in my Fidelity Bank presentation, would be to offer a seamless tax holiday on all profits through a special fund vehicle I called Diaspora Growth Nation Fund.

Yes, if you invest in SMEs, startups, real estate or other productive areas, via official channels like banks, all taxes on profits over 5-10 years would be waived! That is a better way to get people to unload US dollars and hard currency on Nigeria. I am not sure people with many benjamins will care that $1 will add extra N5! That is a distraction!

And if CBN is not careful, it could have a ponzi scheme on its hands with USD for Naira, being round-tripped, outside international money movement ordinance. Yet, the good news is that the bad guy will have to beat the US, UK in addition to Nigeria. And that is why I think abuse will be limited. But it is good to experiment and CBN is doing that which I think is good. It will see data and over time decide on what works.

Consistent with the global trend, Nigeria aspires to ensure that remittance flows and diaspora investments become a significant source of external financing. #Emefiele

— Central Bank of Nigeria (@cenbank) March 6, 2021

We Added A New Company In Our Portfolio

On Friday, I invested in a downstream technology sector of the oil, gas & renewables sector. It is a California-based startup. We will bring visibility on how people buy refined crude products & renewables, orchestrating demand and supply into a more optimal equilibrium, through reduction of information asymmetry. From finance to logistics to payment, we want to uber the downstream sector! And that downstream includes renewables.

I will make a proper announcement within the week. We need to digitize the energy sector.

Fixing Nigeria’s Naira – And The Missing Voices

The conversation on the latest Central Bank of Nigeria (CBN) policy – Naira 4 dollar scheme, i.e. extra N5 is paid by the apex bank for every remitted $1 into Nigeria – has generated many opinions in our platforms. While I truly welcome the opinions, let us not be personally attacking elected or appointed officials. Make your point, challenge their policy choices, but do not insult them. If you check, we are saying the same thing and we know that the mess in Nigeria did not start today. Nigeria used to have tons of dollars that we were looking for countries to pay their bills!

The Central Bank of Nigeria (CBN) needs US dollars desperately to help cushion the nation’s balance of payment, and fight deterioration of the Naira, and is going to Nigeria’s best export: the diaspora community. Yes, the apex bank has unveiled a really ingenious scheme called “Naira 4 Dollar Scheme”. Largely, if you wire US dollars to Nigeria via the approved IMTO (international money transfer operators) like Western Union, the payout bank will pay your recipient N5 per $I besides the recipient receiving the full amount you wired in US dollars. The CBN Governor mentioned in a Diaspora Series organized by Fidelity Bank Plc.

Godwin Emefiele cannot fix this overnight. Obasanjo cannot fix it overnight. Jonathan cannot fix it overnight. Buhari cannot fix it overnight. I cannot fix it overnight. You cannot fix it overnight. We know one thing: unless we produce things in Nigeria, all the financial engineering will fail. Factories and warehouses hold Nigeria’s future, not CBN HQs working financial model with Naira! Sure, we hope the policies provide the path to have those factories and warehouses; the Policies should be the focus, not the persons.

We must challenge these men and women but we must do so with civility. The number of registered voters for Lagos and Kano States were 6.5 million and 5.4 million respectively for the 2019 presidential election. Out of that, about 1.1 million voted in Lagos while Kano had 1.9 million. Simply, 5.4 million people in Lagos where many of us live registered but did not vote. This number does not include qualified people who did not even bother to register.

Run the number and you will see the same pattern across the nation. Simply, nothing is unpredictable: that we stay home and allow party faithfuls to run the show, only to complain later, will not change the outcome. Yes, if there were Candidate M who could have received all the votes of those who registered but did not vote, from state to federal to presidency, that Candidate M would have WON all positions in Nigeria. So, the power is in our hands but we do not use it.

This is what happens: the extremely motivated party faithfuls go out and vote and elect their members. You who stay home or out of the system, come only to complain after the outcome. We need to be real in Nigeria! Insulting those elected officials or their appointees will not change anything because you gave up your rights to help Naira! Sure – challenge their policies but do not think you are not part of the problem.

Nigeria’s Central Bank Targets More Diaspora Remittance with New FX Policy

The Central Bank of Nigeria (CBN) has announced a new forex policy designed to encourage diaspora remittance through Money Deposit Banks (MNOs) that will fuel dollar liquidity in Nigeria.

The initiative tagged, ‘Naira 4 Dollar Scheme’ for diaspora remittances, offers recipients of diaspora remittances through CBN’s International Money Transfer Operators (IMTO)s, N5 for every $1 received as remittance inflow.

The scheme takes effect from Monday, March 8, 2021, and ends on Saturday, May 8, 2021.

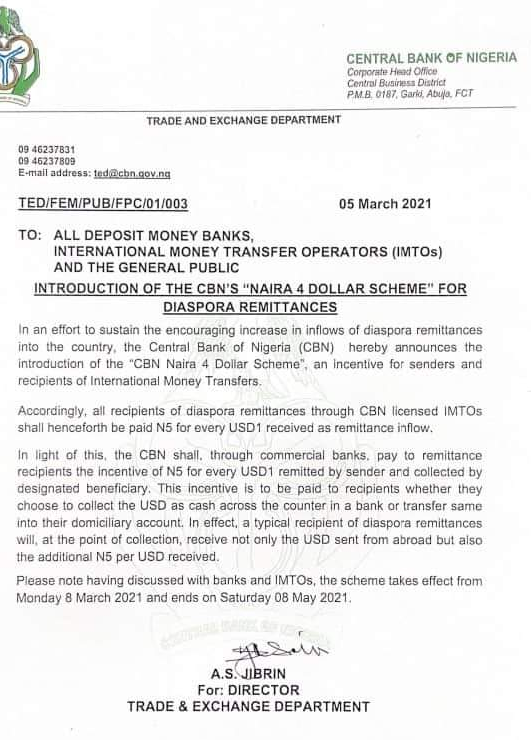

The scheme was disclosed by CBN in a circular which was dated March 5th, 2021, and signed by the Director, Trade and Exchange Department, A.S Jibrin, issued to all DMOs and IMTO. The circular reads in part:

“In an effort to sustain the encouraging increase in inflows of diaspora remittances into the country, the Central Bank of Nigeria (CBN) hereby announces the introduction of the “CBN Naira 4 Dollar Scheme”, an incentive for senders and recipients of international Money Transfers.

Accordingly, all recipients of diaspora remittances through CBN licensed IMTOs shall henceforth be paid N5 for every USD1 received as remittance inflow.

In light of this, the CBN shall, through commercial banks, pay to remittance recipients the incentive of N5 for every USD1 remitted by sender and collected by designated beneficiary. This incentive is to be paid to recipients whether they choose to collect the USD as cash across the counter in a bank or transfer same into their domiciliary account.

In effect, a typical recipient of diaspora remittances will, at the point of collection, receive not only the USD sent from abroad but also the additional N5 per USD received. Please note having discussed with banks and IMTOs, the scheme takes effect from Monday 8 March 2021 and ends on Saturday 08 May 2021.”

The CBN governor Godwin Emefiele said the move is to encourage Nigerians in diaspora to “increase the volume of global remittances,” “reduce rent-seeking activities” and offer “cheaper” and more “convenient remittance process” to Nigerians in diaspora.

He said the success of the scheme for the designated 60 days will determine whether it will be continued.

Emefiele said these in a webinar hosted by Fidelity Bank on Feb. 6, titled: “The New FX Policy, Implications and Positive Impact on Diaspora Investment,” which was graced by the Vice President Prof. Yemi Osinbajo who was represented by Yewande Sadiku, Prof. Wale Sulaiman, Chairman and CEO RNZ Global, Prof. Ndubuisi Ekekwe of Tekedia Institute among others.

“We believe that this new policy will encourage banks and financial institutions to develop products and investments vehicles geared toward attracting investments from Nigerians in the diaspora,” Emefiele said.

He explained that the newly introduced CBN FX policy is expected to enlarge the scope and skill of foreign exchange inflow into the country with a view to stabilizing the exchange rate, supporting external reserve, and more importantly, helping Nigerians living abroad to invest in their home country.

While the new policy is largely applauded, others believe that Nigeria needs more than that to prosper as a nation.

In his position titled: The New CBN FX Policy: The Path to $2 Trillion GDP, Prof. Ekekwe said Nigeria must transit from inventive nation to innovative nation to grow a GDP that will accommodate its exploding population.

While he applauded the new CBN FX policy, describing it as “catalytic”, Prof. Ekekwe said Nigeria needs more than diaspora remittance, which is pegged at $23 billion, to move to the mountain top.

“Our nation Nigeria has knowledge, from that angle; we have the necessary rudiment for us to move from inventive society to innovative society,” he said. “There is also that entrepreneurial capitalism. Across the nation, we have young people who are risk takers who can take us into that mountain top, if we give them the necessary capabilities and the things they need to make that translation.”

He explained that by exporting her best brains, Nigeria is trading $23 billion diaspora remittance for $2 trillion economic value that she could have captured through the development of innovative ideas of Nigerians living in diaspora.

Prof. Ekekwe said Nigerians in diaspora need to do more than remit money back home through investments since the value of their innovations is being captured by their countries of residence. He urged the government to, among other things; introduce incentives that will attract investment from Nigerians living abroad.

Prof. Ekekwe proffered “Diaspora Growth Nation’s Fund,” a sort of capital that will be designated for innovative investments in Nigeria.

“If we do not have capital, Nigeria cannot transition from inventive society to innovative society, because capital is very necessary for us to build the necessary things we need as a nation,” he said.

However, critics said the central bank has introduced the new FX policy to discourage Nigerians in diaspora from making remittances through cryptocurrency, which recently, has become the preferred choice of remittance for many Nigerians living abroad due to its cheap and flexible process.

The apex bank had in Feb. 5, directed all regulated financial institutions in Nigeria to halt cryptocurrency transactions, citing its use for money laundering among other reasons.