In the past, Nigeria has had to grapple with the challenges of governing a multicultural society. Being the most populous black nation on earth, and a country of more than 200 ethnic groups, her leaders have battled with the issue of endemic corruption which has eaten into the fabrics of its institutions.

Although the world recognises Nigeria for her title as the giant of Africa (perhaps due to her population), it’s pitiable that her citizens think that the title is just a consolation. There are other African countries which have significantly grown and managed their economies well than Nigeria. Despite the fact that Nigeria has so many untapped natural and human resources, as well as one of the largest producers of crude, this doesn’t reflect on the citizens.

The citizens see elections as a battle to control resources. The country where its minimum wage is among the lowest in the world has its legislators being paid among the highest in the world, even more than the developed countries. Instead of investing in the country, we have seen her leaders embezzle money and store in oversea accounts. They send their children and relatives to other countries for their education and healthcare, while the facilities in their country dilapidated.

More than ever, an average Nigerian is looking for a way to leave the country. In every part of the world, you will find Nigerians. To them, as long as they leave the country, they are fine. Perhaps, this is why Nigerian citizens are the most suspected in foreign countries. At airports, your identity as a Nigerian would make you be searched almost 10 times. Talented Nigerians who get sponsored overseas or travel due to their affluence, are always honoured. Some of them are legislators and diplomats overseas, which they wouldn’t have gotten if they were in Nigeria due to a failed system and lack of transparency. However, it is easier to destroy than to build.

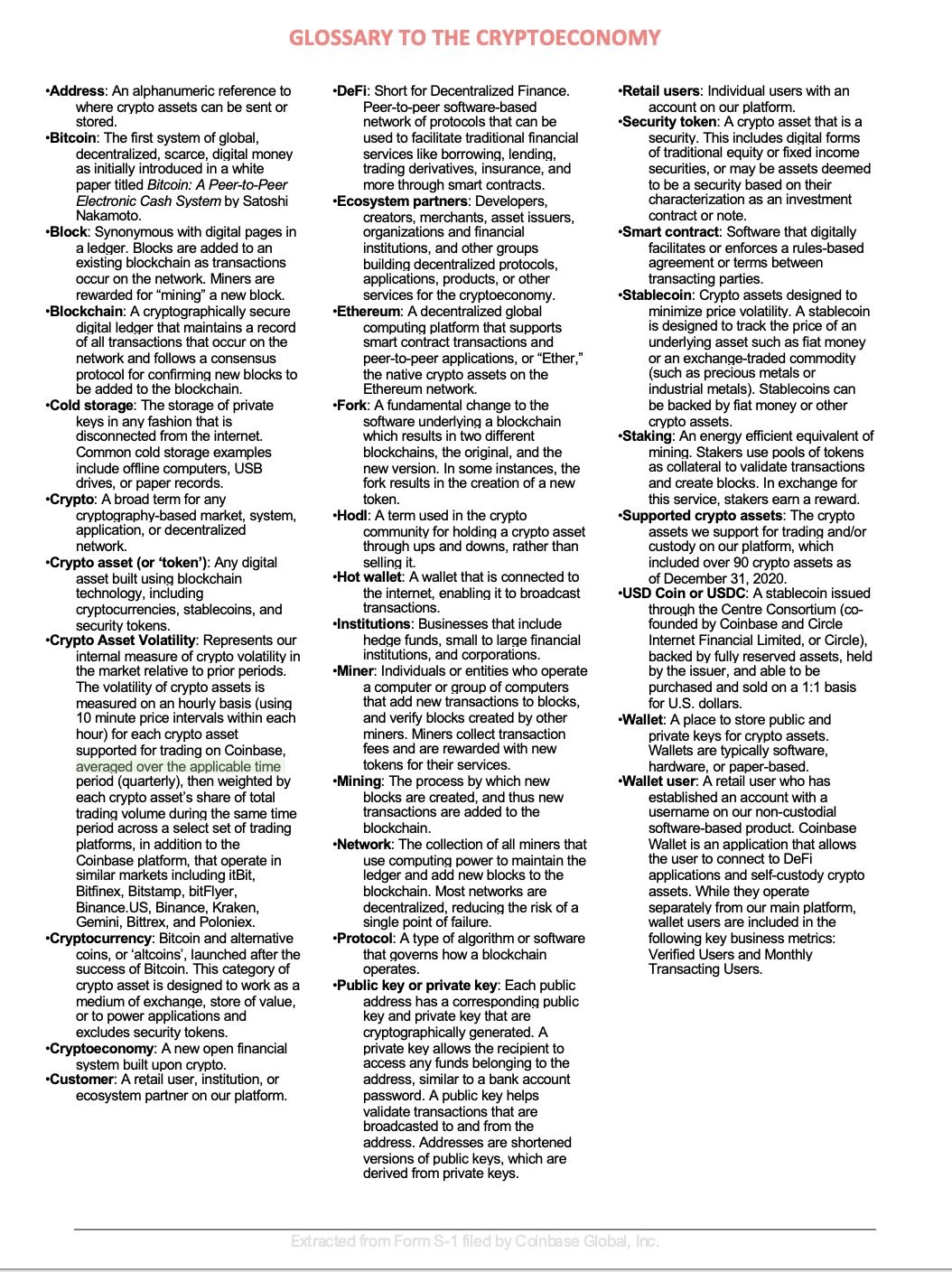

Although there are many Nigerians who are breaking limits and achieving notable feats overseas, the few who are not are making the country to be talked about negatively. While the aged men do not want to leave offices for the younger generation, the youths are also acting on what they have observed from their crooked leaders. Some of them have digitized their corruption through online fraud (popularly known as 419 or Yahoo Yahoo). It’s no wonder that the Central Bank of Nigeria recently banned the country’s financial institutions from every activity that supports cryptocurrency.

As some honourable Nigerians overseas try to do good works, it has been a long fight to rebrand the image of the country. Sometime ago, we saw some countries restrict Nigerians from applying for certain jobs, and even coming into their countries. The country has been referred to as one that lacks the wisdom to manage its resources, when landlocked countries that do not have a quarter of the resources Nigeria has are among the wealthiest in the world. For Nigeria, she has been known to be among the most corrupt countries, and the most unsafe countries. Despite being known as one of the most religious countries, the citizens are known to be among the happiest in the world – not because they have a good quality of life; they are laughing while suffering. Moreover, the human right abuses by its top leaders, even her military and police, has made it nearly impossible for her citizens to speak up due to the fear of being prosecuted, or arrested without trial.

In recent times, the issue of insecurity has become a regular story on tabloids, as the Boko Haram sect which mainly controls part of the sambisa forest in the country’s North Eastern state of Borno has remained undefeated. Although there have been claims by some of the Nation’s leaders that everything is under control, the truth remains that these terrorists are living well, and waxing strong everyday. Despite the huge investment by the country every year on foreign armoury to curb the insurgence, it has remained futile. It is sad to note that the fight against these insurgents has lasted for 10 years, and nobody sees the result to show that the country had indeed spent millions of dollars.

There had been donations by foreign countries and groups to no avail, hence making her citizens think that the government is hiding something from the public about these terrorists and their agenda. And now, the North East has been visited by these terrorists and their factions. Unlike before when they operated in Borno, now, their presence is seen in Yobe, Adamawa, and the boundary areas of Chad.

How about the Fulani herdsmen? For some time, the activities of these herdsmen whom the Nation’s leaders had termed as foreigners had continued to be a point for debate. For years, states watched the Federal government do nothing significant to stem the conflicts arising from the herder-farmer clashes, hence making some citizens take laws into their hands to defend their ancestral homes and families.

Cows were freely allowed to roam the streets and farms of citizens everywhere, thus becoming a bone of contention. There were stories on the molestation and killing of citizens who opposed the grazing activities of the herdsmen, and nothing significant was done about it. The herdsmen were not restricted, neither were they declared as terrorists. The silence by the nation’s top leaders emboldened these herdsmen to continue their nefarious activities, even as they were empowered to carry AK 47. At a point, the North Central States of Nasarawa, Plateau, Kogi, and Benue witnessed bloodbaths arising from these clashes.

Then came the Bandits. At first, everyone thought they were homeless youths trying to raise awareness of abandonment by the government. Some people had thought they would be like the legendary Robinhood who robbed the rich to feed the poor. However, it was not so, as the poor were the victims.

These bandits who have become majorly in control of the North Western States of Nigeria, have continued to wax strong by the day. This time, they target students by kidnapping them. They have also managed to make the government always pay ransom to have their hostages freed. This is an area of concern and something to worry about. At the moment, the country is in huge debt to international organizations and countries.

It had even begun selling off its assets to raise funds. If the country continues to pay ransom to these bandits and terrorists, it may paint a picture that kidnapping is a profitable business to do, and will even embolden them to kidnap more, of which the country may find it difficult to sustain overtime. Schools are no longer safe, even our Farms, as we have to deal with the bandits and the herdsmen. At first, Boko Haram kidnapped girls at a school in Chibok, and later on in Dapchi. This time, the kidnapping had extended to Kankara in Katsina state (where over 300 school boys were abducted), and Kagara in Niger state (where 42 persons were kidnapped as well). The most recent is the Jangebe abduction in Zamfara State where 317 school girls were abducted.

According to SB Morgen, a Lagos-based geopolitical research consultancy, at least $11million was paid to kidnappers between January 2016 and March 2020. That number would have increased by a greater margin now. Reports have it that the Katsina state government had paid $76000 (N30 million) as ransom for the abducted boys.

With the recent issues arising, if drastic measures are not taken, Nigeria may have to face a greater problem than Libya and Syria. With the renewed agitations for a separatist state of Biafra in the South East, community demonstrations against herdsmen activities in the South West, and growing national social unrests (as seen from the #EndSars protests), these could be more than the nation could handle. Prior to this time, the Niger Delta Militants were the major forces in the South South, but had long been pacified, thanks to the amnesty program of the past administration.

The time has come for the nation’s leaders to come together to develop the country. Otherwise, there may be more deadly militia groups in other parts of the country. If nothing significant is done about this, the country may become a failed state, leading to its eventual dissolution.

The issue of unemployment should be addressed, so that these youths can be gainfully employed. There is a saying that an idle mind is the devil’s workshop. There is no other time to fix the nation than now.

‘It would be better if Nigerian leaders always speak the truth to their citizens. They should call a spade a spade, and not a garden spoon’ ~ Godswill Ekwughaonu

If the country’s religious and political leaders continue to fan the embers of war through hate speech, that alone can ignite the fire that will raze everywhere. The country should learn from other countries who thought they were too big to fail. A word for the wise is enough, for to before warned is to before armed.