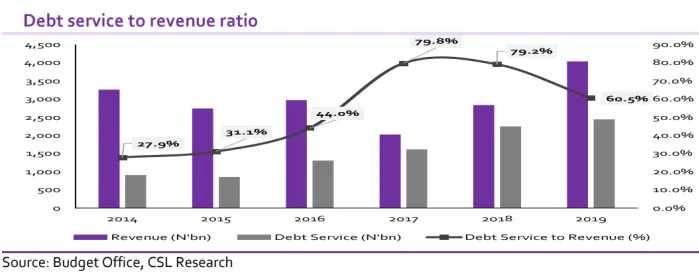

I had expected this to be part of the 2019 electioneering. Of course, ideas do not win elections in Nigeria. People, our debt service to revenue ratio is a real problem. Think about it: if you earn $1,000 as revenue and you spend $600 to service your debt, you will agree that your business has no chance to survive in Nigeria and possibly anywhere on earth. That is exactly what is happening for Nigeria as an institution and the reason why many are fearful.

In 2014, the ratio was about 28%; then it rose close to 80% during the recession and now we are at 60%. When 2020 data comes out, it may be close to 90% considering that revenue was severely affected during the lockdown.

Nigeria will be selling assets in coming quarters as it looks for money. I think nearly all the power plants are gone. Before you wail at Buhari, the state governments are even worse. They have sold what took the states years to acquire largely for nothing! My prediction is that another ASUU strike will end up with a threat of privatizing federal universities.

Besides campuses, are there other things we can sell? Of course Nigeria wants to borrow from unclaimed dividends and dormant bank account balances: “According to the Finance Act 2020 recently signed into law by President Muhammadu Buhari, the trust fund will be a sub-fund of the Crisis Intervention Fund: “Unclaimed dividends and bank account balances unattended to for at least six years will available as special credit to the federal government through the Unclaimed Funds Trust Fund”.

“Any unclaimed dividend of a public limited liability company quoted on the Nigerian Stock Exchange and any unutilised amounts in a dormant bank account maintained in or by a deposit money bank which has remained unclaimed or unutilised for a period of not less than six years from the date of declaring the dividend or domiciling the funds in a bank account shall be transferred immediately to the trust fund,” the act read.

The act exempts official bank accounts owned by the federal government, state government or local governments or any of their ministries, departments or agencies.