Why Central Bank of Nigeria Must Not Listen To Money Transfer Operators On USD Remittance Payments

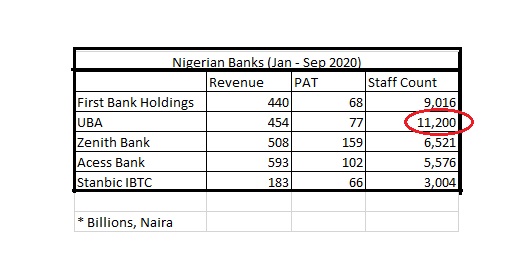

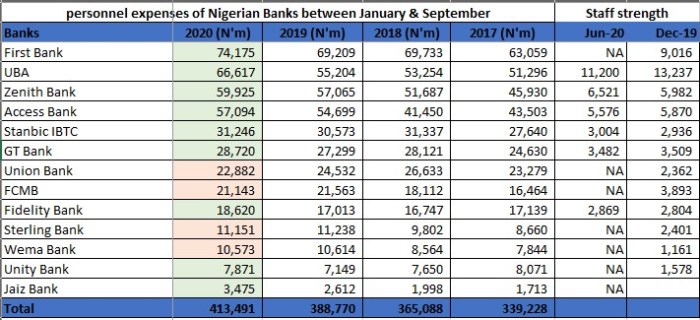

The Productivity in Nigerian Banking (One Table)

On staff count, UBA seems to be using many more workers in its business. First Bank Holdings includes both the bank and other subsidiaries. And yet, even with that, UBA has more staff than First Bank Holdings. Though not included in the table, GTBank employs about 3,500 people with a revenue number that tracks Zenith Banks and profit of N142 billion within the 9 month under examination. Indeed, UBA has to improve its productivity as the numbers seem extremely out of phase with peers.

GTBank remains the most capitalized bank in Nigeria at N965 billion, followed by Zenith Bank at N769 billion.

Meanwhile, the fintech startups are coming after these profits. OPay plans to hit a transaction volume of $2 billion by the end of 2021. That would make it one of the most important financial institutions in Africa. OPay, according to the company, currently processes about 80% of transfers among mobile money operators in Nigeria and 20% of non-merchant point of sales transactions. If that trajectory continues, OPay could be at the center of Nigeria’s consumer sector.

OPay, a Nigerian fintech startup founded by Opera, plans to expand its payments service operations to North Africa early next year after Covid-19 restrictions led to a spike in transactions on its platform.

The volume of monthly settlements on the OPay platform grew almost fourfold to $1.4 billion in November from $363 million in January, as people sought alternative payments services during coronavirus-induced lockdowns, the company’s managing director, Iniabasi Akpan, said in an interview from Lagos.

[…]

We plan to reach transactions value of about $2 billion by the end of this year. The company will leverage its network of 300,000 offline agents to deepen the adoption of its payments service. The company is now planning an entry into the north African market after its success in Africa’s most populous country. The process has begun and we will see how the first quarter turns out.”

The UK Finally Secures A Brexit Deal

The UK finally made a Brexit and security deal with the EU, averting a “no deal” exit from the bloc eight days before the December 31 deadline.

The prolonged negotiation placed both the EU and Britain on a difficult path, as both sides are still battling the COVID-19 pandemic. The deal which upholds the existing zero-tariff zero-quota agreement on imports and exports valued at £668bn ($771bn) has set a new record in the history of the former partners.

While British Prime Minister Boris Johnson still has a battle of approval to face at home, many Britons think it was a great deal.

“Deal is done. Everything that the British public was promised during the 2016 referendum and in the general election last year is delivered by this deal.

“We have taken back control of our money, borders, laws, trade and our fishing waters.

“The deal is fantastic news for families and businesses in every part of the UK. We have signed the first free trade agreement based on zero tariffs zero quotas that has ever been achieved with the EU,” a UK source said.

As the deadline for the deal drew near, talks between both sides were dragging along fishing right on British waters, with British Health Minister Matt Hancock accusing the European Union of making unreasonable demands to hinder a deal.

The final push for the deal which hung on giving EU ships access to British fishing waters and a “level playing field” on standards and state aid, was settled in the eleventh hour and documented in 2,000-page legal text to end the over four years negotiation.

What the deal means for both sides.

The UK source said the deal would end free movement and allow the introduction of a points-based immigration system. It will also end the seamless trade with the bloc that UK is currently enjoying in the single market, and introduce new border checks on UK goods.

Also, bureaucracy bottlenecks created by the new deal means that traders will fill an estimated 200 million customs declarations a year, a development an official said would cost the UK 4% of GDP in the long term compared to staying in the bloc.

However, the deal will require ratification by EU leaders who are expected to give provisional approval for the deal so that it can come into effect this year.

Independent reported that the ratification will pave way for a treaty governing trade between the former partners on the basis of zero tariffs and zero quotas, as well as future co-operation in areas such as security and law and order.

But if the EU leaders fail to ratify the deal, a short period of no-deal could still happen in early January.

In the UK, MPs and peers are expected to reconvene in Westminster on 30 December to rush the agreement into law in a single day.

But that is not certain as division along party lines is posing a challenge that may jeopardize the deal. Independent reported that hardline Brexiteers on the backbench Tory European Research Group have signaled that they are not prepared to act as a rubber-stamp. Consequently, they are reconvening their Star Chamber of legal experts led by Sir Bill Cash to examine the documents to see if any part of it undermines UK’s sovereignty.

Who wins?

The Brexit deal comes at a time when the UK is struggling to keep its economy battered by the pandemic afloat. Experts believe the deal should give a short-term boost to the economy, but the trade agreement will still leave the country poorer as it battles with its worst recession in 300 years.

The UK enjoyed trade rights and benefits that it is no longer entitled to due to the deal, and will have to reel through the consequences amidst economic chaos.

“The United Kingdom has chosen to leave the European Union and the single market, to renounce the benefits and advantages held by member states. Our agreement does not reproduce these rights and benefits, and therefore despite this agreement there will be real changes in a few days from now,” said EU chief negotiator Michael Barnier.

The UK’s win is based mainly on avoiding a “no deal” Brexit. CNN noted that the deal seems to mostly cover trade in goods, where the United Kingdom has a deficit with its EU neighbors, and excludes key service industries like finance, where it currently enjoys a surplus.

“The good news is that a disruptive and acrimonious ‘no deal’ has been avoided. The bad news for the UK in our view, is that the EU appears to have secured a deal which allows it to retain nearly all of the advantages it derives from its trading relationship with the UK, while giving it the ability to use regulatory structures to cherry pick among the sectors where the UK had previously enjoyed advantages in the trading relationship,” JPMorgan’s Malcolm Barr wrote in a research note.

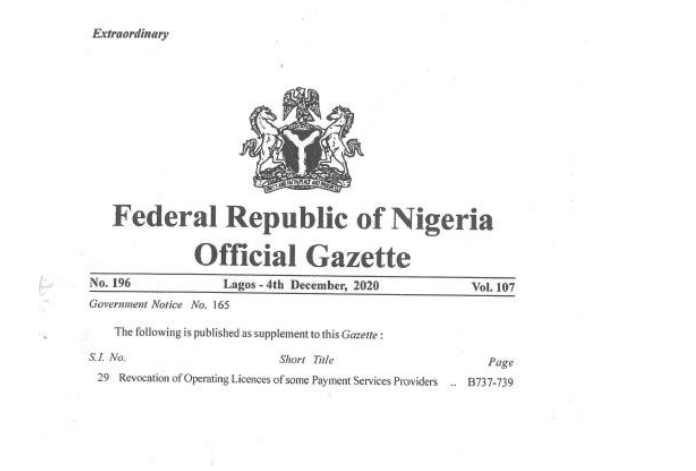

Central Bank of Nigeria Revokes Licenses of 7 PSPS and 1 SSP

The Central Bank of Nigeria (CBN) has revoked the operating licenses of 7 payment service providers and one switch service provider. These entities have failed to meet their statutory obligations, according to a Federal Republic of Nigeria Gazette.

The 7 payment service providers are:

- Easifuel Limited

- Transaction Processing System (TPS)

- Grand Towers Limited

- Paymaster Limited

- E-Revenue Gateway Limited

- Eartholeum Network Limited

- Globasure Limited.

The affected switch service provider is 3Line Card Management Limited.

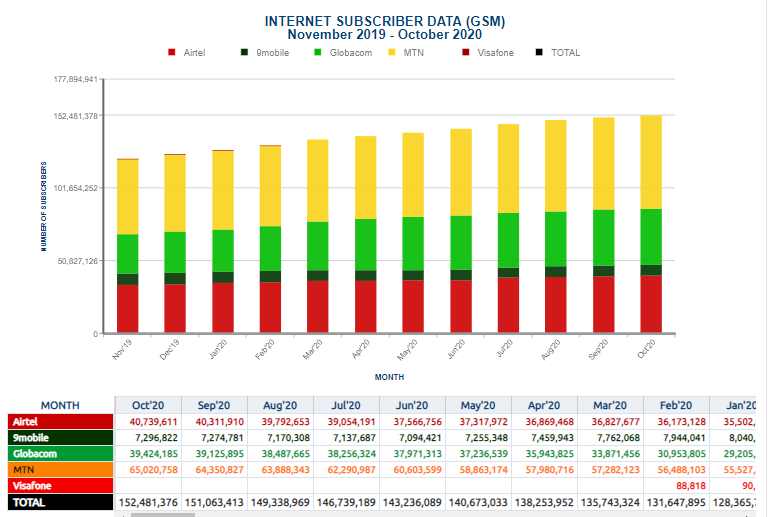

MTN Remains Dominant In Nigeria [Plot]

As at October 2020, MTN has about 25 million subscribers ahead of its next competitor, according to NCC, the industry regulator, data. On the voice telephony, the data is presented below.

The report released by Nigerian Communications Commission (NCC) shows that MTN leads the pack of the GSM operators in Nigeria, with active subscribers for telephony services of 83,331,682 as of October 2020, representing 40.14% of the entire operators’ subscriber base.

According to the report, MTN is followed by Airtel with 56,214,072 telephony subscribers (27.08%), Globacom 55,079,362 (26.53%), and 9Mobile with 12,953,121 subscribers (6.24%).