Sports is one of the industries that unites people throughout the world. During local, national, regional and international competitions, people of different races do come together to engage in physical activity that benefits everyone. Apart from the personal benefits to individuals, sporting activities have been found as part of activities that enhanced socioeconomic development and strengthen governmental relations. Out of the numerous sporting activities, people and countries participate in football than other games.

From club football to national football competitions, the king of sport [football] has greatly contributed to the national GDP of governments in Europe, North America and other continents, when a conducive atmosphere is provided. In its report on the growth and contribution of football to the UK’s, the Ernst & Young notes that “the League and its 20 member clubs contributed a gargantuan figure of £2.4 billion to the British economy in the 2013/14 season.”

In 2019, apart from the direct participants in the league, the British government also earns over £800 million in tax from Premier League players. In our checks, we have also seen how the economies of countries that hosted World Cup improved and suffered. For the countries that experienced positive economic growth, it emerged that the governments managed the preparation for the competition effectively, removed wastages and blocked corrupt system ahead and after the competition. For instance, in 2002, South Korea recorded a strong real GDP growth of 7%. After hosting the 1998 edition of the championship, France attained a higher GDP growth rate of 3,4% than what it had in 1997 [2.3%]. Spain, the United States of America and Italy also had higher GDP growth rates. In the history of hosting global fiestas, South Africa remains the only African country that has hosted the World Cup competition of national teams. The country hosted the competition in 2010. In its preparation for the championship, $3 billion [US] was spent on infrastructure [stadia, recreational centres, hotels among others].

Despite this, a number of citizens believed that a contribution of 0.1% to the GDP growth was insignificant. This view is not quite different from Nigeria after hosting several regional and global competitions such as junior World Cup. While on global competition, the Nigerian Football Federation [NFF] budgets substantial amount without bringing expected results. During the 2018 World Cup, the Federation spent N6.4 billion on its activities for the competition.

Beyond hosting and spending, Nigeria is one of the countries that is yet to consider a place for the measurement of sports in the Gross Domestic Product calculation. This affirms the fact that sporting activities remain insignificant economic activities to the Nigerian government. Over the years, sporting activities have been measured within the arts, entertainment and recreation sector.

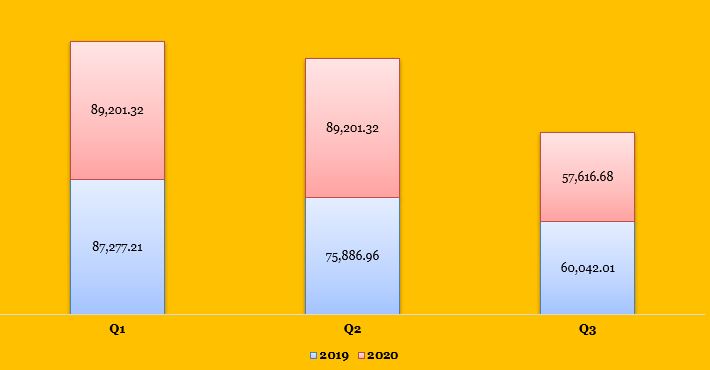

Exhibit: Arts, Entertainment and Recreation in Gross Domestic Product at Current Basic Prices (=N=Million)

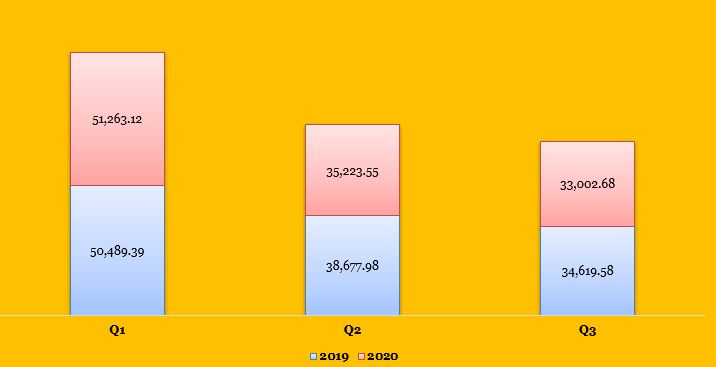

Exhibit 2: Arts, Entertainment and Recreation in Gross Domestic Product At 2010 Constant Basic Prices (=N=Million)

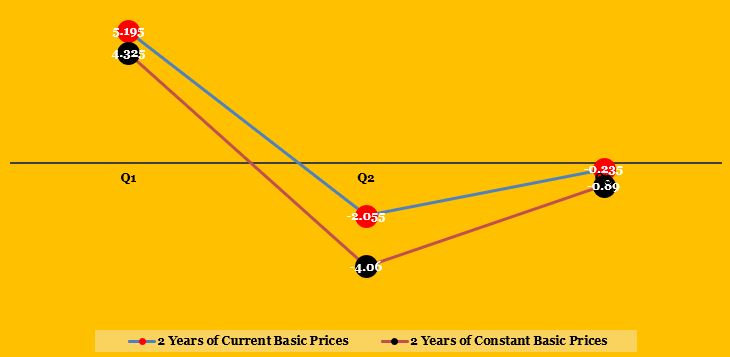

Exhibit 3: Arts, Entertainment and Recreation’s Average Contribution to the GDP growth in Current and Constant Prices [%] 2019-2020

In this piece, our analyst notes that Nigeria needs to consider football as part of ‘objects’ that would increase its economy. This is necessary considering the citizens’ love for the game and the country’s place in it globally.

Our Data and Measures

Five hundred and sixty-one matches played between 1960 and 2019 [with the exception of 1964] and the country’s Gross Domestic Product growth rates during the period were our data. In 2019, report has it that Nigeria’s GDP in purchasing power parity was $1.2 trillion. Our period of analysis is 58 years. During the period, the national team’s friendly, qualifications and the main competition games were analysed along with the GDP growth rates.

In our measurement, we follow gravity model framework, which proposes that playing home and away matches [during friendly, qualifications and competitions] have the tendency of attracting socioeconomic opportunities to the teams’ countries. We also examine the extent to which Nigerian team played away games when the GDP growth rate contracted in a year. Before using the GDP growth rate data, we categorised it into positive and negative. When the rate had 0 and – as starting number and symbol, we classified it as negative GDP growth. Rates with 1 and more than 1 were categorised as positive GDP growth.

Emerging Insights

Looking at our insights, it is clear that Nigeria can benefit from playing and hosting football competitions. Our first analysis shows that a strong association exists between the GDP growth rates [positive and negative] from 1960 to 2019 and the years of playing the matches. In spite of this, our analysis did not establish a strong association between the rates and outcomes of the matches. By outcomes, we looked at the number of matches won, draw and lost by the national team. In our analysis, we discovered that 0.4% of outcomes of the matches could be determined from the GDP growth rates. However, the outcomes influenced the GDP growth rates more than 1.3 times during the period.

A total of 137 matches were played when GDP growth rates were negative. During the negativities, 58.4% of the matches were played by the Nigerian team as an away team and 41.6% as a home team. Being an away and a home team cuts across the categories of competitions participated in. Four hundred and twenty-four matches were played when the GDP growth rates were positive. Out of these matches, the Nigerian team was an away team in 51.9% and played as a home team in 48.1% of the matches. When the GDP growth rates were negative, the national team was more than 2 times, losing and almost 3 times winning their matches. Also, when the rates were negative, the national team was more than 1 times draw their matches.

Examination of the matches by tournaments indicates that 48.2% of the 561 matches were friendly matches and played when the GDP growth rates were negative. More than 15% of the matches were played during the African Cup of Nations. When the GDP growth rate was positive, friendly matches [39.6%] were played more than African Cup of Nations [21.2 %] and FIFA World Cup qualification [20.0%] matches. When GDP growth rates were negative and positive, they played away matches 2.1 times than home matches.

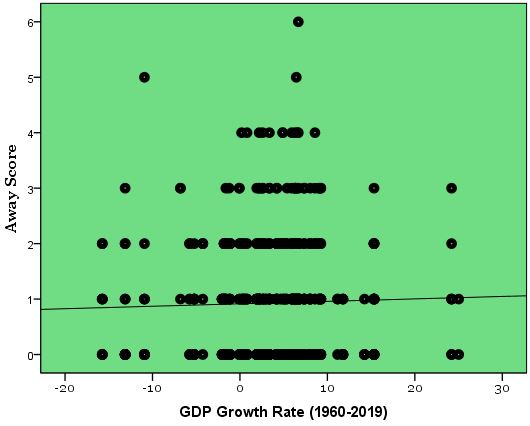

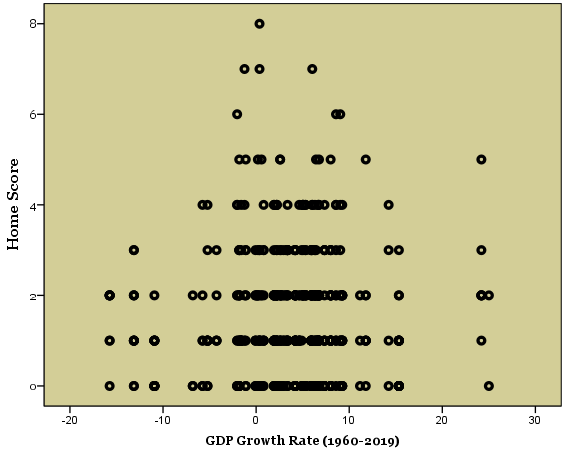

In our analysis, we found a clear differentiation between playing away and home matches during economy dwindling. One of the surprising insights that emerged from our analysis is that home and away scores when the economy was dwindling were the same. When the growth rates were negative, the highest home score was 1 followed by 0. This is not quite different from when the team played during the negative economic situation. The highest score was 1 followed by 2. During positive and negative economic situations, the team’s highest score was 0 followed by 1.

What does play away and home matches mean to the GDP growth rates in 58 years? In our analysis, we found that home matches impacted the growth more than the away matches. On average, away matches contributed 3.35% to the GDP growth rate, while home matches made a 3.88% contribution. In 58 years, both the away and home matches made a 3.59% contribution, on average, to the GDP growth rates. Analysis further shows that playing away matches and having a score indicated 2.7% increase in the GDP growth rates, whereas home matches increased the rates by 2.2% when the team scored one goal.

Exhibit 1: GDP Growth Rate Versus Away Score

Exhibit 1: GDP Growth Rate Versus Home Score

The Way Forward

These insights have indicated that the Nigerian government needs to take football serious if truly it intends to improve its economy and diversified from the oil industry. Sports, especially football, need to be treated as a business before substantial contribution to the GDP could be realised from it.

“In the football league, we can count about 28 sub businesses across associated value chain that can stimulate growth in the economy, drive employment and reduce youth delinquency in the society but we need to harness the potential of our football as a business to open these opportunities,” Shehu Dikko, Chairman of the League Management Company, said during a recent interview.