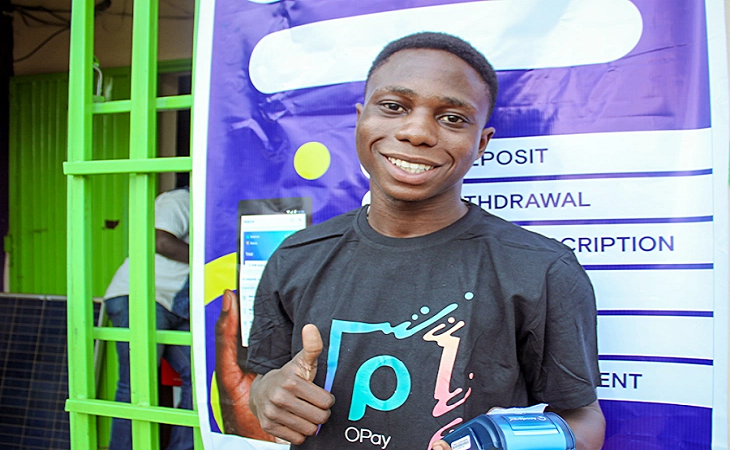

OPay is Nigeria’s biggest mobile payment solutions and you can call it the fastest growing customer brand in any sector in Nigeria. From Opera Q3 2020 earnings call; Opera holds 13.1% of OPay: “In October, OPay processed a gross transaction value of $1.4 billion on its platform more than three times the level in January.”

OPay continues to grow and scale its payment offerings. In October, OPay processed a gross transaction value of $1.4 billion on its platform more than three times the level in January. Further, we expect that OPay will be expanding beyond Nigeria soon, and believe it can continue to grow its payments platform at elevated growth rates. StarMaker continues to scale as well growing users roughly 80% year-to-date, and more than doubling revenue year-to-date to an annual run rate of over $100 million.

The OPay’s Invisible Layer Strategy is working at scale.

People, marginal cost of zero has come to the paytech sub-sector of Nigeria’s fintech sector. Yes, OPay is running what I call the Invisible Layer Strategy. The Invisible Layer Strategy is a strategy where a company builds a product utilizing critical infrastructure of another competing company, in the same product line, but finds a way to under-cut that company on cost of services to end users. Today, OPay offers zero fee to customers who use it to pay for DStv services in Nigeria. It utilizes and relies on Nigeria’s banking infrastructure. But if the same customers use banks, directly, they would be charged fees, by banks. Largely, OPay has invented an invisible layer which makes it possible to handle those payments at zero cost that even the banks themselves cannot do. It is important to note that OPay is not absorbing any cost to acquire customers; there is no cost whatsoever in the value chain, and that means even in the long-run, it can process payments in Nigeria at absolute zero fee.

OPay is now well positioned to even battle telcos if they decide to come into the mobile money domain at scale. This company has provided a textbook case study on how to win consumers in Nigeria: pile losses and keep making losses and keep running losses. One day, everyone will come to your party. Of course, you need reserves, tons of reserves I must note, to run that playbook. Hey, China Unlimited makes everything look easy.

Nigeria is now an OPay nation! By operating at the edges of the smiling curve, they have a promise to capture huge value.