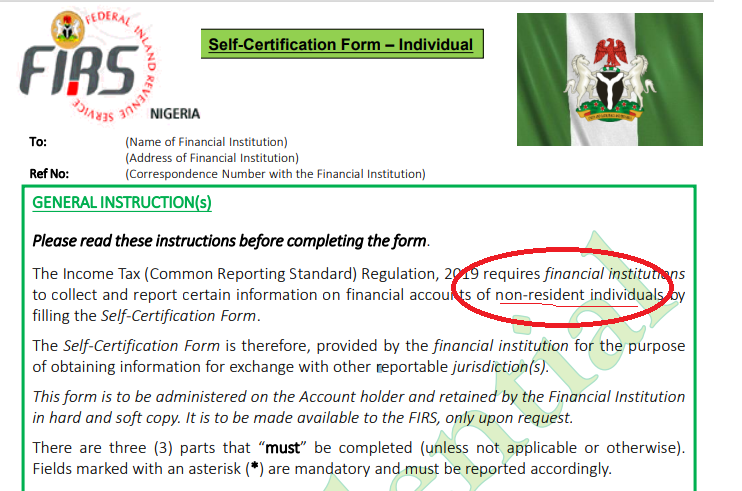

Many questions after I posted Nigeria’s self-certification form for bank deposits. Many have asked “who is a non-resident in Nigeria?” People, that is a very hard question which naturally should not be. I will attempt it, not legally, but operationally.

You can download the form here – a copy of the self-certification form (pdf). As you can see, the government is not deceiving anyone. This is just a pure class of communication mistake. The form is clearly written “non-resident” which means it does not apply to Nigerians. They sent a copy to us to assuage Nigerians who are already running to withdraw money from their bank accounts. Please this is under control – government is not coming after your deposit. Hope we learn from this as a nation. If this is not well managed, some banks could have issues. Share with others.

On that form, Non-Residents should be seen as Non-Nigerians who have financial relationships in other countries. It would have meant anyone not living full time in Nigeria as they have in the U.S. and other advanced nations but the problem here is that Nigeria does not have data to know that a Nigerian who lives in US but visiting and operating an account in GTBank with his Nigerian PASSPORT is non-resident.

The bank will assume the person is a resident citizen. And because most diasporas open these accounts with their Nigerian passports, differentiating becomes hard. So, at the end, the non-residents will apply MAINLY to non-Nigerian passport holders.

Sure, there are Nigerians who run diaspora bank accounts. I do not think that is the target here since the government expects the affected people to go to their banks to complete the forms. Possibly, they would be verified with BVN. You will not expect someone to leave London to travel to Lagos to do that! https://www.tekedia.com/a-copy-of-the-nigerias-self-certification-form-individual/#comment-50261

The tax agency clarifies.