In the past, the philosophy was the rise of the few, because the world was largely disparate in many ways. Provided my wine continues to taste great in New York, London or Berlin, I do not care what happens in Beijing, Nairobi and Santiago. Yes, all their problems would end there!

Unfortunately, the new world is totally different because the world is more integrated and intertwined that no one can disconnect nations easily despite any travel ban or restrictions. Today, coronavirus is normalizing global leaders to understand the reason to push for the RISE OF ALL, and not Just The Few (watch my national TV address on the Platform where I made the case for the Rise of All).

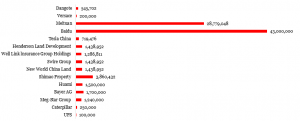

The U.S. Commerce Secretary, Wilbur Ross, could not hold his emotions when he thought that coronavirus would provide a competitive advantage to the United States as China deals with the demons in this virus. Unfortunately, today, the virus is ravaging everything on its path, and that bull that makes Mr Ross happy is getting drowned as Wall Street money men are running for safety. The Dow, a U.S. stock index, lost more than 2,000 points today.

May the world leaders pursue the Rise of ALL because in today’s economic infrastructure, nothing else makes sense. This virus is educating and normalizing many leaders who thought it was a great idea to cut a few $millions the United States was sending to foreign countries to build capabilities to prevent infectious diseases. These leaders failed to understand that spending the millions to save hundreds of billions of dollars now lost in stock markets, productivity, etc is chicken change.

The Dow Jones Industrial Average closed over 2,000 points lower, coming back from a point drop of more than 2,150 points, or 8.2 percent, at session lows while the S&P 500 and Nasdaq Composite were lower by 7.9 percent and 7.2 percent, respectively.

Monday’s sharp selloff, which caused the major averages to be temporarily halted due to volatility, caused the New York Federal Reserve to increase its daily cash injections into the banking system to $150 billion from $100 billion.

The stock-market’s steep slide comes after a production dispute between OPEC members, led by Saudi Arabia, and Russia sent West Texas Intermediate crude oil, the U.S. benchmark, plunging by as much as 33.8 percent, the most since the outbreak of the 1991 Persian Gulf War, to a low of $27.34 a barrel in overnight trading. The energy component finished the day down 24.59 percent at $31.13 a barrel